Clyde & Co

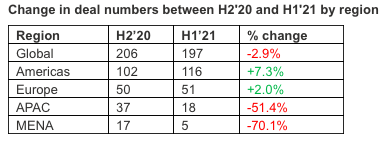

Mergers and acquisitions (M&A) in the global insurance industry dropped back slightly in the first half of 2021 with 197 completed deals worldwide, down from 206 in the second half of 2020 and 201 at the same point last year, according to Clyde & Co’s Insurance Growth Report mid-year update.

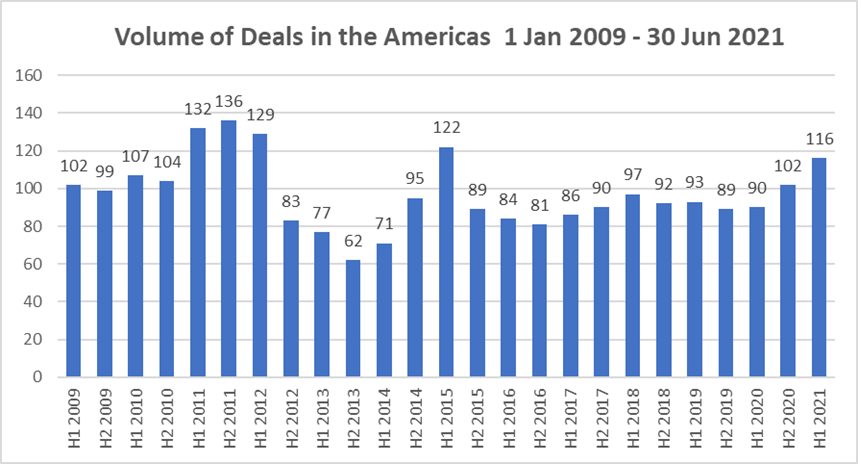

Driven by robust activity in the US, the Americas led the way with 116 deals, up from 102, pushing M&A in the region to its highest level since 2015. After a steep drop in transactions in 2020, Europe held steady in H1 2021 with 51 completed deals, up one on the previous six-month period. The UK was the leading European country – and second most active worldwide behind the US – ahead of Spain and Germany.

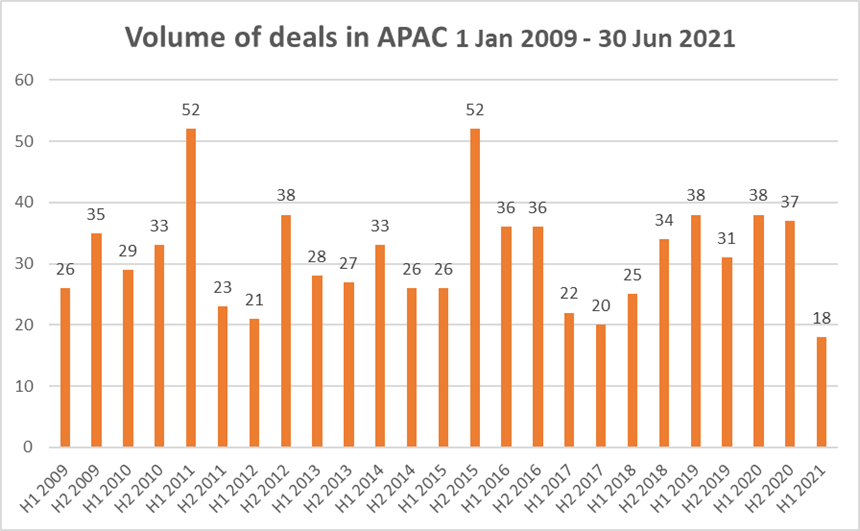

In contrast, Asia Pacific saw completed deals fall from 37 to 18 – the lowest level since we began this report in 2011 – as post-pandemic and geo-political uncertainty weighed heavy on deal-makers. Japanese acquirors were again the most active compared to 2020, ahead of India and Australia.

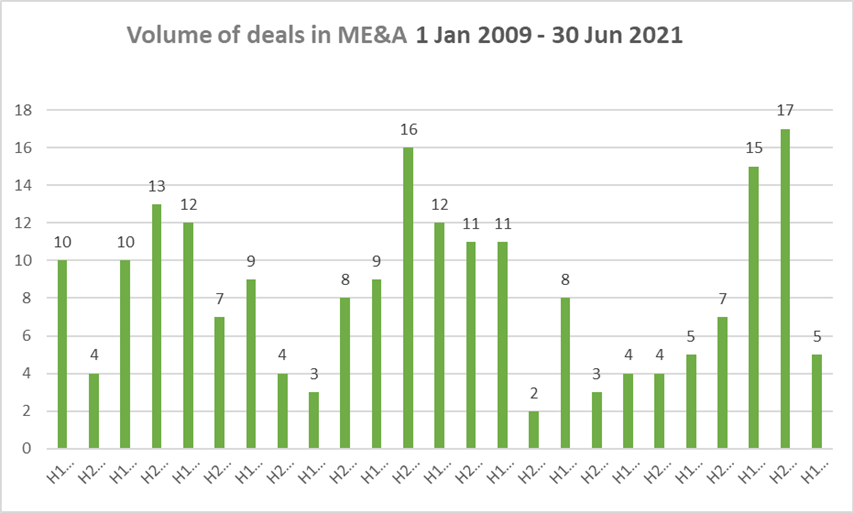

After a standout 2020, which saw a total of 32 deals, M&A activity in the Middle East and Africa dropped back with only 5 completed transactions in the first half of this year. These all involved Middle East acquirors – two from Israel and one each from Egypt, Saudi Arabia and the UAE.

Peter Hodgins, corporate insurance Partner at Clyde & Co in Dubai, says: “M&A activity in the Middle East insurance markets continued at modest levels during the first half of 2021. Activity appears to have been opportunistic with local investors capitalizing on the strategic decision of some European insurers to scale back operations in the region. We expect further developments later in the year 2021, as insurers seek to focus on core lines of business / specific regional markets where there is perceived scope for future growth. Consolidation remains high in the agenda, particularly in the larger insurance markets of the UAE and Saudi Arabia, driven by high levels of competition and ongoing regulatory developments. There has also been a significant volume of transactions involving intermediaries and insurance support businesses, with notable interest in health insurance third party administration businesses.”

Ivor Edwards, Partner and European Head of the Corporate Insurance Group at Clyde & Co, says: “Despite the challenges of the last 18 months, the insurance industry has responded well and demonstrated a remarkable degree of resilience when it comes to getting deals over the line. Market hardening is creating organic growth opportunities for re/insurance carriers, but the availability of cheap liquidity, active interest from private equity investors and strategic re-underwriting of portfolios at larger carriers signal that an uptick in M&A is likely. The extent of that increase will vary by region and investor sentiment – deal-makers in the US are comparatively bullish whereas their counterparts in Asia-Pacific remain more cautious as they wait for a more positive economic outlook.”

Key M&A drivers remain constant

Strategic disposals increasingly common

There were 11 deals in H1 2021 valued at over USD 1.0 billion, compared to 15 in the whole of 2020, including the largest of the period, the sale of UK-headquartered RSA to Regent Bidco for USD 9.2 billion. In addition to the rise in big-ticket transactions, in a sign of a bifurcated market, there is an increasing number of more modest strategic divestments from carriers looking to focus on their core business as part of a long-term strategy.

Vikram Sidhu, Clyde & Co Partner in New York, says: “We are seeing a lot of legacy books being sold off or prepared for sale. The sellers tend to be companies looking to the future in a robust and creative way, trying to clean up their balance sheets and free up capital; they are taking a proactive focus on the next 2, 5, 10 years.

Technology both a deal catalyst and barrier

H1 2021 saw technology investments into a variety of businesses around the world including deals focussing on coverage to homeowners in catastrophe-prone regions, online insurance comparison platforms, and digital healthcare,

Eva-Maria Barbosa, a Partner at Clyde & Co’s office in Munich says: “Covid-19 has underlined the importance of having digital capabilities and technology remains a primary driver of M&A. Many start-ups have matured to the point where they have a proven business model and a robust balance sheet, which makes them very attractive to buyers. Meanwhile, on the flipside, the absence of sufficient technology investment on the part of a seller can be a deal breaker – potential acquirors can be put off if they think they need to spend millions to make a target company’s IT systems fit for purpose.”

Regulators flexing their muscles

The sharp drop in M&A activity in Asia Pacific can be attributed in part to the high regulatory bar in some jurisdictions. Not only do prospective acquirors face higher solvency capital requirements in some markets, but there is a more robust scrutiny of business plans to assess the longevity of new entrants’ interest.

Joyce Chan, Partner at Clyde & Co in Hong Kong says: “Regulators are becoming increasingly cautious. When new players come in and buy a particular insurer in the region, local regulators usually request quite a substantial capital increment as well. The solvency requirement expectation is much higher, acting as a brake on M&A. Conversely, regulatory actions are also making some significant portfolios available to acquirors. In Australia, for example, the knock-on effect of the recent Royal Commission is forcing the country’s major domestic banks to offload non-core lending businesses, which is making a number of attractive insurance assets targets for acquisition.”

Outlook varies by geography

US optimism abounds

After a standout first six months of the year, the expectation is for more M&A to come in the US. Vikram Sidhu says: “Deal-makers are looking past concerns around the Covid-19 pandemic and economic uncertainty. There is an expectation in the US that the economy is going to grow in leaps and bounds over the coming quarters and years – the post-pandemic outlook is very positive. Even weak sectors have been rebounding and the concerns of the last year have been receding (albeit tempered by a rebound in Covid cases due to the Delta variant), bolstering investor sentiment. We expect M&A to remain at a high level for the remainder of the year and into 2022.”

Europe ready for an M&A re-set

Although deal activity in Europe has continued steadily at a comparatively low level for a couple of years, there are signs that some of the region’s structural issues are being addressed. Eva-Maria Barbosa says: “The high number of life insurers and composite carriers facing stringent capital requirements make these businesses unattractive to potential acquirors, while companies looking to build scale in their non-life book through M&A have to solve the conundrum of what to do about their life operations before seeking a merger partner. Some larger carriers are looking to exit the life market in order to improve their balance sheets, with the bulk of life business divestments expected to end up in the run-off sector.”

Asia Pacific considers alternative routes to growth

M&A activity in Asia Pacific is likely to remain subdued until the markets have stabilised post-Covid-19 and there is greater certainty about the economic outlook. Joyce Chan says: “Deal-makers in Asia Pacific remain in wait-and-see mode for the time being. Given the cost and effort required to get transactions over the line, insurers are considering a range of growth options. These include strategic alliances with online banks, e-commerce giants, or other online retail platforms to access new distribution networks. The MGA model is likely to expand, especially in the medical insurance sector due to the uptick in middle-class spending coupled with an ageing population.”