In Aon’s 2019 Global Risk Management survey, failure to innovate or meet client needs was pegged as the #9 risk facing businesses around the globe. A year later, the COVID-19 pandemic and subsequent global lock-downs have magnified the need for digital technology solutions to drive operational efficiencies and deliver service to clients.

“Normal” operational processes and service channels have been upended, and by all counts a new way of work and service delivery looks set to stay long after COVID-19 gets a vaccine. In the process, client needs and expectations have been radically altered, and expectations of their service and product providers are higher than ever before. Their newfound autonomy and ‘instant gratification’ enabled by digital channels is set to endure, and this has significant implications for the insurance sector and how advice, risk products and insurance claims are processed and managed.

Claims automation

An area that Aon South Africa continues to highlight is claims automation – finding new and innovative ways to gather all the powerful data that sits behind claims history from disparate insurer databases, and gathering it all in one centralised claims repository, to analyse and inform a client’s risk strategy going forward.

“Aon has been on an extensive journey utilising technology to make a meaningful impact throughout the client’s insurance lifecycle. One of the key focus areas is on claims management and automation, taking what has essentially been a mundane paper-driven and admin intensive process, that is not exempt of human error, and digitised both current and historical claims data to deliver faster, simpler and informed claims fulfilment for our clients,” explains Rene van Schalkwyk, Claims Unit Head at Aon South Africa.

The insurance claims environment has been ripe for disruption for years and has a reputation for being sluggish and paper-driven, often hindered by legacy systems that are siloed from business processes, but especially from the client’s usual service engagement channels. With this as a point of departure, Aon’s team set out to develop a claims automation platform that could not only process the current volumes of data and claims, but also gather and sort volumes of historical claims data. This provides clients not only with more efficient claims fulfilment, but also with comprehensive claims reports in real time, that can be used to inform their risk strategies and mitigation measures going forward. The kind of analytical capability that can be drawn from this is of immense value to large and small businesses.

Data capturing

“A large portion of claims handling comprises of data capturing, which then needs to be updated into a claims management system, much like a database. It is time consuming, highly repetitive and subject to human error in the capturing process. Once you start automating these aspects of a claim, you remove the potential for error, improve accuracy and thus the value of the data, resulting in better and faster outcomes. The impact on claims management teams is marked as they are able to focus their efforts on the value-adding aspects that make a difference to clients, provide far greater personalised service, and most of all, leverage the insights that come from having accurate claims data to advise clients on trends in their claims history that require intervention,” Rene explains.

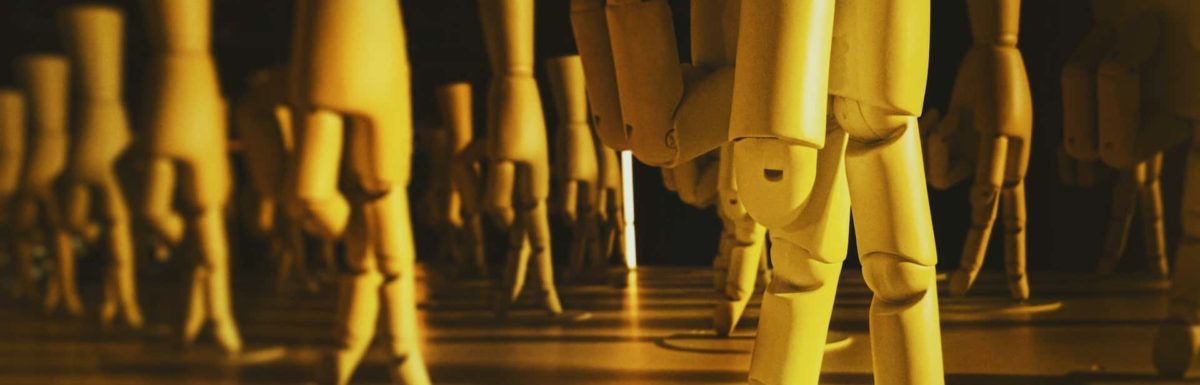

As for taking the ‘mundane and repetitive’ out of claims, Aon continues to investigate and invest in technology that support clients and employees. For example, Robotic Process Automation (RPA), commonly known as a ‘robot’, is technology that allows one to configure computer software, or a “robot” to emulate and integrate the actions of a human interacting within digital systems to execute a business process. RPA has the capability to complete tasks in minutes, something that historically took hours with manual interventions.

“The impact that this has on productivity, and what this means for client experience is vast. Where a claims handler might get bogged down in manual, tedious and repetitive processes, they can now refocus their time on more important aspects such as claims advocacy on complex or challenging claims, and clients get a much faster claims settlement,” says Rene.

Managing perceptions

One of the biggest hurdles in technology adoption is people’s perceptions of the role of technology and the potential threats posed by it. Clients are often hesitant to engage with a machine or bot as they still want the human interaction. On the other end of the spectrum, employees have concerns about job security and the threat that automation presents.

“I don’t believe that being digitally agile and enabled is a replacement for human intuition and contact – it’s not a case of one replacing another. In fact, the opposite is true – Aon believes that technology is an enabler, it enables our employees to have more time with our clients, understanding their business, their challenges and their requirements to ensure that we bring the best advice and the best of Aon to clients to better support them. It means that both clients and employees get better outcomes faster, and with less room for error.

Think of the example where previously a client with a windscreen claim would need to lodge a claim manually, then have the hassle of a quote, then revert to their broker to capture all the data, submit to insurers and then get the claim lodged and approved, and finally get a service provider appointed to do the replacement. This now happens seamlessly, speeding up the process and getting all the mundane back and forth sorted in minutes, all digitally and seemingly without manual intervention,” explains Rene.

Data and analytics capabilities

Another key benefit of its claim automation process has been the powerful data and analytics capability that Aon now brings to clients by having accurate claims data in one centralised, intelligent digital repository.

Aon South Africa has successfully integrated claims history and management across major insurers, overlaying this with its data analytics capabilities to create one consolidated, digitally delivered claims infrastructure, with interpretations and recommendations for clients. This capability is a game-changer for Aon when it comes to risk management and mitigation strategies for clients.

“We use data and analytics to inform our risk strategy for clients, providing insights and usable knowledge that includes aspects of their insurance cover, claims history and benchmarking against industry peers. In the context of risk, a major area of investment for Aon is cutting-edge data and analytics that provide intelligence to help our clients take action. Our claims dashboards – which are enabled by having all our client’s claims history across disparate insurers and time periods consolidated – underpin the insights that help manage risk and leverage opportunities for growth.

“Imagine what this kind of claims data means for risk and insurance managers, CFOs and company owners – think of a fleet operator as one example who is now able to pick up that a specific region, vehicle make, driver team or time of day lodge the most claims, for similar incidents. We can quickly analyse claims data to review specific trends and claims causes that require intervention and mitigation that otherwise would go unnoticed if claims data was processed manually and disparately. Now we are able to effectively support the client in managing total cost of risk, reducing cost of supporting renewals pricing as well as the reputation and profitability of the business,” says Rene.

“If there is one positive aspect that has presented itself from the pandemic, it’s the immense advantage of having automated processes in place and the role it plays in freeing up the time that claims teams spend on mundane tasks.

In an industry where a client’s claims experience can make or break their satisfaction levels and loyalty, being digitally enabled and automated is an absolute must,” concludes Rene.