By Ursula Marchioni at BlackRock Portfolio Analysis and Solutions

In spring 2022, BlackRock Portfolio Consulting team partnered with 170 clients in Europe for an annual survey reviewing their portfolio-construction practices relating to sustainability. In this article we outline the key results from this research.[1]

Against a materially different macro environment, sustainable investing appears to remain a central priority for European investors. 63% of participating investors said the challenging macro backdrop had not altered their conviction on sustain-ability, and 23% said they were more likely to invest sustainably than last year. While long-term sustainable-investment conviction remains firm, the shorter-term picture has been more complicated. End clients have sought short-term performance opportunities in non-sustainable investments, primarily in the energy sector. One of the main themes we saw in this year’s survey was managing short-term style biases resulting from tactical allocations designed to enhance performance.

If we compare 2021 and 2022 portfolio samples,[2] the share of Article 8 and 9 products[3] grew from 35% last year to 37% for traditional portfolios and to 55% for sustainable portfolios. This shows a barbell approach to client portfolio offerings: most clients are retaining traditional portfolios while launching sister offerings that are fully dedicated to sustainable investing. The penetration of sustainable strategies in these sister sustainable portfolios is increasing fast, while it shows a lower but stable growth for the traditional portfolios.

THINK BACK.THINK AHEAD.

Now Rethink Insurance.

For all insurance solutions related to the commercial, agricultural, engineering or sectional title sectors contact your broker or call Western:

Western Cape 021 914 0290, Eastern Cape 044 011 0049,

Gauteng 012 523 0900 or visit www.westnat.com

Western National Insurance Company Ltd, affiliates of the PSG Konsult Group, a licensed controlling company, are authorised financial services providers. (FAIS: Juristic Reps under FSP 9465)

The tectonic shift to sustainability continues, with the transition to net zero expected to take centre stage in the upcoming years.

Source: BPAS Analysis, insights from clients’ portfolios collected in the context of 2021 and 2022 editions of Green Spirit Initiative.

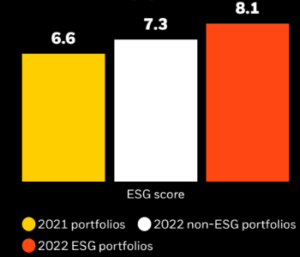

Another key finding relates to the rise in the average ESG scores of portfolios from 6.6 (in 2021) to 7.3 for traditional portfolios and to 8.1 for sustainable portfolios in 2022. This is the result of both product evolution and product substitution. The net zero transition is emerging as a key catalyst for investment actions in the upcoming years. A quarter of respondents have started to transition their portfolios. Meanwhile, 16% have a plan in place and are yet to start executing it. The remaining portion of our sample haven’t set a transition strategy – showing that, moving from pledges to practice is taking longer than expected. This is partly due to the current focus from investors on ensuring compliance with MiFID and SFDR regulations, which is taking priority.

It is clear from EMEA investors’ portfolios that the net zero transition will be a multi-year journey. The universe of EMEA products that our investors can currently access is broadly not aligned to the Paris Agreement, which poses significant challenges for investors who want to build diversified portfolios that limit the global temperature rise to below 2°C, preferably to 1.5°C, compared to pre-industrial levels. In our sample, ESG-focused portfolios were only 2-2.5°C aligned while non-ESG portfolios were even ‘warmer’ at 2.5-3°C. Nevertheless, as the real economy shifts towards net zero and the availability of investment products and metrics advances, we expect progress to be made towards clients’ 2030/2050 pledges.