Rupert Hare, Co-Head of Multi-Asset, Prescient Investment Management

Active funds have been subjected to continuous waves of attack from passive alternatives, and the gist of the argument is that they are in some way inferior to their

passive peers.

The reasoning is mixed, but the argument’s primary drivers are historic underperformance over the past five years, lower fees and fund costs, and high tracking errors vs what investors are expecting – i.e., you invest in “SA equities”, but often get a completely different animal with an active approach, with returns drifting away from the market.

While these points are valid, they’re also often subject to some serious framing by passive funds looking to aggressively capture AUM from other asset managers. They leverage off emotional biases of investors like the anchoring of views on recent performance and a degree of framing bias. For example, if you tell an investor that a fund is “one of the most expensive in its category”, that sounds rather gloomy on its own. But if you instead tell the investor that “while the fund is one of the most expensive in its category, it has by far the highest performance”, it will frame the fund in a completely different and more positive light. The point is that the most important thing investors can do is to focus on the facts and leverage off them in their judgment.

That brings us to the heart of this article, which may at first glance seem like the same topic the industry’s been talking about for the past five years – how and why active funds are losing money to passive alternatives. While that may be the case, there’s a lesser-known approach that could be a solution for investors and allow them to capture the best of both worlds – known as systematic investing, or process-driven asset-management leveraging off large amounts of data to make investment decisions. The key is to be able to take the best of active investing and combine it with the benefits of passive investing.

“Systematic” funds require smaller, more specialised teams with a background in both data science and asset management to process large amounts of data – which a traditional manager would require many boots on the ground for. The translation comes directly into the investor’s pocket, with lower fees required to cover fewer analysts.

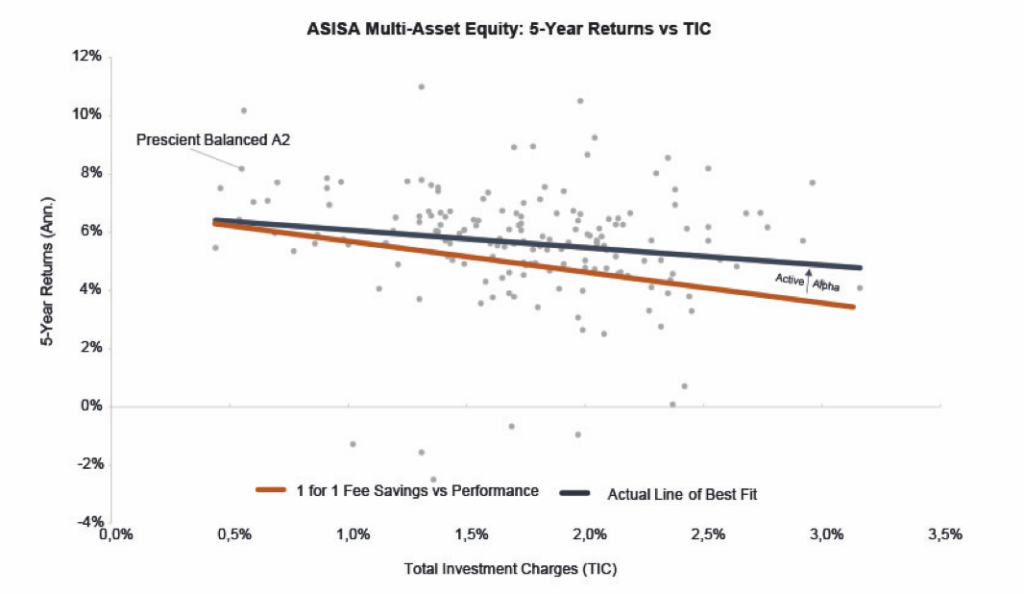

Lower fees are the surest form of alpha. Looking into the evidence over the last five years for the ASISA Multi-Asset High Equity category, investors made an additional 0.53% for every 1% saved on fees. So why then is that relationship not 1 for 1? The answer lies in active management lifting that line up at the higher end of the total investment charge (TIC) spectrum through the creation of alpha. In other words, you can indeed get more by paying less, as well as earn more by paying more – both active and passive asset management have their place in a portfolio.

How can a fund then combine low fees with that positive alpha profile from active management through investment decisions? At Prescient, we believe the multi-asset investment nirvana is to combine low fees offered in passive funds with the potential for positive alpha offered in active funds. We do this by running our Prescient Balanced Fund with an efficient strategic asset allocation to anchor the portfolio similar to a passive approach, plus a systematic approach to taking tactical asset allocation tilts using reams of data distilled into simple investment decisions.

We implement this by investing in predominantly passive indices using our portable alpha process rather than picking stocks.

These three approaches, combined with one of the lowest fees in the market, allows the Prescient Balanced Fund to print small, consistent amounts of alpha year in and year out. And consistency, no matter which way you frame it, is just what investors are looking for.