By Clyde Parsons, Chief Innovation Officer at BrightRock

The residual impact of the COVID-19 pandemic, ongoing geopolitical conflicts and a series of climate shocks have led to a worldwide increase in the cost of living. According to the IMF’s 2023 Annual Report, countries in sub-Saharan Africa saw an average increase in food prices of 24% in 2020–22, the largest since the 2008 global financial crisis. This has had a knock-on effect on the life insurance industry in South Africa, with affordability becoming a primary concern to clients when discussing their risk portfolio with their financial adviser. Long-term insurance statistics recently released by ASISA show that in-force policies increased only marginally in 2023, while there was a slight reduction in lapse rates. Together, these factors are driving a highly competitive and commoditised space, where both clients and advisers are actively comparing premiums between different providers.

One of the levers that financial advisers have at their disposal to address the affordability of cover is premium funding patterns. However, clients and financial advisers need to weigh up both the short-term affordability as well as long-term sustainability of premiums, as there is essentially a trade-off between initial premium affordability and the long-term affordability of cover and premium increases. In principle, the most cost-efficient funding pattern over time is the least aggressive option, as it’s also the most sustainable funding pattern. However, clients often opt to ‘buy now, pay later’ through a lower initial premium – and a lower initial level of cover – which then increases aggressively with age. These age-rated funding pattern are among the most prevalent funding patterns in the market, despite the fact that they are, for the most part, neither efficient nor sustainable. A study published by BrightRock and True South Actuaries in 2012 showed that most people with an age-rated funding pattern would end up with unsustainable premium increases or insufficient cover, or both. This is because, as premiums increase and become increasingly more expensive, clients are likely to buy down or lapse their cover owing to affordability constraints.

Compounding this problem is the complexity and confusing terminology that surrounds premium patterns in the industry. For example, a “level” funding pattern may, in fact, be age-rated. A financial adviser who has quoted their client on a yearly cover increase of 5% and a 5% compulsory premium increase, may be forgiven for expecting their premium will increase by 5% every year to pay for the 5% increase in cover. At worst, they might expect a 10% increase to fund the cover increase plus the compulsory premium increase. In most instances, however, if cover is added with a scheduled annual cover increase, it will actually be priced for the client’s age at the time of the increase (and with many providers, this component of the premium increase isn’t guaranteed, despite the contract containing a premium guarantee). In other words, age rating applies even though most insurers would not call this an age-rated premium pattern. What’s more, this age-based rate will typically increase every year as the client gets older and be added to the 5% compulsory increase. So instead of the 5% or 10% premium increase implied by the 5/5 funding pattern, the client’s actual yearly increase could be anything between 11% and 13%, with their premiums becoming unsustainable in just a few years.

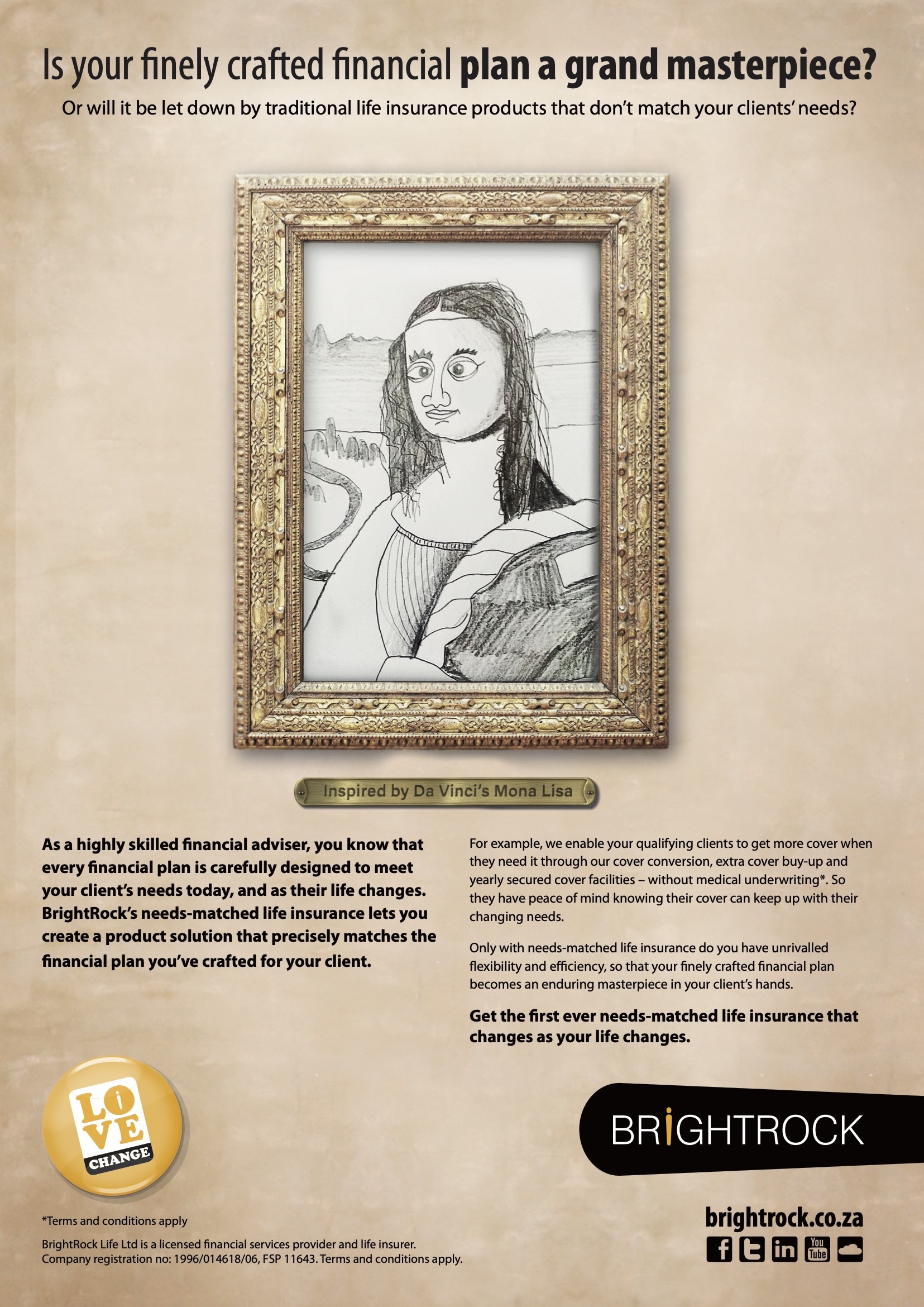

Is your finely crafted financial plan a grand masterpiece?

Or will it be let down by traditional life insurance products that don’t match your clients’ needs?

As a highly skilled financial adviser, you know that every financial plan is carefully designed to meet your client’s needs today, and as their life changes. BrightRock’s needs-matched life insurance lets you create a product solution that precisely matches the financial plan you’ve crafted for your client.

BrightRock Life Ltd is a licensed financial services provider and life insurer. Company registration no: 1996/014618/06, FSP 11643. Terms and conditions apply

Ashley Laatz, independent financial adviser at Consult by Momentum, concurs: “In our practice, we have identified funding patterns as a major concern in terms of the long-term sustainability of clients’ cover and it’s something we actively highlight to our clients. Especially because the industry terminology may create a gap between a client’s expectations and the actual increases they experience. To bridge this gap, we have developed a tool in our practice that enables us to illustrate the impact of different premium pattern choices to our clients. We find that, equipped with this information, clients are easily able to grasp the impact of an age-rated premium increase on the long-term sustainability of cover. As a result, we have been able to shift the discussion with our clients, especially thanks to newer technology available in the market that promotes transparency and offers clients greater flexibility and choice in terms of selecting their premium and cover increases. In fact, in our business, 90% of the business we sell has a 0% premium increase with a 4% cover increase – this is only possible through the new generation, needs-based options now available in the market”.

When BrightRock entered the market, we identified premium funding patterns as an area where insurers have too often failed to treat clients and advisers fairly. To address these shortcomings, our product design aims to offer clients predictable, consistent premium increased that are clearly disclosed through detailed premium projections that show both the rand amount and percentage increase. The full premium increase is guaranteed for 10 years, irrespective of cover increases, and we have opted not to brand our premium patterns, as we believe in names that tell clients what to expect. For example, if a client has a 5% cover increase and a 5% premium increase, both their cover and their premiums will increase by 5% each, every year. This approach helps to demystify premium patterns for clients and advisers alike, supporting informed decisionmaking.

As Laatz concludes: “In our practice, we believe that highlighting premium patterns and their downstream impacts on the sustainability of cover is good business. It supports and enables the sales process, helps us retain clients on our books, and above all, it promotes the long-term financial wellbeing of our clients.”