In a recent webinar, Ashburton Credit Portfolio Manager Tshepo Shabalala provided insights into how credit fits into a diversified investment portfolio.

He covered the definition of credit, its differentiation from equity, the distinctions between listed and unlisted credit, and the fundamentals of credit risk assessment. We unpack these key points to help personal investors and Independent Financial Advisers (IFAs) better understand how credit investments can enhance portfolio performance.

Defining credit

Credit, as Shabalala explains, is essentially a contractual agreement where a borrower receives a sum of money or another valuable asset (the use of a car, equipment or property under a lease agreement) and commits to repaying it later, typically with interest. Most people are familiar with this concept in their daily lives, whether through personal loans, credit cards, or home loans. However, when it comes to investing, credit as an asset class often remains less understood compared to equity (shares in listed and unlisted companies).

Credit versus equity

The fundamental difference between credit and equity lies in its risk and return profile. Credit offers limited upside but can have significant downside risk if the borrower defaults. Returns on credit are usually predetermined and typically do not change throughout the investment term. In contrast, equity investments offer unlimited upside potential, but this comes with the possibility of substantial losses and volatility. Additionally, in a liquidation scenario, credit holders are prioritised over equity holders, making credit a comparatively less risky investment in distressed situations. There are various categories of credit risk that one may be exposed to. At the lower end, you have government bonds which are considered risk free assets provided the debt is issued in local currency. It is considered risk free as the government can theoretically print money to service the local currency debt. However, this does have inflation implications which will result in reduced purchasing power of the local currency. Government bonds are typically liquid and issued on a fixed rate basis. Due to their liquidity, there is volatility on its market values as indicated with its Yield To Maturity (YTM). YTMs will increase or decrease depending on country and global factors.

Upside versus downside risk

Upside risk refers to the return you earn, which is capped based on the agreed-upon interest. As an example, if you enter into a loan agreement with the bank, they will normally quote you a prime plus x% interest rate which means the bank’s return is capped to that interest. Downside risk means the investment can go to zero if there are defaults. On equity the upside (return) is not capped but there are risk-return trade-offs, making credit a less risky investment compared to equity.

Types of credit investments: listed versus unlisted credit

Credit investments can be classified as either listed or unlisted. Listed credit, normally in tradable note form, is often traded on stock exchanges like the Johannesburg Stock Exchange (JSE). These instruments are dematerialised and standardised through documents such as the Domestic Medium-Term Note (DMTN) programme and Applicable Pricing Supplement (APS). Unlisted credit, on the other hand, involves more bespoke agreements that are not publicly traded, often allowing for more tailored terms and conditions.

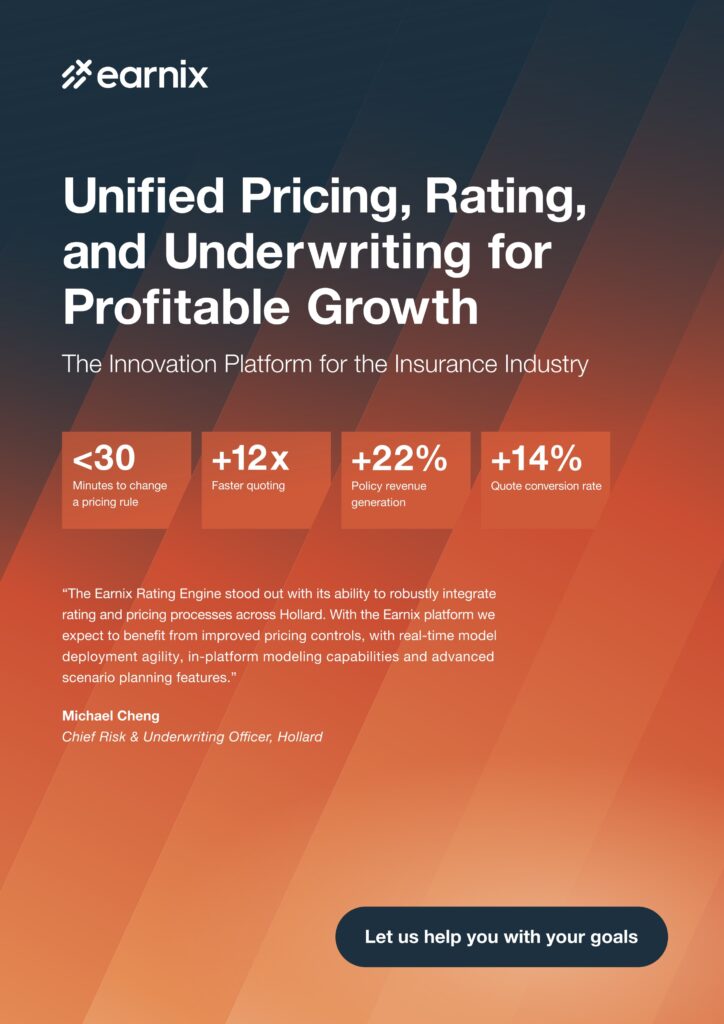

Unified Pricing, Rating, and Underwriting for Profitable Growth

“The Earnix Rating Engine stood out with its ability to robustly integrate rating and pricing processes across Hollard. With the Earnix platform we expect to benefit from improved pricing controls, with real-time model deployment agility, in-platform modeling capabilities and advanced scenario planning features.”

Michael Cheng

Chief Risk & Underwriting Officer, Hollard

The Innovation Platform for the Insurance Industry

Credit risk assessment

Effective credit risk assessment is crucial for minimising downside risk, in other words the probability that the borrower will default leading to a write down in the investment made.

The four pillars of credit risk assessment are:

1. Business character: This involves evaluating the company’s business risks, market position, and sustainability.

2. Corporate governance: Good governance practices, including board independence and management integrity, are critical.

3. Environmental and social responsibility: Companies need to act responsibly towards the environment and society.

4. Financial health: Assessing the financial stability and cash flow capabilities of the company to ensure it can meet its debt obligations.

The evolving credit market

The credit market in South Africa has seen significant growth, says Shabalala. From 2002 to 2023, the total outstanding debt in the market increased from below R500-billion to R4.5-trillion. This growth was driven by both sovereign (government) and non-sovereign (corporate) issuers. However, economic challenges and cautious borrowing practices have moderated the pace of non-sovereign credit issuance since the 2008 global financial crisis.

Conclusion

Credit investments, when understood and effectively managed, can play a vital role in a diversified investment portfolio. By offering predictable returns and relatively lower risk, credit provides a valuable counterbalance to the volatility (albeit potential high returns) of equity investments.

A measured approach to credit risk assessment and strategic credit investment selections can help investors and IFAs achieve a more stable and diversified portfolio in the currently volatile global economic environment.