Johann Swanepoel – Product Actuary at Just SA

There are many options for retirees to consider when choosing an investment or product to provide them with an income in retirement. Life annuities (a guaranteed income for life) are growing in popularity to serve this purpose. Although many agree that a guaranteed life annuity should form part of their post-retirement investment strategy, they may still opt to defer annuitisation.

Three possible reasons for this are: human behaviour, the misperception of relative value, and the misperception of the drivers of the price of a life annuity.

Human behaviour

Arguably the biggest factor contributing to this conundrum is that humans tend to have an inherent desire to defer big decisions. Unfortunately, this inclination makes fertile ground for opposing arguments to take root and look for reasons to support the desire to defer. It is therefore easy to see how common misperceptions can lead to decision making that is contrary to ensuring a sustainable retirement income for life.

Misperception of value

There is a common misperception that high life annuity rates at older ages represent better value.

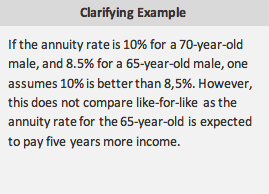

While it is true that life annuity rates are higher for older ages, it isn’t true that these rates represent better value for money. For example, many people incorrectly assume it is better value to buy a life annuity at age 70 with an annuity rate of 10% than buying at age 65 with a rate of 8,5%.

In fact, it is relatively more expensive. This is because it allows for 5 years’ worth of additional potential annuity payments from a product provider, which are not included in the annuity rate from age 70 onwards.

If you correctly compare the price of the payments from age 70 onwards, the decision to defer annuitisation from 65 to 70 is between 10%-15% more expensive. It is better value for money to secure an income for life sooner, rather than later.

Misconception of the drivers of the price of a life annuity

Another common misperception is that low short-term interest rates (like South Africa is currently experiencing) make guaranteed life annuities unattractive.

What matters in pricing life annuities is long-term interest rates. In South Africa, long-term interest rates have increased from pre-COVID levels and despite coming down from their peak in March 2020, annuity rates are still attractive. Buying an annuity now means you benefit from these higher long-term rates. A view of short-term interest rate movements should not influence the decision of when to buy a life annuity.

To defer or not to defer

The inherent desire to defer big financial decisions; and the common misperceptions of price and value are some of the reasons why many South African retirees opt to defer annuitisation.

As we’ve shown, it makes sense to annuitise earlier, but that doesn’t mean that retirees must commit solely to a guaranteed life annuity.

Partial annuitisation in a blended living annuity is also an option and is deemed an optimal solution in retirement. A blended annuity is a living annuity that uniquely has a guaranteed life annuity as an investment portfolio option inside its legal structure. This means the best features of both products are offered in one solution.

Research shows that blended annuities provide a more sustainable income in retirement. Retirees can secure cover for essential expenses with guaranteed income from the life annuity, while allowing for the balance to be invested more aggressively for capital growth and to possibly leave a higher capital legacy at death – all in a single product. And it is not an all or nothing decision. Blending allows annuitants to structure a suitable combination over time, balancing the various trade-offs by switching additional tranches into the life annuity component as required.