By: Lyle Sankar, Head of Income at PSG Asset Management

The definition of risk significantly influences both the outcome investors are most likely to experience and the probability of whether that outcome is aligned to the objectives they set out to achieve, over a given time period. For investors, the burning question at the heart of their dilemma as they seek to balance risk and return is whether their hard-earned savings are safe.

The only question that matters is: “Am I going to be okay?”

Simply, fixed income investors seek:

- Capital protection

- Attractive yields that outpace inflation or cash

- Low volatility of returns

At PSG Asset Management, we define true risk as the permanent loss of capital, and place substantial weight on ensuring that capital is preserved relative to any additional yield we could achieve for clients. We believe all three of the objectives above are easily attainable in a market with an abundance of yield opportunities, but caution that a skew towards one specific objective can result in significant unintended consequences for investors. In recent years, we have increasingly seen a drive for higher yields (Objective #2) at lower volatility (Objective #3). When it comes to evaluating income funds, the focus has been on risk-adjusted measures such as the Sharpe ratio, which measures a fund’s excess historical returns versus a benchmark (e.g. cash) relative to the variability of such returns (volatility). Conventional wisdom concludes that the higher the Sharpe ratio, the higher the historical return per unit of risk, and the better the fund. However, we believe that focusing too much on these historical measures that use volatility as a proxy for risk has inadvertently created greater unseen risks which deserve attention, particularly in the context of protecting client capital.

The use of Sharpe ratios in the local fixed income market is flawed

Fixed income portfolios are often viewed as interchangeable, with each one comprising similar assets in different ratios, resulting in slightly different yields and volatilities. We believe the funds can be materially different, and have for some time advocated for a closer look at the underlying securities in the portfolios, as this will ultimately drive risk and return outcomes. In our view, excessive use of illiquid instruments such as corporate bonds (including structured notes and unlisted instruments) can both increase yields and suppress volatility, resulting in a high Sharpe ratio. When considering the risks in corporate bonds, given our bottom-up valuation-driven approach, we continue to believe these securities are not providing sufficient compensation for the underlying risks. In fact, spreads (compensation above cash rates) for investing in these securities are at the lowest point in a decade. Investors are at risk of spreads moving wider (resulting in capital losses on these instruments), especially given the current phase of the economic cycle, where the embedded risks are particularly high. This environment (low spreads, high fundamental risk) is particularly poorly suited to investors in search of the highest yield at the lowest volatility.

We are Clear About Service

- Mobile Service: My Glass comes to you, offering convenient on-site solutions

- Versatility: Not just vehicle glass. My Glass also specializes in building glass repairs and replacements

- Custom claims management: Experience seamless incident reporting with My Glass Bordereau, our bespoke online claims management system

- Extensive stock: My Glass boasts the widest range of available stock, ensuring prompt service.

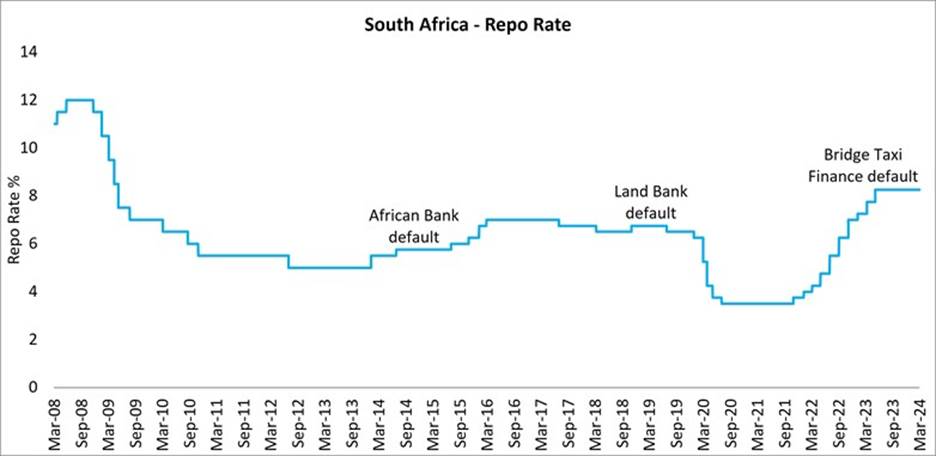

Thinking about the economic cycle

A Sharpe ratio can never forecast a permanent capital loss event. Today, the repo rate is at the highest level since the Global Financial Crisis (GFC). The South Africa Reserve Bank (SARB) has increased the repo rate by 4.25% since late 2021. With the majority of corporate bonds issued on a floating rate basis, these securities have offered increasing yields, leading to improving Sharpe ratios at a fund level as we progressed through the hiking cycle. However, higher yields are associated with increased risk, and investors always have to consider whether the risks are worth taking. As rates rise, economic activity slows, and corporates and consumers come under immense pressure through higher funding costs. This is particularly difficult for cyclical and highly geared corporates, or those directly facing the consumer in SA. We believe the market has been incentivised to focus on investing based on the highest yields at the lowest possible volatility at precisely the wrong time, inadvertently driving clients to greater exposure to these types of entities at the wrong point in the cycle. While all defaults are different, a simple look back at the repo rate cycle since the GFC illustrates the risks to fixed income investors associated with higher rates or a weaker economic environment.

Repo rate over the past 15 years and defaults in South African fixed income

Constructing portfolios to ensure all three client objectives are met.

The consensus is that interest rates in South Africa are likely to come down in the near term. However, consumers and corporates in SA will likely remain under pressure given the significant interest rate increases over the past year. As we have demonstrated over the long term, a philosophy and process that focuses on protecting clients’ capital as a primary objective increases the odds of successful outcomes. We aim to get less wrong, rather than pushing for higher yields. Considering where true risk may lie, we are increasingly focused on where the next pitfall will be as the consequences of skewed incentives play out.

Over the long term, our clients have been able to meet all three objectives through our approach to managing fixed income risk and return objectives. While we may not get every investment decision right, by placing capital protection at the forefront while managing volatility in a responsible manner, we have helped to ensure that our clients have been more than ‘okay’ through difficult markets.

The PSG Diversified Income Fund won the trophy for Best South African Interest-Bearing Fund and certificate for Best South African Multi-Asset Income Fund (over varying periods) in both 2022 and 2023 and was nominated for the Best Risk-adjusted Multi-Asset Income Fund to the end of 2023 at the Raging Bull Awards. The PSG Income Fund won the award for Best Interest-Bearing Short-Term Fund on a risk-adjusted basis over five years in 2021 and 2022.

Importantly, from a risk perspective, the funds have delivered on their return objectives without excessive exposure to securities that we believe create an artificial sense of comfort. In the context of the current market, we offer attractive inflation-beating yields that are likely to be enhanced by a positive outlook for securities that will benefit in a rate-cutting cycle. We do not aim to offer the highest yields in the market. Rather, we would caution that high yields at low volatility do not come without risk, and require deeper consideration as to whether all three client objectives are being met consistently and reliably.