Anil Thakersee, Executive: Marketing & Business Development at PPS Investments

When investing, you do so with the intention of achieving your required investment outcomes.

While there are several factors that can contribute to, or detract from, performance, the underlying asset allocation of your investments is the large lever impacting both risks and returns delivered by any portfolio. Asset allocation as an investment strategy is based on empirical studies focused on how each asset class performs and correlates relatively to each other. Let’s look at the asset classes typically used for investments, what asset allocation means and the process employed.

ASSET CLASSES EXPLAINED

Broadly speaking, there are four main traditional asset classes that money can be allocated to when investing. These are cash, bonds, property and equity. Each asset class has different levels of risk and reward, investment time horizon and protection against inflation, which are explained as follows:

- Cash: investments linked to an interest-bearing bank instrument, such as call deposit accounts or money market funds. This asset class is lower risk, and works best for short-term goals (typically one year or less). The performance of this asset class is directly linked to interest rates.

- Bonds: interest-bearing loans issued by the government or corporates. This asset class is a low- to medium-risk category with a medium- to long-term investment time horizon (5 – 10 years). The risk associated is linked to the issuer being able to pay returns (honouring the bond agreement), prevailing interest rates potentially being higher than the rate of return of the bond, and inflation reducing the real interest that an investor may receive.

- Property: linked to listed property companies and property investment companies. This asset class is a medium- to high-risk category, with a medium- to long-term investment time horizon (5 – 10 years). These investments are generally adversely affected by interest rate increases and are impacted by the macroeconomic environment of the country.

- Equity: the high-risk, high-reward asset class. Investors own a share in the listed company that they are invested in. You are directly impacted when there are profits or losses in a company and investors are subject to stock market movements on a daily basis.

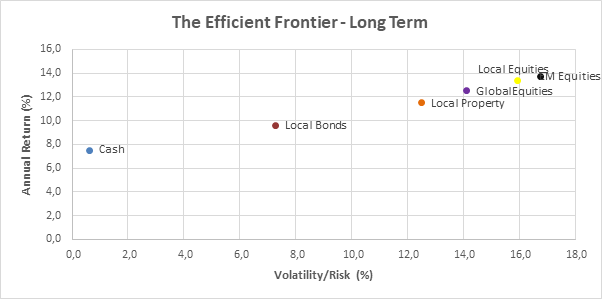

Equity is considered a long-term investment (7 – 10 years or more), due to the volatile nature of this asset class. Your capital may not be guaranteed, but there is no ceiling on the returns. As an asset class Equity has generally produced higher returns for investors over the long run, however, this asset class has also historically produced high levels of volatility. The table below looks at the risk and return outcomes for the core traditional asset classes over the last 20 years, showing the risk-return trade-off achieved through asset allocation.

Source: PPS

Another important factor to consider is what country this asset class invests in. If the asset class invests mainly outside of South Africa, the return will be significantly impacted by sharp moves in the local currency. Therefore, offshore returns when measured in Rand are not just impacted by the underlying investment performance but also by movements in the Rand relative to the currency of the underlying investment. A typical balanced fund, for example, will have exposure to both local and global assets.

WHAT IS ASSET ALLOCATION?

Asset allocation is the process of dividing an investment portfolio between different types of asset classes, such as stocks, bonds and cash, as well as choosing the right mix of asset classes while constructing the portfolio with the intention to minimise investment risks and maximise growth potential or enhance returns.

There are two common approaches to asset allocation, strategic and tactical asset allocation. Strategic asset allocation (SAA) is the long-term focus of the fund and is considered the most likely approach to achieve the fund objective. Tactical asset allocation (TAA) uses techniques to improve risk-adjusted portfolio returns by taking advantage of short-term opportunities and aims to maximise short-term investment strategies.

Over the long term, a portfolio’s SAA will be the main contributor to achieving its return and risk objectives. These returns can, however, be enhanced through short-term TAA, where we seek to take advantage of temporary mispricing across the asset class spectrum.

WHAT IS THE ASSET ALLOCATION PROCESS?

To illustrate this concept in action, let’s look at the approach that our investment team employs in terms of our asset allocation. When taking an asset allocation view, we remain committed and patient, allowing it time to play out. At the same time, we remain agile and open to re-evaluating these views as new information arises. When assessing tactical asset class opportunities, we adopt a 12 to 18-month view which, together with our underlying manager alpha estimates builds on our baseline strategic asset allocation (SAA) return assumptions when we construct portfolios.

We believe that a portfolio’s SAA will be the main contributor to achieving its return and risk objectives over the long term. Returns can however be enhanced through short-term tactical asset allocation (TAA), where we seek to take advantage of temporary mispricing across the asset class spectrum.

House view meetings are held regularly to determine the positioning that informs TAA shifts relative to a portfolio’s long-term SAA.

Multiple inputs from various internal and external sources inform the debate around adjusting asset allocation. These inputs are distilled into three key areas for each asset class: fundamental valuation, macroeconomic backdrop and price momentum.

ACCESSING SOLID ASSET ALLOCATION CAPABILITIES

The PPS Investments Multi-Manager fund range is designed to provide different levels of risk-adjusted returns calibrated through the underlying asset class weightings, which are built into the investment framework. This significantly enhances our ability to consistently deliver returns that meet the required investment outcomes.

FINANCIAL PLANNING AND ASSET ALLOCATION

It is important to note that it is the financial planning process that determines the required return outcomes and then seeks to match that requirement with an appropriate investment solution. The benefit of reviewing your financial plan, as your required outcomes change, helps to ensure that the underlying asset allocation is still aligned to your required investment outcomes.