Click2Sure

At a glance

- Until now, there has been a distance between the makers and buyers of products large and small.

- Manufacturers sought deeper insights on consumers who bought their products from retailers, but lacked the channel to gather them.

- Embedded insurance creates that channel, while bringing in extra, perpetual revenue.

- Click2Sure’s proven embedded insurance software can be launched for manufacturers within a month.

Whether you make baby strollers, sprinkler systems, appliances or bicycles, you face the same challenges: differentiating your brand in an increasingly competitive market, growing your direct relationship with consumers and being retailers’ and resellers’ top brand to sell. We’re here to help you solve them.

How? By helping you bring in consumer insights and revenue from extended warranties or special insurance offered with everything you make. We’ll do this by partnering you with one of our 30+ traditional insurance partners, then digitally embedding their policies into the purchase journey of your products, using our proven software platform.

Embedded insurance is a massive growth opportunity that enables retailers and manufacturers whose products they stock, to offer a value-added service to consumers, gather information on consumers and grow a deeper relationship with them.

Picture it: when a customer buys one of your products, they’ll be delighted to be offered an extended warranty or additional cover with it – breakage, theft, etc. – in the knowledge that they can use it and enjoy it with total peace of mind. When it comes to high-ticket purchases like racing bikes or scuba gear, that’s important to people.

Any insurance, any product

It’s not just product cover we embed in products. We can help you embed almost any type of insurance into almost any product, from accident cover sold with crash helmets to pet insurance sold with pet toys or health insurance sold with nappies.

Because embedded insurance can be offered to consumers under your brand name (rather than your insurance partner’s), they’ll also come away with the feeling that you’re a customer-centric brand that cares, and will keep an eye out for your future offerings.

If you haven’t been offering any kind of insurance with your range before now, keep reading – and if you have, there are two reasons to do the same:

- You don’t offer insurance in this way

- Our solution can raise take-up of your insurance offering to 43%

Here’s the secret: we make it so easy

The main reasons consumers don’t take out extended cover or insurance with purchases are because the offer is not immediately obvious to them, meaning they forget about it; or it looks like too much effort to apply (brands that are still making consumers fill out paper application forms with a pen are doing them a major disservice). This results in what’s called the global “protection gap”; billions of Rands in lost policy take-up.

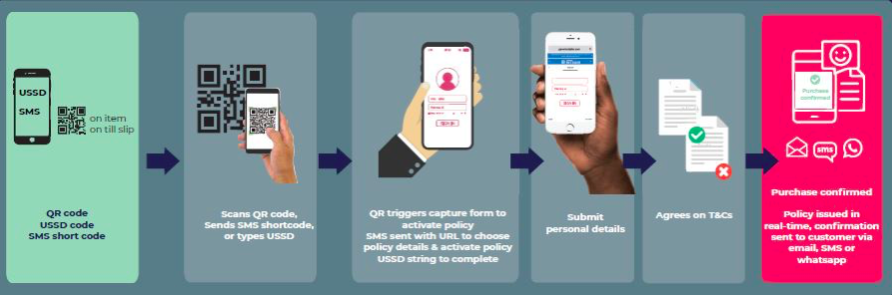

We can place your extended warranty or insurance offer right in front of consumers, the moment they select your product and make the application easy via QR codes or SMS/WhatsApp details on your product, the packaging and/or the customer’s till slip.

Because their purchase feels most special to them on the day they buy it, and because taking up cover feels easy and natural using their phone, they will. Here’s an example of how the digital journey goes:

How do we do it?

We won’t dive deep into the software technicalities, but in essence, we provide our clients – brand manufacturers and leading South African retailers – with a comprehensive, cloud-based, digital SaaS platform that enables distribution and management of digital insurance products in a simple and cost-effective way.

Our solution helps brands introduce digital insurance products as a value-added service – without any Capex outlay or risks. We simply spend a bit of time embedding our software solution into their existing tech stack, without disruption to their core operations.

How much work would that mean for you? Almost none. The work to do would be on our part, and the insurer’s.

It’s about more than money

Sure, you’ll generate some revenue from premiums but how often, as a manufacturer, do you get the chance to gain real insights on the people who buy your products at the other end of the retail chain? Once your digital insurance offering goes live, you will start collecting data on all consumers who take it up – who they are, where they are, what they bought, their contact details. All of the consumer data that would normally sit with a retailer or reseller, via on-credit purchases or their own warranty policies, would become yours.

You can imagine the cross-selling or up-selling opportunities this will create. More importantly, you will have a whole new channel devoted to “customer care” communications. This could even impact the products you decide to launch in the future, where and when.

Two steps to make it a reality

First step: we would need to bring you together with an insurance provider. More than 30 leading insurers have so far assessed and approved our digital embedded insurance solution, so it will be simple to arrange. The insurers we work with can engineer various innovative policies specific to different products or services offered by your brand.

Secondly, as mentioned, we would need to overlay our technology onto your systems so that the facilitation, distribution, administration and reporting of your insurance offering can go to market.

We can get you live in 30 days, and remember: there is no capex outlay, only a set-up fee and monthly subscription fee. So you have everything to gain and nothing to lose.

To start building a direct relationship with consumers and growing a new revenue stream, call +27 (10) 045 4019 or chat to us on hello@click2sure.co.za.

If you’re an insurer coming to us from the other end of the equation, schedule a demo with us so we can show you how our SaaS will move you to the digital forefront.