In a compelling interview at the FPI convention, Mark Neil, Chief Distribution Officer at Bidvest Life, shared insights into the dynamic landscape of the financial advice space and the exciting opportunities that lie ahead.

With a focus on income protection and a commitment to client-centric innovation, Bidvest Life is reshaping the industry. Mark discussed the evolution of products, the importance of personalisation, the role of financial advisors, and the intersection of technology and the human touch in enhancing client experiences.

Unlocking Opportunities in the Financial Advice Space

Mark highlighted the immense opportunities in the financial advice sector, citing the significant sum insured of 1.1 trillion rands written last year. He emphasised the need for adaptation in challenging times and identified income protection as a crucial area with substantial growth potential. Bidvest Life’s 28-year expertise in income protection positions them as leaders in the field, presenting an opportunity to lock in the financial security of hardworking South Africans who rely on their monthly income to provide for themselves and their dependents.

Innovative Product Development: A Shift Towards Inclusivity

Discussing the evolution of products, Mark mentioned Bidvest Life’s Event Based product, a testament to their commitment to protecting the income of a diverse range of occupations, including dual income earners, commission earners and contract workers, not to mention the riskier occupations like professional sports players and high voltage electricians. This inclusivity reflects a positive shift in the industry, addressing the needs of individuals who historically may not have had access to income protection. Mark highlighted the trend of developing malleable, personalized products that adapt to clients’ life events, showcasing Bidvest Life’s Future Cover Protector as an example.

Behavioural Financial Advice: Guiding Clients to Financial Wellness

Mark delved into the industry trend of behavioural financial advice, emphasizing the importance of insurers guiding clients through various life stages and their subsequent evolving financial needs. Metrics focused on clients’ health and well-being play a key role in ensuring a client-centric approach. Bidvest Life’s dedication to putting clients first aligns with the broader industry shift towards holistic financial advice that considers clients’ overall wellness.

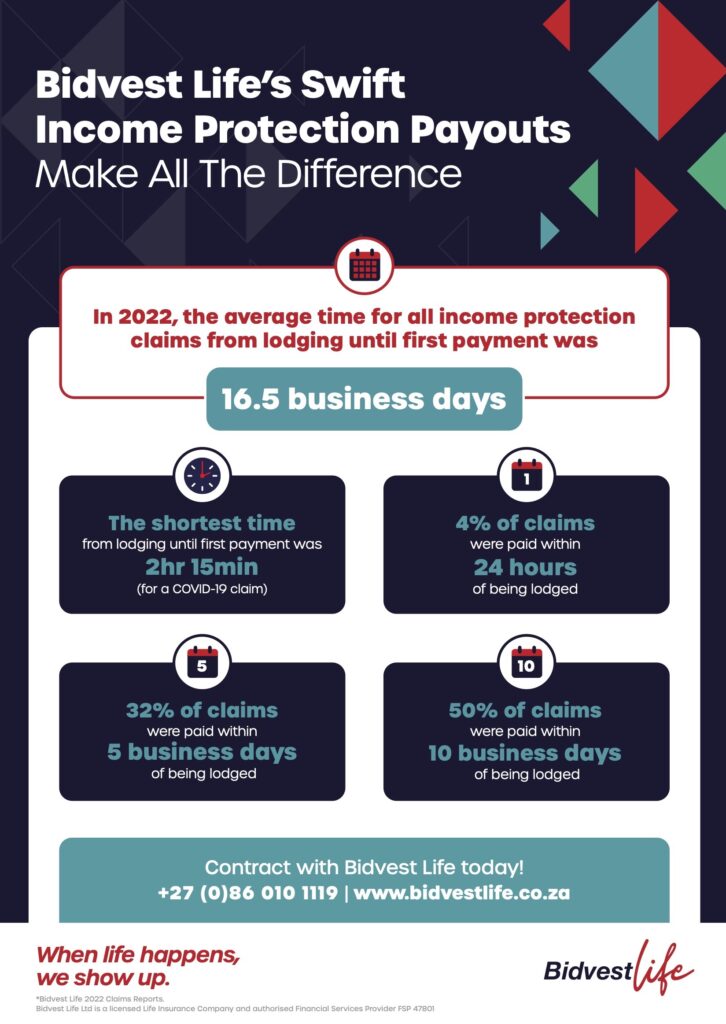

Bidvest Life’s Swift

Income Protection Payouts

Make All The Difference.

In 2022, the average time for all income protection claims from lodging until first payment was 16.5 business days

*Bidvest Life 2022 Claims Reports.

Bidvest Life Ltd is a licensed Life Insurance Company and authorised Financial Services Provider FSP 47801

Navigating Information Overload: The Role of Life Insurers

With the current information overload and accessibility of advice, Mark acknowledged the challenge clients face in discerning valuable information. Bidvest Life remains committed to engaging exclusively with financial advisors, recognizing their critical role in providing guidance and advice tailored to clients’ specific needs. Mark emphasised the pivotal role financial advisors play in a client’s financial journey, particularly in challenging economic environments.

Harmonizing Technology and Human Expertise

Addressing the intersection of technology and financial advice, Mark dismissed the notion that technology would replace financial advisors. Instead, he highlighted how technology enhances the daily operations of financial advisors. Bidvest Life’s Digital Client Application (DCA) exemplifies this, streamlining the application process and significantly reducing turnaround time. The marriage of technology and human expertise is crucial for Bidvest Life, ensuring ease of doing business while maintaining a strong advisor-client relationship.

The Crucial Role of Income Protection

In closing, Mark reiterated the significance of income protection, Bidvest Life’s core focus. He emphasised the client’s income as their greatest asset and underscored their commitment to protecting it. The strength of income protection is evident in the real-life examples showcased in Bidvest Life’s 2022 Claims Report and YouTube videos. Financial advisors have historically always been significant claimants on Bidvest Life’s income protection benefits which highlights the efficacy of these very products.

Conclusion

Mark Neil’s insights into Bidvest Life’s approach to financial advice underscore a commitment to innovation, inclusivity, and client-centricity. In a rapidly evolving industry, they stand out as leaders, driving positive changes that prioritise the financial wellness of clients.

The intersection of technology and human touch, coupled with a strong emphasis on income protection, positions Bidvest Life at the forefront of shaping a brighter future for the financial advice landscape.