By: Mariska Comins, Head of Technical Support, PSG Wealth

The risk of outliving one’s savings – also called longevity risk – is increasing. People live longer mainly due to better healthcare and improved medical technology and, according to the United Nations, South Africans’ life expectancy is on an upward trend.

It certainly does sound a bit odd to refer to living longer as a risk, but the impact it may have on your retirement planning could be substantial if not addressed correctly.

Investing to mitigate longevity risk

You can mitigate against longevity risk by saving more, contributing more regularly, and remaining committed to saving on an ongoing basis. Frequently evaluating your financial goals will also help you determine if your plan is still on track.

Investing for a long-term goal allows you to take on more risk by investing in riskier asset classes, as a longer investment period allows your portfolio to recover from any losses that may occur early on. Asset allocation is about diversifying your investment into different asset classes (e.g. equities, fixed interest or cash) to ensure you achieve your desired financial planning outcomes at a level of risk that you are comfortable with.

Higher returns require a riskier asset allocation, e.g. a higher allocation to equities. If the required level of risk is not acceptable, then the desired financial planning outcomes need to be reviewed and the asset allocation adjusted in a manner that reduces risk exposure. At the same time, you need to re-evaluate your contributions to ensure you make enough provision to achieve your investment goals.

OWLS™ Insurance Software

Proud providers to insurance companies, UMA’s,

administrators, intermediaries and financial services companies.

You can start investing in a retirement annuity or a tax-free savings account from any age.

A tax-free savings account (like the PSG Wealth Tax Free Investment Plan) is a voluntary investment that can be used to supplement savings for retirement. Unlike with retirement annuities, funds invested in these products can be accessed at any time. Annual and lifetime limits apply to the contributions you make, but growth within the product is unlimited. Withdrawals should be considered carefully however, because once an amount is withdrawn, that amount is deducted from your lifetime contribution limit.

It is incredibly important to preserve the capital you have already saved if you resign from your employer, and not be tempted to access those funds. A large part of financial planning is discipline.

A real-life example

Sue (40) resigns from her current employer and decides to take the full R500 000 she has contributed to her provident fund over the past seven years. If she chooses to do, so she will have to pay tax on the R500 000, but it seems like a good idea as she wants to pay off some credit card debt and spend a month overseas before she starts her new job.

When Sue starts her new job, she starts contributing to her pension fund (R7 500 a month, increasing by 6% every year, with the pension growing at a rate of 10%). She anticipates retiring at age 70.

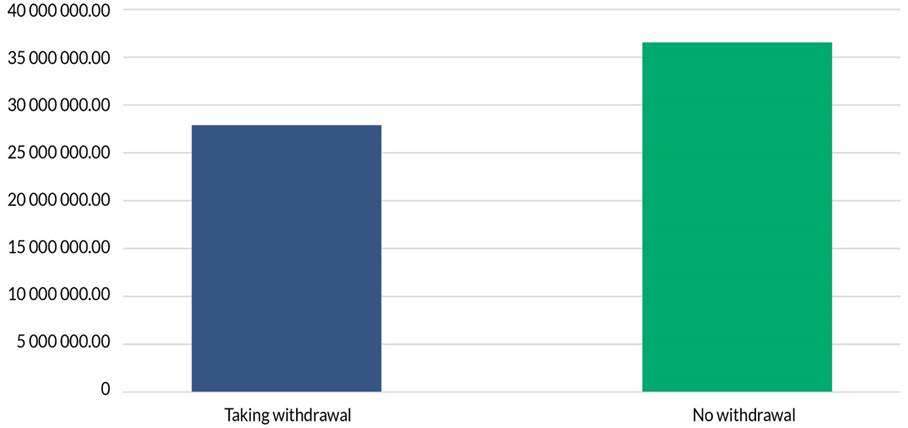

The graph below illustrates the net result of her decision to withdraw her funds. At retirement, her retirement fund value is R27 764 939. If she had not withdrawn the R500 000, it would have been worth R36 489 631. In other words, the R500 000 withdrawal has cost her R8.7m at retirement (loss of the saving over 30 years).

Sue’s pension fund at 70 years of age

It is never too late or too early to start saving for retirement.

Do something incredible for yourself and your children – consult a financial adviser, agree on a financial plan with clear retirement goals, and strive for financial freedom and peace of mind at and in retirement. You can spend your golden years pursuing your passions and follow in the footsteps of Lise Meitner who, at the age of 60, became the first person to describe nuclear fission, or Pablo Picasso who only completed his first masterpiece ‘Guernica’ at the age of 55, instead of worrying about how you will survive.