Across the globe, digitally transformed insurers are weathering the pandemic more successfully than those relying more on in-person intermediation. Robin Wagner, Senior Vice President of International Insurance at TransUnion, explains why — and the importance of speeding up the digital transformation journey.

Consumer behaviour has shifted — digital is the new normal

As pandemic measures, such as social distancing and working from home, shape new buying and work habits, insurers must adapt to meet an ever-growing number of consumers on their chosen channels.

Global research confirms consumer demands have changed. Over the first two quarters of 2020, online insurance sales spiked by 35–50%, and online sales of life and health insurance in India jumped 25–40% during lockdown.

Across the globe, digitally transformed insurers are weathering the pandemic more successfully than those relying more on in-person intermediation. Robin Wagner, Senior Vice President International Insurance at TransUnion, explains why — and the importance of speeding up the digital transformation journey.

Consumer behaviour has shifted — digital is the new normal

As pandemic measures, such as social distancing and working from home, shape new buying and work habits, insurers must adapt to meet an ever-growing number of consumers on their chosen channels.

Global research confirms consumer demands have changed. Over the first two quarters of 2020, online insurance sales spiked by 35–50%, and online sales of life and health insurance in India jumped 25–40% during the lockdown.

“Customer experience is becoming a key competitive weapon — and insurers need to make sure they keep up with customers’ expectations.” – Evangelos Avramakis, Head of Digital Ecosystems R&D Swiss Re Institute

Digital and multichannel insurers perform better

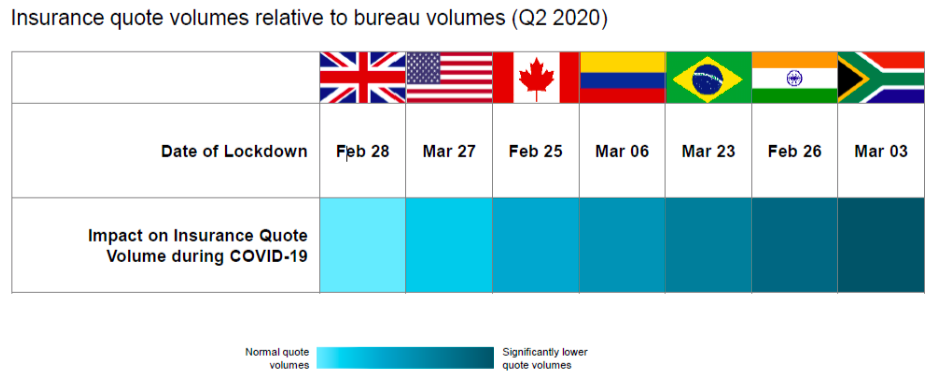

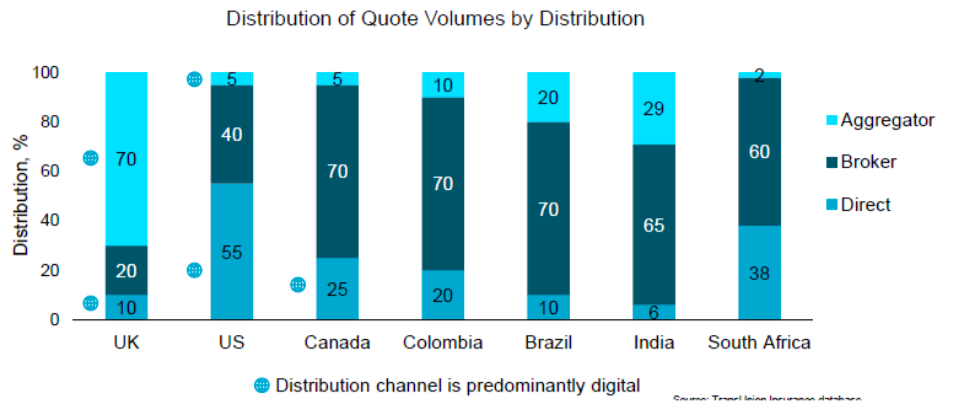

As consumers opted to buy insurance online, insurers with a robust digital presence outperformed competitors during the COVID-19 crisis. In an analysis of Q2 2020 quote volumes, fully digital and multichannel insurers performed 22% better-than-average YoY. In addition, digital aggregators and direct online distribution proved more successful than in-person interactions.

Since the start of the pandemic, countries such as the UK, US, and Canada — where digital penetration is high and insurance well-legislated — fared better than more heavily intermediated industries in nations like India and South Africa.

For the UK, where 70% of insurance uses digital aggregators, quote volumes reveal a highly digitally transformed market. In South Africa (with 60% broker distribution), it’s clear digital insurers outperformed the competition by avoiding the need for physical interaction.

Lockdown challenges aside, insurers that most effectively weathered the COVID-19 storm got these three things right:

- Multichannel distribution across digital, direct and intermediated

- Enabling digital customer onboarding to contract fulfilment

- Offering digital ability to change policy cover and load a claim online

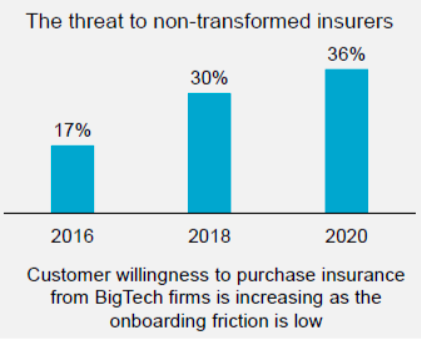

Digital transformation is now a must-have

Investor expectations evolve with consumer demands; insurers that don’t digitally transform and show resilience will lose out. There’s also cost — where insurers looking to improve expense ratios must actively reduce expensive broker commissions to stay competitive.

For 19 US life insurer carriers — using TransUnion data-driven underwriting — client volumes rose by 23% YoY (vs. -7% across the market). This was due to higher levels of straight-through processing enabled by credit-based decisioning and identity verification solutions.

All this doesn’t mean the end for brokers/agent-driven channels. On the contrary, as life insurers strengthen their digital distribution, organisations offering multichannel options will achieve higher Net Promoter Scores (a key measure of customer experience and business growth).

Achieve digital readiness with three quick wins

Increased digital engagement and expectations for a seamless online experience drive the need to fast-track transformation. As a result, insurers must have the protocols to detect and manage risk, and alleviate manual or offline processes that frustrate consumers.

To test these findings, we conducted a mystery shopping exercise to establish the critical differences in digital journeys through a consumer lens and found:

- Digitally ready insurers (primarily property and casualty) offered user-friendly, transparent, efficient and effective journeys

- Digitally unready (mostly life insurers) required too many documents and fields to be filled in, and offered archaic document upload functionality

Automated, data-driven solutions can enable friction-right engagement throughout the customer lifecycle to achieve quick wins. Here’s how:

- Streamline the onboarding process with prefilled, validated third-party data

- Digitally verify consumer identity to protect your customers and your business

- Effectively balance customer experience with compliance and fraud risk

To learn more about how a friction-right online experience can enhance customer onboarding, visit our website today.