Urs Baertschi, Chief Executive Officer Reinsurance EMEA / Regional President EMEA, Swiss Re

Over the last few months, the world has been jolted awake by the widespread and devastating impact of an unprecedented global crisis in the context of Covid-19.

We have seen first-hand the terrible consequences from taking a “just in time” approach. We have also learned the importance and value of “just in case” risk management and the need for preparation before disaster strikes. Now we must apply these lessons to another global crisis currently underway, that of climate change, and the re/insurance industry has a major role to play.

The climate reality

I personally experienced the terrifying potential of climate change when I lived in Miami and my family had to evacuate the area to escape destructive storms. Additionally, heavy rain regularly submerged entire neighbourhood streets, and rising sea levels and king-tide phenomena flooded communities even during sunny days. As a father, a citizen and an insurance professional, I find this situation profoundly worrying.

Now I live in Europe again, where we know that climate-related “secondary perils” such as droughts, floods, and wildfires can be just as harmful as the more visible hurricanes and tropical cyclones we see in the Atlantic and Pacific oceans. In its most recent sigma report, the Swiss Re Institute showed that secondary perils were once again responsible for most of the USD 52 billion global insured natural catastrophe losses in 2019, and that after record losses in 2017 and 2018.

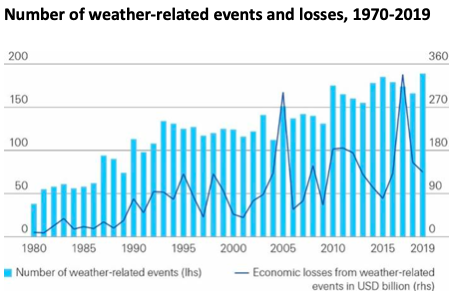

There’s mounting evidence that weather extremes are likely to become more common globally, including in the Europe, Middle East and Africa region that I call home now. For instance, if we look at the last 50 years, large parts of central and north-western Europe saw an increase of up to 11% per decade in annual river-flood discharge, while the Mediterranean area and Eastern Europe have shown sharp decreases. Another area of concern is higher tropical cyclone activity in the southwestern Indian Ocean which exposes countries like Mozambique, Malawi and Zimbabwe to more extreme weather events. A third example is serious and persistent drought conditions in Southern Africa caused by reduced and late rainfall combined with long-term increases in temperatures. More broadly, the impact on societal resilience in the form economic losses from the combination of more frequent and more extreme weather events with higher “values at risk” can be seen in the chart below:

The role of re/insurance

I believe the re/insurance industry will play a leading role in a future world where extreme weather is the norm. Of course, the most obvious contribution is risk transfer and claims payments, but our industry also plays a fundamental role in society through its considerable knowledge and expertise in risk identification, risk assessment, and risk mitigation. Our leadership in building resilience against climate change will therefore stem from our ability to leverage a unique combination of knowledge, data and infrastructure.

In order to underwrite risks, our industry must understand them profoundly. This requires detailed knowledge of almost all aspects of our environment and our activities: construction, geography, climatology, geology, demography, health and finance, just to name a few. On top of that, technological advances are transforming our industry’s ability to analyse and mitigate risks. This will enables us to support our customers as well as local and national governments through the development and implementation of climate adaptation policies and preventive measures.

Next, data will enable our industry to develop solutions that reduce the impact of climate change. For example, detailed flood mapping data combined with big data and advanced modelling capabilities mean that the specific exposure of an individual property to flood risk can be calculated. This enables more specific pricing strategies that, combined with rebates for climate-proofing, can “nudge” owners and local governments into building a more resilient housing stock.

Finally, infrastructure is our first line of societal resilience in the face of climate change. In our more turbulent future, huge investments will be needed to build an infrastructure for a low-carbon world as well as to upgrade existing infrastructure to endure and minimize the impact of disasters. Here, the value of re/insurers is threefold.

First, as risk experts, we understand how, where and what forms of infrastructure can create the most resilience. This can also include acting as an advisor for governments on such topics as the development of building standards and land use. By creating the right legislative and regulatory environment, governments can mobilise the insurance industry in the development of a more resilient infrastructure backbone, fit for an increasingly volatile climate.

Second, as investors, we have a long-term outlook and seek to match the extended time horizon of our liabilities with similar-duration investments and predictable cashflow. Our investment interests therefore include the development of and investment in infrastructure fit for the future.

Third, as risk carriers, insurance is often a pre-requisite for project financing and provides additional certainty that projects will be completed as designed and on-time. It also enables the delivery of more complex and impactful projects, many of which will facilitate the adoption of green technologies that lower carbon emissions.

Conclusion

Climate change poses an existential threat to the human race. One key lesson in resilience we can take away from the Covid-19 disaster is the importance of early risk awareness and decisive risk management. That’s why the re/insurance industry, working closely with the public sector, must play a central role in the mitigation of the impacts of climate change.

Together we make the world more resilient ⎯ for ourselves, for our children, and for generations to come.