- The Mercer CFA Institute Global Pension Index compares 39 retirement income systems, covering almost two-thirds of the world’s population

- The Netherlands and Denmark retain first and second place respectively and the coveted A-grade’

- The impact of Covid-19 on the provision of future pensions around the world will be negative due to reduced contributions, lower investment returns and higher government debt

Mercer released the results of Mercer CFA Global Pension Index survey (MCGPI) that compares pension plans across the world. According to the survey, South Africa had an overall index value of 53.2 among the countries analysed, scoring better than countries like Austria, Italy, Indonesia and South Korea.

This year’s index edition added two retirement systems – Belgium and Israel to compare a total of 39 retirement systems across the globe and covering almost two-thirds of the world’s population.

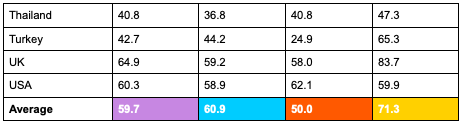

The index highlights key strengths of retirement pension systems around three sub-indexes – adequacy, sustainability and integrity, where South Africa scored 43.0, 46.7 and 78.3 respectively.

Craig Bentley, head of Multinational Consulting at Alexander Forbes, Mercer’s strategic partner in Africa commented: “It is pleasing to see the improvement for adequacy and sustainability. The integrity index, while reducing marginally when compared to the prior year, still remains a strong indicator of the integrity of the South African pensions industry. The SA pensions system has some good features; however, there is still room for improvement to ensure long-term adequacy and sustainability.”

In South Africa, the report suggests improving the minimum level of support for the lowest earning group, as well as introducing preservation requirements when members withdraw from occupational funds under the adequacy sub-index. In terms of sustainability, it recommends increasing the coverage for employees in occupational pension schemes, thereby increasing the level of contributions and assets as well as introducing a minimum level of mandatory contributions into a retirement savings fund.

Globally, the Netherlands had the highest index value (82.6), thereby retaining its top position in the overall rankings, notwithstanding the significant pension reforms occurring in that country. Thailand had the lowest index value (40.8).

For each sub-index, the highest scores were the Netherlands for adequacy (81.5), Denmark for sustainability (82.6) and Finland for integrity (93.5). The lowest scores were Mexico for adequacy (36.5), Italy for sustainability (18.8) and the Philippines for integrity (34.8). The widespread economic impact of Covid-19 is heightening the financial pressures which retirees face, both now and in the future. Coupled with increasing life expectancies and the rising pressure on public resources to support the health and welfare of ageing populations, Covid-19 is exacerbating retirement insecurity, according to the 12th annual Mercer CFA Institute Global Pension Index.

Dr David Knox, senior partner at Mercer and lead author of the study, said:

“The economic recession caused by the global health crisis has led to reduced pension contributions, lower investment returns and higher government debt in most countries. Inevitably, this will impact future pensions, meaning some people will have to work longer while others will have to settle for a lower standard of living in retirement. It is critical that governments reflect on the strengths and weaknesses of their systems to ensure better long-term outcomes for retirees.”

Covid-19’s impact on the future of pension systems

The impact of Covid-19 is much broader than solely the health implications; there are long-term economic effects impacting industries, interest rates, investment returns and community confidence in the future. As a result, the provision of adequate and sustainable retirement incomes over the longer term has also changed.

The level of government debt has increased in many countries following Covid-19. This increased debt is likely to restrict the ability of future governments to support their older populations, either through pensions or through the provision of other services such as health or aged care.

“Even before Covid-19, many public and private pension systems around the world were under increasing pressure to maintain benefits,” said Margaret Franklin, CFA, President and CEO at CFA Institute.

“We have learned a lot about the effectiveness of pension systems over the years, and while there is no single pension system model that will work for every country, the Global Pension Index provides comparative information to differentiate what is possible and practical in each market. CFA Institute is thrilled to be sponsoring this year’s Global Pension Index and we look forward to expanding its impact even further through this collaborative effort.”

To help alleviate the impact of Covid-19, governments deployed a diverse range of responses to support their citizens and pension systems. “It is interesting to note that the top two retirement income systems in the Global Pension Index, the Netherlands and Denmark, have not permitted early access to pension assets, even though the assets of each pension system are more than 150% of the country’s GDP,” said Dr Knox.

Covid-19 has also increased gender inequality in pension provision – “Even before Covid-19 disrupted economies across the world, many women faced retirement with less savings than men. Now, that gap is expected to widen further in many pension systems, particularly in the hardest hit sectors where women represent more than half of the workforce, such as hospitality and food services,” added Dr Knox.

Measuring the likelihood that a current system will be able to provide benefits into the future, the sustainability sub-index continues to highlight weaknesses in many systems. The average sustainability score dropped by 1.2 in 2020 due to the negative economic growth experienced in most economies due to Covid-19.

For more information about the Mercer CFA Institute Global Pension Index, click here

2020 Mercer CFA Institute Global Pension Index

About the Mercer CFA Institute Global Pension Index

Formerly known as the Melbourne Mercer Global Pension Index, the Global Pension Index benchmarks retirement income systems around the world highlighting some shortcomings in each system and suggests possible areas of reform that would provide more adequate and sustainable retirement benefits.

The Global Pension Index is a collaborative research project sponsored by CFA Institute, the global association of investment professionals, in collaboration with the Monash Centre for Financial Studies (MCFS), and Mercer, a global leader in redefining the world of work and reshaping retirement and investment outcomes.

This year, the Global Pension Index compares 39 retirement income systems across the globe and covers almost two-thirds of the world’s population. The 2020 Global Pension Index includes two new systems – Belgium and Israel.

The Global Pension Index uses the weighted average of the sub-indices of adequacy, sustainability and integrity to measure each retirement system against more than 50 indicators. The 2020 Global Pension Index introduces new questions relating to public expenditure on pensions, ESG (environmental, social and governance) investing and support for caregivers.

All the expertise, products and service to help you to keep your clients focused on the destination.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services (FSP6406) and registered credit (NCRCP173) provider.