Discovery CEO Adrian Gore

Discovery Group last year announced the launch of Cogence, a discretionary fund manager (DFM) seeking to significantly enhance the business of wealth creation in South Africa.

Uniquely, Cogence combines the investment expertise of BlackRock, one of the world’s leading asset managers, with personalised health data from Discovery, which operates the world’s largest behavioural change programme.

It offers model portfolio solutions built upon BlackRock’s asset allocation views and integrates Vitality’s data and analytics, all supported by industry-leading portfolio analytics and risk management technology, Aladdin Wealth™.

Through this merging of technology and investment expertise, Cogence is not only the first truly global DFM in South Africa, but the first DFM globally to add a layer of personalised health and longevity insight to essentially map out every aspect of an individual’s financial plan.

These metrics consider how long you will live, how healthy you will be, how much money you need and, importantly, they support financial advisers in making recommendations to their clients.

It’s an innovative solution designed to help tackle one of the greatest socio-economic challenges in our society.

It is well known that South Africa has a well-documented and alarming retirement savings shortfall. More than 90% of people are unable to afford retirement, meaning that they rely on their families, communities, or the state to survive.

With this gap having remained stubbornly persistent, it is evident that change is required to help people achieve financial health during their life after work.

But what does physical health have to do with financial wellbeing in retirement?

A multi-dimensional approach to retirement

It goes without saying that the better the growth of an investment portfolio, the better the financial outcome for the individual investor at retirement. But returns are less than half the picture.

Simply put, the fact is we try to save money to make sure that at retirement, we have enough compared to our pre-retirement savings.

In calculating the replacement ratio, we need to consider the amount of money you’ve saved, its investment growth, divided by life expectancy. That determines what you have per year or per month to live on.

Buying vs. Building?

The debate is real.

What are the main factors when deciding whether to build or purchase insurance software?

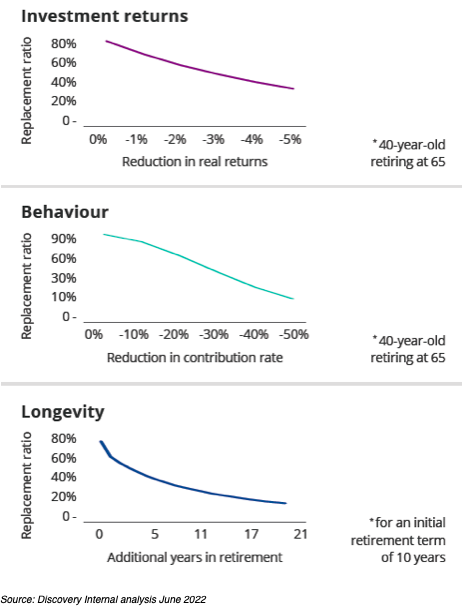

A mere 1% retardation of expected investment returns reduced a 40-year-old saver’s replacement ratio at a retirement age of 65 from roughly 80% to 60%.

A replacement ratio is a basic measure of retirement-income adequacy equivalent to the ratio of pension entitlement to lifetime gross earnings.

A 2020 study 1 reported the replacement ratio in South Africa for individuals with ‘average’ earnings to be just 19% – well below the mean of 59% for OECD countries.

In its calculation, the same study considered pension income to last earnings for full career workers and assuming individual earnings grow in line with average earnings but did note considerable differences between pension systems globally.

This dramatic swing in the adequacy of retirement savings due to a small change in expected returns, demonstrates a high degree of elasticity – the extent to which changes in one variable will cause changes in another.

However, the real point here is that replacement ratios are often more elastic to these behavioural and longevity risks, than investment returns.

By the same analysis of elasticity, a 20% reduction of a 40-year-old’s contribution rate could see her replacement ratio drop from 70% to around 50% at retirement, while living beyond 75 can dramatically reduce the amount of money available for each extra year.

In traditional models for retirement advice, what is often underappreciated are these behavioural risks – how much you save – and longevity risks – how your physical condition and behaviours impact how long you will live, and how much of that time you are expected to be healthy.

With this in mind guiding people, nudging them, incentivising them to make sure that they understand these aspects is just as important as chasing investment returns.

A multi-dimensional approach to retirement savings extends beyond concerns about costs and returns to consider behavioural and demographic factors that are critical in achieving an optimal retirement outcome.

These might include failing to anticipate the impact of living for longer, and the associated medical costs, as well as behavioural issues such as saving too little and too late, withdrawing from those savings early or withdrawing too much in retirement.

The first DFM offering holistic health and behavioural insights

Supported by Aladdin Wealth™, BlackRock’s industry-leading investment and risk technology platform, and Vitality insights and data, Cogence is the world’s first discretionary fund manager that fully models retirement solutions, taking health experience into account.

In so doing, Cogence moves beyond the conventional approach of considering primarily investment outcomes – finding the best returns – to factor for issues relating to behaviour and longevity.

With lifespans extending, clients need the financial means to retire comfortably and withdraw income at a sustainable income level; and most importantly, also the good health to ensure they can enjoy it.

Source

1 Credit Suisse Research Institute, “Rethinking Retirement.” Davos Edition (2020).