Adriaan Pask, Chief Investment Officer of PSG Wealth

In wealth creation, as in life, true success lies in helping the next generation become independent. We all want to leave something behind for our children and grandchildren, but what if, more than just a lump sum, you can leave them with financial wisdom?

The problem with bestowing your beneficiaries with a lump-sum amount combined with no financial know-how is that they can find themselves right back where they started (or worse). Too often, a lack of financial education can cause money to be misspent or capital to be poorly allocated. Research conducted in 2015 by the Williams Group wealth consultancy stated that about 70% of family wealth is lost in the second generation, which increases to about 90% in the third generation. So, what can you do to protect your beneficiaries from having this happen?

Focus on building a healthy relationship with money

Just as with saving for your retirement, the best time to start speaking to your children or grandchildren about money is when they are young, and the next best time is right now. David Anderson, PhD, clinical psychologist at the Child Mind Institute, advised that you can start a child’s financial education from about eight or nine years old, when their math skills are advanced enough to understand basic arithmetic. Be open and help them become comfortable with using money and wealth journeys as an everyday occurrence, instead of having to figure out how to build (and stick to) a budget when they get their first paycheque.

Discuss things like the difference between a long- and short-term financial goal and the aspects involved. For example, comparing a “rainy-day fund” to retirement – you’ll look at the ultimate size, the monthly contributions, the type of product needed, ease of access to the funds, duration, etc. A visual way to show little ones how savings can accumulate is to give them a glass jar for a piggy bank so they can see the money fill it up.

Always keep in mind when discussing finances that a healthy relationship with money can open a wealth of doors and lead to optimal wealth creation.

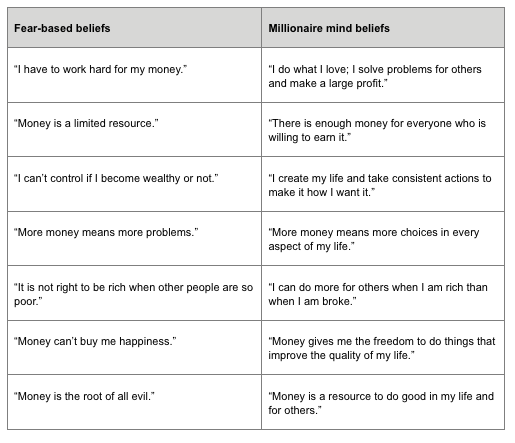

Limiting beliefs around money

Source: HarvEker

Practice the art of setting financial goals

Again, there is no age limit to setting SMART (specific, measurable, attainable, realistic, time-bound) financial goals. The goal can be anything, from saving for a pair of sneakers to buying a house or for retirement, depending on you or your beneficiary’s current need. One of the great advantages of this type of measurable goal setting is that it can help you avoid the instant gratification vortex that can so easily lead to squandering.

The first step is to be specific. Don’t just say, “I want to be able to retire comfortably”. Pen it down to “I want to retire with R10 million”.

Make sure the goal is measurable, but also know how you’ll measure the progress made. In this example, you can look at investment statements to see how your fund grows and adapt your monthly contributions as needed.

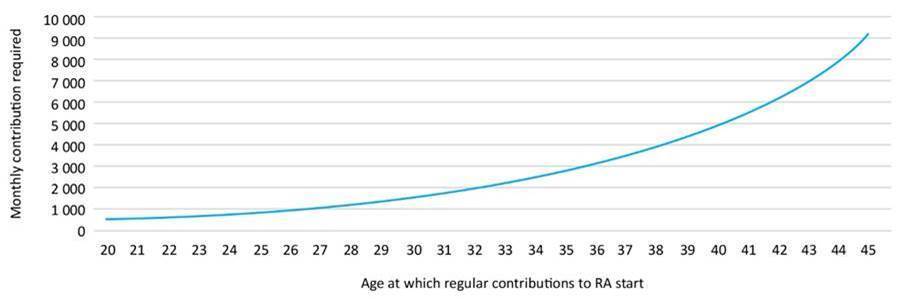

Ensure your goal is attainable; it should be challenging but possible. Based on your investment period, is it possible to reach your R10 million retirement goal? As illustrated by Graph 1, the sooner you start to invest, the smaller the monthly contributions need to be.

Graph 1: How much more do you need to save to reach a given target?

For a more ambitious goal such as a retirement plan, speak to your financial adviser to help define each step accurately for you or your beneficiary’s specific needs.

Let your legacy be more than a number

PSG Wealth advisers construct wealth journeys specific to their clients’ individual needs and circumstances. So, the next time you speak to your adviser, why not ask about products suited for your beneficiaries and advice on how they can manage investments to continue building intergenerational wealth after you’re gone? By focusing more on the journey, and sharing wisdom with the next generation, you can leave your loved ones with one of the most valuable gifts – financial independence.

Editor’s note: As most readers will know, it’s not just about the calculations and figures anymore when it comes to financial planning and especially when assisting clients in attaining financial freedom. This article provides some great guidelines for advisers to tackle the subject with clients.