By: Bianca Botes, Executive Director at Peregrine Treasury Solutions

The rand has been surprisingly strong since early April, with a few reversals along the way. What is driving this and how long can it last?

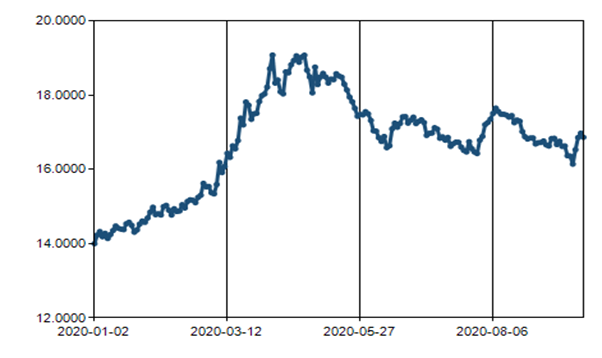

The rand’s nadir this year came unexpectedly just over a week into South Africa’s extreme lockdown. The local unit bottomed at R19.08/$ on 6 April 2020. After its rapid decline to that level, it spent the next 6 months in a generally strengthening trend, although experiencing set-backs along the way. By 18 September, the rand had clawed back over 15% of its value to reach R16.13/$.

Figure 1: R/$ exchange rate 2020 year to date

Source: SARB (2020)

But this was still some way off the R13.99/$ level at which the rand kicked off the year. And while the timing of the rand’s recovery mirrors the country’s lockdown, it’s important to realise that the two are not connected. In fact, if local factors were being taken into consideration, the rand might have moved in the opposite direction.

South Africa implements extreme lockdown and the economy comes to a halt

In March, South Africa embarked on a journey that saw the country enter one of the strictest lockdowns worldwide in an effort to flatten the coronavirus curve in a society where many face existing health conditions such as HIV, TB and diabetes.

The extreme restrictions – which initially limited the manufacture and sale of anything beyond the barest of essential items – had a hugely deleterious impact on an economy which was already in a recession going into the lockdown. As a result, the SA economy suffered untold damage with estimates for 2020 growth now ranging from a contraction of 8% all the way to 12%, while the global lockdown measures and risk factors weigh heavily on the local currency.

The SA economy needs stimulation

It is clear that this is an economy in dire need of stimulation, a mechanism which aims to grow the demand for goods and services and through creating additional jobs, higher incomes and additional tax revenue for government.

There are typically two levers to stimulate a faltering economy: fiscal stimulus and monetary stimulus. Traditionally, fiscal stimulus is an increase in government spending combined with a reduction in taxation, while monetary stimulus is deployed by the central bank, consisting of interest rate cuts and the purchasing of government bonds, also known as quantitative easing (QE). In effect, these measures leave more money in the hands of businesses and individuals, which increases their ability to spend money on goods and services, thereby boosting the economy.

Most of us are familiar with the effect stimulus can have on other aspects of the economy, such as an increase in inflation and the devaluation of currency that are often a direct result of interest rate cuts.

But so do all the others

The US has implemented both monetary and fiscal stimulus as the ailing economy has seen record unemployment claims and a record contraction of 9.1% on the second quarter of the year. Interest rates were slashed to near zero and the Federal Reserve implemented QE. In the first round of fiscal stimulus, the US government committed $2.4 trillion to provide relief from the coronavirus crisis and the resulting financial fallout. To put this historic number into perspective, this staggering amount of money is larger than the economies of all but six other countries. And further stimulus has stalled in Congress which cannot reach agreement on a package.

However, in Europe, extremely low interest rates and QE have been deployed since the global financial crisis of 2008, but we can see that these conventional strategies have not successfully stimulated growth in all economies and neither has inflation risen. There are many technical reasons that contribute to the failure of monetary policy in the EU versus its success in the US – including share ownership, export and import prices and employment levels. However, the important lesson here is that structural elements often prohibit economies from achieving the desired effect with QE and interest rates alone.

In SA, interest rates were cut and a R500bn package was cobbled together

In South African, the South African Reserve Bank (SARB) has argued that QE has not been used for stimulus – and the term itself has only found its way into our lexicon recently – stating that it is purchasing bonds in the secondary market to provide liquidity and is not QE, the essence of it is in fact the same: purchasing government bonds, albeit not directly from the government.

Often stimulus packages are perceived as hard cash which is not the case. Let’s unpack the dynamic of the R500bn stimulus package announced for relief from the ravages of COVID-19 on the economy.

At the time, there was a call by some people for the government to merely pay the amount out to the country’s citizens instead (erroneous maths had some thinking that each person would receive R1 million if this were to happen), and the simple reason this couldn’t be done is that there is no R500bn in cash floating around. Instead the “stimulus” is attributed to:

- The reallocation of R130 billion of existing funds from other capital expenditure that was already budgeted for;

- The deferment, not cancellation, of tax – the same amount will be paid by business, just at a later stage;

- A loan guarantee scheme of R200 billion – basically government is underwriting debt, in partnership with the major banks.

Can this save the SA economy?

Two questions arise on the back of the aggressive stimulus deployed:

- Is it sufficient to save the South African economy? The short answer is, in all likelihood, no. The local economy was in a recession prior to the pandemic, and the subsequent lockdown will see economic turmoil for years to come. With the mass closure of businesses, we saw a rapid increase in unemployment. This will, in turn, lead to additional fiscal pressure.

- Where to from here? One cannot rely purely on stimulus to save the economy. While it remains a valuable tool for cyclical downturns, it cannot correct or counter structural shortcomings. Government policies will require drastic reform towards pro-growth economic policy that will aim to attract foreign direct investment (FDI), and support the business environment.

Where does this leave the local currency?

Stimulus, in the absence of demand shocks such as those brought on by the lockdown, will lead to inflation, and the devaluation of currency.

In the absence of demand, stimulus will fail to generate an uptick in inflation, however, the lockdown is not infinite, and should too drastic measures be taken now, such as allowing the SARB to purchase government bonds directly from treasury as a means of funding, the effects could be catastrophic in terms of severe devaluation of currency and hyperinflation as seen in Zimbabwe.

So what is driving the rand?

While the underlying factors determining the rand’s value would suggest it should be weak, its movements have been largely driven by global factors and risk appetite. The local stimulus package pales into insignificance in comparison with that in the US and the rand strength has rather been a reflection dollar weakness.

It is no coincidence that the dollar peaked in the first week of April and declined through to September. However, given the dire South African economic data as a result of the lockdown – local GDP slumped 51% in the second quarter – there are numerous local risks to the currency looming.

In addition, the currency market must account for the following hazards:

- Risk aversion as a result of the global fallout of COVID-19;

- Downgrades by all three ratings agencies to sub-investment grade, and South Africa’s subsequent exclusion from the WGBI

- A poor South African outlook amidst the pandemic, and the expected effect it will have in the future

All-in-all, while the rand will find bursts of strength from any dollar weakness, the local unit’s underlying trend points to a weakening currency in the long term. We would suggest making use of any rand rally to fill up on foreign currency requirements.

At OWLS Software we offer 8000 insurance software features designed to automate any Insurers, UMAs or Brokers insurance admin.