44th OESAI Annual Conference – Zanzibar, Tanzania

The Tanzanian insurance industry hosted a fantastic 44th edition of The Organisation for Eastern and Southern Africa Insurers in Zanzibar.

According to Mzee Mama Margaret, Chairperson of the Tanzania Local Organising Committee, the Tanzania Insurance Industry has been growing both in terms of the number of players and now has 33 Insurance Companies, 2 Reinsurance Companies, 3 Reinsurance Brokers, 86 Brokers and over 600 agents, including Bancassurance. Gross written premium in 2021 was TZS 923.5mil.

On behalf of the Tanzania Regulatory Authority and the insurance community in Tanzania, Tanzania Insurance Regulatory Authority CEO, Dr. Baghayo Abdallah Saqware, welcomed all the delegates attending the conference. In his opening address, he said: “The pandemic and other emerging risks that the continent is facing are creating challenges for the industry and providing opportunities to create new products and services for our clients. The 44th OESAI Annual conference theme, “Future proofing the Insurance industry, for sustainability” is apt for the environment in which we are doing business.”

The following three days saw a variety of speakers and panel discussions, tackling topics such as The Future of Insurance, by Tavio Roxo, CEO of Owls Software. He stated that “the bottom line is that the future of insurance, very much, hinges on technology”. His warning to the industry was clear: “It is going to be increasingly difficult for you to, as an insurer or a UMA or as a broker, lean on and utilize technology later. You need to start the journey now by engaging with technology providers. You need to start engaging with technology resources within your organization, and you need to start mapping out a digital framework or technology framework, which you are going to adopt over the next few years. It must be intentional; it cannot be haphazard.”

On the topic of IFRS 17 Compliance, Equisoft’s Shingie Maramba said that to be ready for 2023 you ideally need to have completed. your implementation in 2022 to generate the results for the 12-month transition period. During that year leading up to final launch, you need your solution up and running so that it can generate the required data and reports. This gives a carrier time to compare the new outputs against IFRS 4. Problems can be identified, and corrections made, before the solution goes live. He concluded that there will unlikely be any more extensions. The start of the IFRS 17 comparative period is now less than one year away. Putting off your compliance initiatives is no longer an option.

Businesses and communities along parts of the east coast of South Africa were devastated by catastrophic flooding. What was once a relatively well-defined risk has become more erratic, if not unprecedented, meaning effective business continuity planning is more vital than ever, said Allianz Global Corporate & Specialty (AGCS) South Africa CEO Thusang Mahlangu in his presentation. According to Thusang, the flood risk landscape, previously well defined by historical and government flood maps, and to some extent local knowledge is being challenged by erratic and unprecedented weather patterns.

Flooding in figures

- US$1trn estimated flood damages worldwide since 1980, only 12% of which were insured

- 181% increase in annual average reported flood events since 1980

- 2.2bn people live in locations expected to experience inundation during a one-in-a-hundred-year flood event

- 25 new countries could be added to the 32 already experiencing increasing floods by 2030 as a result of climate and demographic change

Calling-God Temu spoke about Capacity Building in the wake of the African Continental Free Trade Areas (AfCFTA). According to Calling-God, the operational phase of the AfCFTA was launched during the 12th Extraordinary Session of the Assembly of the Union on the AfCFTA in Niamey, Niger on 7 July 2019. The start of trading under the AfCFTA Agreement began on 1 January 2021; however, no trade has yet taken place under the AfCFTA regime.

Accelerating intra-African trade and boosting Africa’s trading position in the global market by strengthening Africa’s common voice and policy space in global trade negotiations. African risks are unreasonably sometimes ceded to other continents and reduced much on premium retained. In his presentation, he mentioned that amongst the major challenge faced by reinsurance and insurance organizations in Africa is the shortage of skilled talents in core jobs despite of capital constraints. To be more precise, many youngsters in Africa are also not growing in the manner that sees insurance studies as professional after secondary school rather they just found it accidental on their ways.

Amir Hussain, Senior Underwriter, Political & Credit Risk, Africa Specialty Risks addressed the topic, De-risking Investment and Trade in Africa. He said that today, Africa finds itself facing a plethora of political and geopolitical events which need to be protected against for businesses to flourish, attract new investment and for governments to function. Whilst Africa is abundant in natural resources, from hydrocarbons to metals and minerals as well as large volumes of underutilised arable land, the continuing inability to add value to such exports results in persistent trade deficits. He mentioned that he is excited about: “the growing resilience of its economy. Demand for minerals that power the battery economy is strong. Healthcare and ICT including digital infrastructure continue to be promising with demand from fast growing populations as well as increasing IT savvy amongst Africa’ young population. A McKinsey & Company report highlights that Africa contains nearly 60% of the worlds uncultivated agricultural land as well as having the potential for circa 30-50% higher yields.”

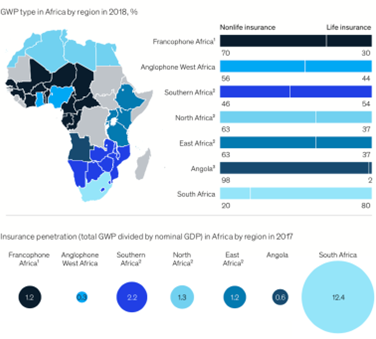

In a very interesting presentation, Anselmi Anselmi of the African College of Insurance and Social Protection unpacked some facts and figures of the African insurance markets. He started off with some population figures, mentioning that with the poverty ratio declining from 38%, to hovering around 32% (close to 460m people), Africa has a population of 1 billion that has the ability to buy insurance (effective demand). If we are to design a $70 life assurance product for all our people, there is a potential for $70bn from life assurance only.

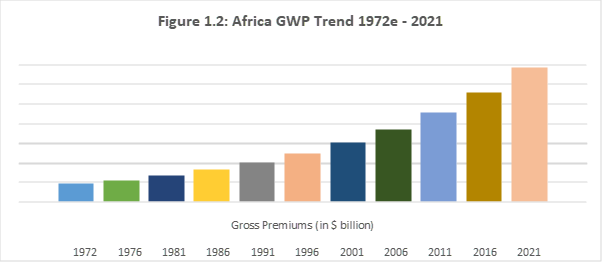

The insurance industry in Africa for the period of fifty years 1972 – 2021 collected an estimate of USD. 1.411 trillion. If we estimate the average premium of 3% across the risks it would mean a total of USD 47.033 trillion was protected by insurance. Thus, in this period of growth in Africa, insurance played its key roles of guarantee, organization, investment and risk management. Insurance services form part of the integrated world of global finance. It played a crucial infrastructural and commercial role in the Continent’s economy. From an infrastructural perspective, the provision of insurance services is closely linked to macroeconomic factors such as inflation, national economic policies and the achievement of national development objectives. This is particularly important since a well-functioning insurance sector promotes financial stability.

Figure 1.2 below shows the trend of insurance premium in Africa as estimated from 1972 to the year 2021.

Anselmi went on to say that Africa has an average insurance penetration rate of 2.8%, presenting a big untapped market opportunity for companies interested in providing affordable insurance products suitable for the mass market.

Not all work

The event was not all work and no play. With Zanzibar’s stunning beaches, lively nightlife, and vibrant sea life, there were lots of entertainment on the cards. Festivities kicked off with a welcome cocktail function at the Madinat Hotel, hosted by The Association of Tanzania Insurers (ATI).