By: Patrice Rassou is Chief Investment Officer at Ashburton Investments

In 1962, President John F. Kennedy announced America’s interplanetary intentions in a rousing speech at Rice University, forever remembered for his famous words: “We choose to go to the Moon and do the other things, not because they are easy, but because they are hard, because that goal will serve to organise and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one we intend to win, and the others, too.” For many, global investing feels like going to the moon! It’s a venture into unknown unknowns in a vast universe where one can disappear without a trace.

Things Fall Apart

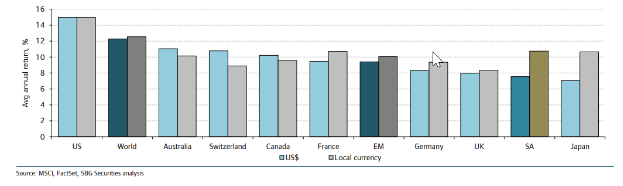

If we measure real equity returns globally since the 1900s, South Africa leads the pack followed by Australia and the United States, according to a 2023 Credit Suisse Study. The picture changes as we look at the more recent experience. Over the past four decades, the JSE has continued to deliver strong annual average returns of 17% per annum in Rands but due to our currency depreciating some 6% per annum against the US dollar, the local equity return in US dollars reduces to 11% per annum. This is still very decent and only marginally behind what developed market equities delivered over the same period. However, over the past 15 years, a study by SBG Securities shows that equity returns on the JSE delivered 7% p.a. in dollars, lower than the average emerging market at over 9% and lagging developed markets which delivered over 12% p.a. in dollars as seen in the chart:

Over the same period, it is the US which has taken leadership, delivering whopping 15% p.a. in hard currency, while Australia remains in second place.

Paradox Of Choice

Changes to Regulation 28 of the Pension Funds Act at the beginning of 2023 allow institutional investors to invest up to 45% of assets offshore. Given the lackluster performance of the JSE, the lure of investing offshore is understandable. Investing offshore opens a Pandora’s box of choices. For those wanting to go it alone, there are over 58 000 listed securities to choose from. This means that perhaps it would be wise to enlist some professional help and invest in an offshore unit trust. In this case, instead of narrowing down our options, it actually makes things even more complex as there are some 138 000 mutual funds globally, requiring knowledge of the investment philosophy and investment processes of the managers under consideration. Even if you were to focus only on exchange traded funds, you would have over 9 000 different options globally. So there is an obvious paradox of choice in the world of global investing, which means that sound financial advice is required in order for end clients to get the solution that best satisfies their need.

From TINA to TARA

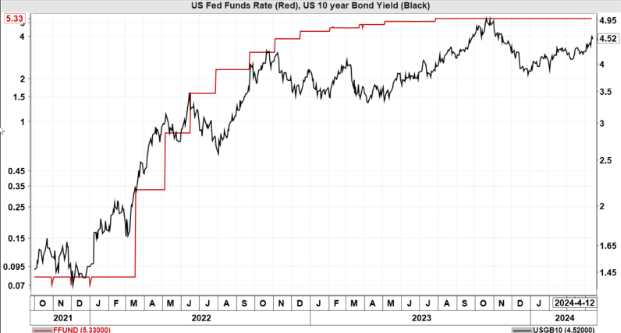

Post the Global Financial Crisis in 2008, the major global central banks targeted a Zero-Interest Rate Policy (ZIRP) to stimulate their economies. Post Covid in 2020, central banks doubled down and engaged in an onslaught of monetary loosening. This led to the expression, There Is No Alternative (TINA), as investors were forced to take more risk by moving out of low yielding assets into equities. With inflation rearing its head post the eruption of the Russia-Ukraine conflict and the Federal Reserve and other developed markets central banks tightening interest rates. Both short-term and long-term term interest rates in the US moved up sharply, as seen in the chart:

In fact, the Bank of Japan was the last central bank to end its negative interest rate policy earlier this year. We have moved from TINA to There Are Reasonable Alternatives (TARA). Cash in the US is now yielding close to 5% and the 10-year government bonds are yielding 4.5%.

Rise of the Machines

The Performance of Global Stocks has also been dominated by the so-called Magnificent Seven stocks (Amazon, Alphabet (parent of Google), Apple, Meta (owner of Facebook), Microsoft, Nvidia and Tesla). The Magnificent Seven has gone up over 160% since the beginning of 2023 while the broader US index of 2000 smaller companies has only gone up 30% over the same period.

The poster child of the Artificial Intelligence (AI) revolution has been chipmaker Nvidia – which gained 80% in the first quarter of 2024. It is also our top holding in the Ashburton Global Growth Equity Fund and one of our top ten holdings in our flagship Ashburton Global Leaders Fund. While diversifying offshore makes a lot of sense, those who avoided the Mega-caps would have missed out on this windfall. Offshore investing requires proper financial and tax planning and the selection of an investment manager with the requisite offshore know-how to deliver growth. So rather do your homework before making a decision based on the past few years of exceptional returns. And be careful, as per the iconic horror movie alien, “in space, no one can hear you scream”.