Deane Moore, CEO of retirement income specialist, Just SA comments on the Fairness of Annuity Pricing for Low Income Earners in South Africa (Combrink, Taylor) presented at the Actuarial Society of SA Convention

The presentation on the Fairness of Annuity Pricing for Low Income Earners in SA at the Actuarial Society of South Africa is a valuable piece of research, with interesting observations that provide a strong challenge to the industry. As a retirement income and life annuity specialist, we agree on the main finding of the research that fair pricing should allow for income rating. However, we differ on some important aspects:

- Income rating is only part of the picture. Longevity is driven primarily by health, therefore to price a life annuity fairly, it is necessary to underwrite an individual holistically, allowing for an assessment of their health and lifestyle risk factors, in addition to income.

- We disagree with the suggestion that low-income earners should be denied access to with-profit annuities. Historically with-profit annuities have offered better value for money over a pensioner’s lifetime than conventional non-profit annuities, and provide a cost-effective solution to longevity, market and inflation risk.

The effect of taking income, lifestyle and health into account in retirement

For conventional life insurance products, it is appropriate to underwrite in order to price more fairly in the retail market.

This is accepted standard practice of all life insurers on pre-retirement risk benefits, to calculate a fine-grained risk premium based on health, lifestyle and income; clients with higher risk factors pay higher premiums.

So, how is it that these same individuals suddenly become “standard risks” in an industry that embraces the principles of Treating Customers Fairly? Instead, those with higher risk factors should receive higher guaranteed income over their shorter life expectancy.

The health assessment is the most important factor to enable an insurer to provide higher retirement income. The other two factors – lifestyle and income – are proxies for the probability of suffering poor health in the future. At Just SA, where we underwrite on all these factors, we find that more people in lower socio-economic categories qualify for uplifts and higher annuity rates.

However, it is worth noting that a relatively low-income marathon winner will not necessarily be expected to have shorter longevity than a relatively wealthy executive with a family history of heart disease, who leads a sedentary lifestyle and smokes to control stress. So, one would expect an overlap in annuity rates between low and high income earners when other factors are considered.

THE BROKER’S even better

BEST FRIEND.

WITH GREATER MUSCLE NOW,

RENASA CAN DEPLOY

EVEN MORE TECHNOLOGY

TO MAKE US MORE

COMPETITIVE, ARCHIE.

Licensed non-life insurer and FSP.

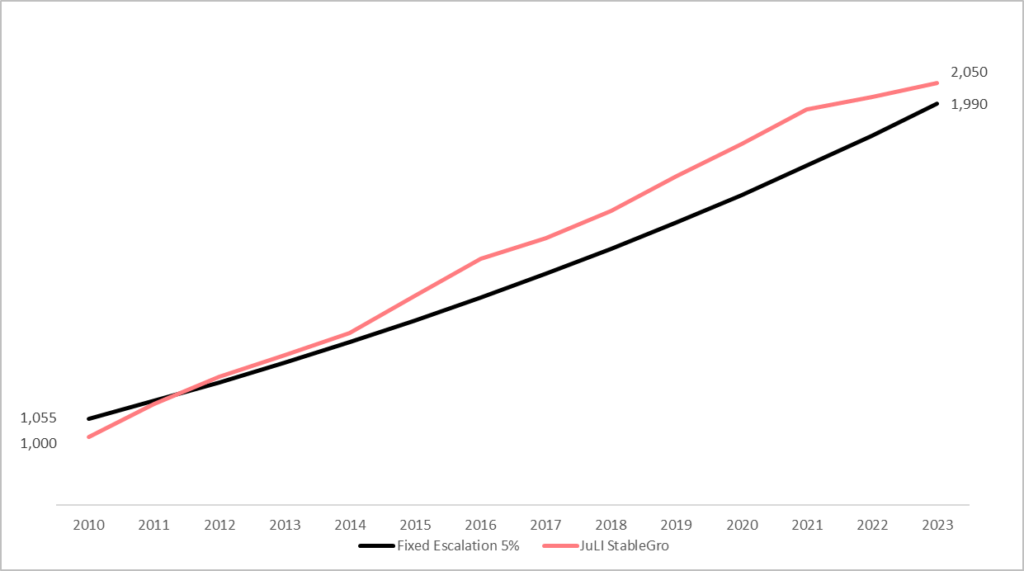

With-profits annuities have outperformed historically

We disagree that with-profit annuities are not appropriate for low income pensioners.

Historically, with-profit annuities have delivered significantly higher value over the lifetime of pensioners relative to fixed escalation annuities.

This graph shows how a pensioner’s income would have grown in the Just Lifetime Income with-profit annuity (JuLI Stablegro) compared to a 5% fixed escalating annuity, both commencing in 2010. Cumulative income from the with-profit annuity has been 5% higher over the 13 year period.

If key features of a product are explained properly, and information about these products is made readily available, low income earners will be able to assess the benefits of an income for life and choose the right option to suit their needs.

It is certainly more appropriate than the “easy to understand” level annuity which the majority of annuitants have been purchasing in the retail market.