In a recent conversation with Santho Mohapeloa, Senior Cyber Specialist at Allianz Commercial, he revealed key insights from the Allianz Cybersecurity Resilience Report for 2024.

The report highlights significant trends and risks in cybersecurity, particularly focusing on ransomware, data breaches, and emerging threats that organisations face today.

Ransomware: An Ongoing Threat

Despite a slight decline in ransomware incidents, it remains a critical concern for businesses. The report indicates that ransomware attacks account for 58% of claims exceeding one million euros. While the pandemic of ransomware may have subsided, its impact is still profoundly felt across various sectors. “The fact that ransomware is still present is alarming,” stated Mohapeloa, underscoring the ongoing need for vigilance.

The Rise of Data Breaches and Exfiltration

Alongside ransomware, there has been a noticeable increase in data breaches and class action lawsuits in both the U.S. and Europe. A shift has been noted in criminal tactics, moving away from encryption-based ransomware attacks to data exfiltration. This change allows cybercriminals to steal sensitive information, giving them leverage to demand higher ransoms. “The value is in the data,” explains Mohapeloa, highlighting the importance of protecting organisational data from unauthorised access.

High-Profile Incidents

Recent high-profile breaches, such as those involving MGM Grand, T-Mobile, and Snowflake, underscore the growing threat landscape. These incidents not only result in substantial financial losses but also pave the way for increased class action lawsuits. With the U.S. legal system favouring consumer rights, organisations face heightened legal risks following data breaches.

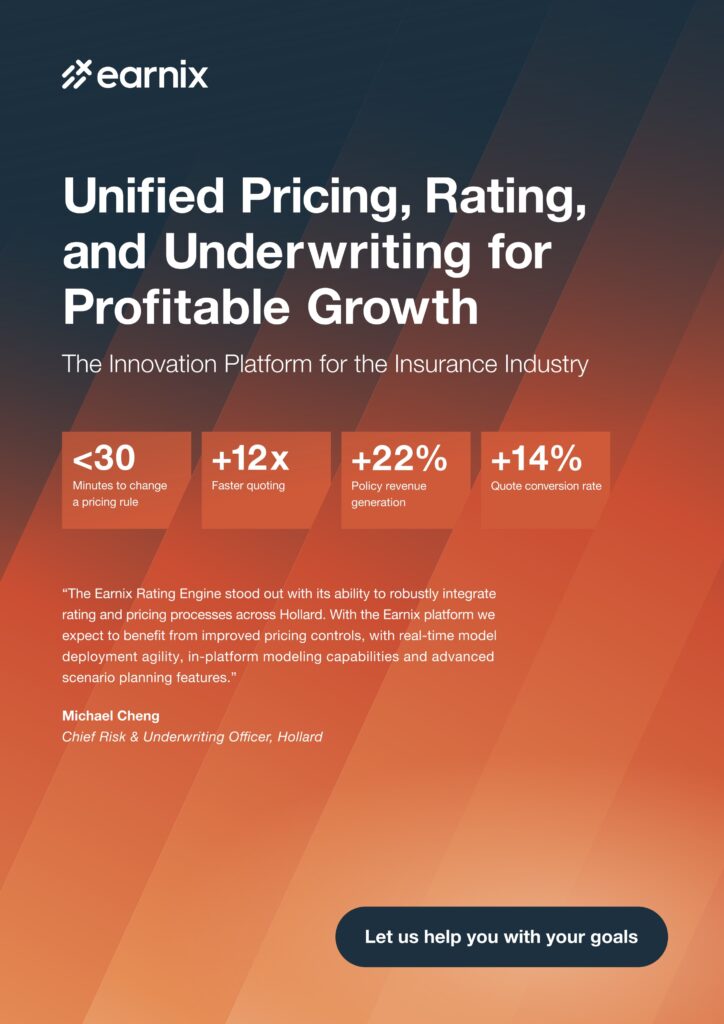

Unified Pricing, Rating, and Underwriting for Profitable Growth

“The Earnix Rating Engine stood out with its ability to robustly integrate rating and pricing processes across Hollard. With the Earnix platform we expect to benefit from improved pricing controls, with real-time model deployment agility, in-platform modeling capabilities and advanced scenario planning features.”

Michael Cheng

Chief Risk & Underwriting Officer, Hollard

The Innovation Platform for the Insurance Industry

Understanding Non-Attack Data Breaches

Non-attack data breaches occur due to improper data collection or storage practices. These breaches can lead to significant legal repercussions, especially in light of stringent data protection regulations in the U.S. and Europe. The report reveals that the fallout from such breaches is extensive, often resulting in costly litigation for organisations.

Claims Management and Risk Mitigation

From a claims management perspective, Allianz utilizes threat intelligence to predict and mitigate risks. Mohapeloa stated, “We have a global outlook on these claims, allowing us to preemptively address potential attacks.” This proactive approach includes advising clients on best practices for cybersecurity.

Best Practices for Cybersecurity

The report identifies several best practices for organisations to strengthen their cybersecurity posture:

Employee Training: Regular training and simulated phishing attacks can significantly reduce the likelihood of successful cyberattacks.

Multi-Factor Authentication (MFA): Implementing MFA policies adds an essential layer of security to protect sensitive data.

Disaster Recovery and Business Continuity Plans: Organisations should develop and routinely test these plans to ensure preparedness in the event of a cyber incident.

Data Breaches: Entities can prevent and mitigate privacy breaches by using Data leak prevention tools, user behaviour analytics, data destruction policies and maintaining good data governance.

By adopting these best practices, companies can lower the impact and severity of potential claims. Clients who have implemented these strategies have fared better during the ransomware pandemic than those who have not.

Collaboration with Brokers

Brokers play a crucial role in the effective implementation of cybersecurity strategies. The importance of collaboration cannot be emphasised enough, brokers who embrace Allianz’s recommendations help clients mitigate risks more effectively. “Those that work with their brokers to manage risks experience the best results,” stated Mohapeloa.

Conclusion

The Allianz Cybersecurity Resilience Report serves as a vital resource for brokers and risk managers, providing insights into current trends and future anticipations in the cybersecurity landscape.

As cyber threats continue to evolve, the importance of remaining informed and prepared cannot be overstated. Organisations must take proactive steps to safeguard their data and mitigate risks in an increasingly complex digital environment.