A challenging environment for traditional asset classes means less correlated assets – like insurance-linked securities – are in higher demand. Beat Holliger, Head of Product Management, ILS at Schroders unpacks the ins and outs

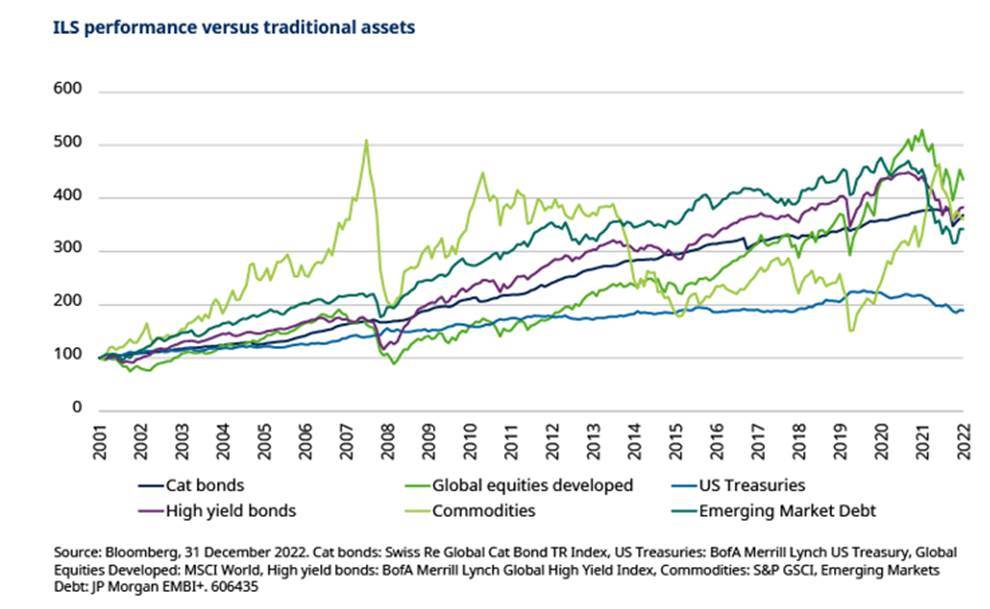

Events in the natural world drive the performance of insurance-linked securities (ILS). This means that their returns are not closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns, as with traditional asset classes. This diversification benefit is a key reason that investors are increasingly interested in the area. In this article, we unpack ILS and how they fit into a portfolio.

The market for ILS

The best-known part of the ILS market is probably catastrophe bonds or “cat” bonds. These instruments are more conventionally tradeable and normally have a life span of between three and five years. But you also get non-tradable, “over-the-counter” contracts, mostly with a 12-month lifespan. This market gives investors access to a wider range of insurance perils than those available in the cat bond market, including marine, aviation and specialty risk and a broader range of investment structures.

These instruments also require managers to model the risks themselves rather than using a third party, and there is no secondary market. Their non-tradeable nature means there is an additional “illiquidity premium” for managing this segment of the ILS market.

How do ILS differ from corporate or sovereign bonds?

Credit risk

ILS are a way for companies to buy protection against the risk of incurring a loss due to an event. These companies, referred to as “protection buyers”, are generally insurance or reinsurance companies looking to reduce or remove the risk of paying out on an insured event. An investor in ILS will receive interest payments, paid out of the insurance risk premium plus a money market return. As such the return is mainly determined by the insurance risk assumed.

Cat bonds and other insurance-linked instruments are not directly exposed to the credit risk of the issuer. The insurance risk is made available to investors via a special purpose vehicle (SPV) known as a “transformer”. The buyer of the protection (which could be an insurer or reinsurer) passes a risk, or a proportion of it, to the protection seller (such as an investment fund). The risk moves from the seller to the buyer through a reinsurance contract in the form of a bond (an ILS), issued by the SPV.

This reinsurance contract is backed by collateral which is paid to the SPV by investors when the transaction starts. The SPV then issues securities – such as cat bonds or preferred shares in the case of a private transaction – against this collateral. The result is an insurance risk that has been transformed into an investible instrument.

Cutting-edge technology to grow & adapt with you

PROFIDA will meet your needs, both now & on our journey together into the future

The structure means that the cash paid for an ILS is not directly exposed to the credit risk of the issuer, as it is held separately in a trust account and invested in money market funds or instruments. As a result, the insurance-linked instrument is not exposed to the issuer’s ability to pay claims. The likelihood that the pre-defined risks occur, which could impact the investment, is the metric used instead to assess the riskiness of the instrument.

What could result in a loss of notional capital is the “insured event”. If the tropical cyclone, flooding or earthquake the protection buyer has sought cover for were to happen, this would cause losses to the instrument. This is the insurance risk embedded in the instrument, rather than credit risk. It is also a significant reason for the asset’s lack of correlation to traditional markets.

Source: Schroders, Bloomberg

Duration (interest rate) risk

Duration (the sensitivity to changes in interest rates) for ILS instruments is also generally negligible. ILS are notionally floating rate instruments, in so far as part of the coupon paid is based on money-market return. However, the coupon is reset quarterly, meaning shifts in monetary policy make little difference to the instrument’s value. Furthermore, the bulk of the coupon is based upon the risk premium. This is a combination of the modelled likelihood of the insured event occurring and – particularly in the case of privately negotiated ILS instruments – an illiquidity premium.

Where are the opportunities in ILS?

A fairly valued investment opportunity for ILS is one that compensates investors sufficiently for taking the insurance risk embedded in it (both on a stand-alone basis and within a portfolio). This means understanding and rigorously testing modelled losses relative to potential return.