Hennie de Villiers, Deputy chair: Life and Risk Board Committee, Association for Savings and Investment South Africa (ASISA)

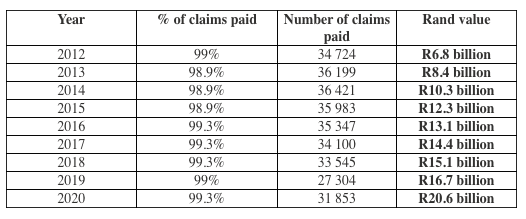

South African life insurers paid 99.3% of all claims against fully underwritten individual life policies in 2020 to a value of R20.6 billion.

The 2020 annual death claims statistics for fully underwritten individual life policies, released this week by the Association for Savings and Investment South Africa (ASISA), show that life insurers received 32 072 claims, of which 31 853 were paid. Only 219 claims were declined due to dishonesty, fraud, or contractual exclusions like suicide within the first two years from when the policy was taken out.

ASISA and its members have been publishing the rate at which claims against fully underwritten life policies are paid since 2012 to provide consumers with the peace of mind that valid claims are paid.

Life companies exist primarily to provide consumers with the option of insuring themselves and their loved ones against the financial impact of an event like death, disability, or critical illness. Policyholders and their beneficiaries should be able to trust that their policies will pay when a life-changing event occurs.

Fully underwritten life policies are issued to individuals who have participated in a detailed underwriting process involving a comprehensive health assessment and review of the applicant’s medical history. The extensive underwriting process provides the policyholder with the peace of mind that beneficiaries will receive the benefit as stipulated in the contract, provided the contractual obligations were met by the policyholder.

There are only four reasons for an insurer to decline a claim from a beneficiary against a fully underwritten life policy:

- Fraud: A fraudulent claim is submitted, or the beneficiary committed a crime that resulted in the death of the policyholder.

- Suicide: The policyholder committed suicide within the first two years of taking out the policy.

- Material non-disclosure: The policyholder purposefully withheld important information from the insurer when applying for the policy.

- Exclusion: The policyholder dies because of an excluded dangerous activity or in an excluded territory. The policyholder would have been informed of this exclusion before the contract was finalised.

While the underwriting process is considered onerous by some, the peace of mind for beneficiaries who have to claim following a devastating loss is invaluable.

The impact of the pandemic has been so severe that most of us know of at least one person who lost their life because of COVID-19. This means that many of us have also witnessed the financial impact on a family when a breadwinner dies. While a policy pay-out can never make up for the loss of a loved one, it can ease the financial consequences of losing an income earner.

Fully underwritten individual life policies – claims paid since 2012

Other types of life insurance policies not included in these statistics are partially underwritten life policies where applicants complete a questionnaire, but are not required to undergo medical assessments and tests, as well as credit life policies, funeral policies and group life policies.

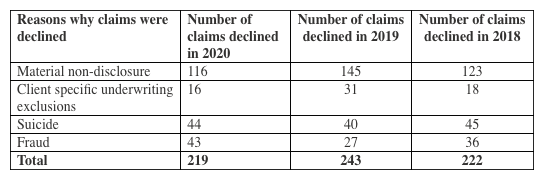

Why claims were declined

Despite receiving a higher number of claims in 2020 due to the pandemic, the number of claims declined was lower than in the previous year before COVID-19. In 2019, life insurers declined 243 claims compared to the 219 claims declined in 2020.

Most claims were rejected by life insurers due to non-disclosure of material information, which involves an act of dishonesty on the part of policyholders.

• Material non-disclosure

Non-disclosure refers to policyholders not disclosing material information to a life insurer about a medical or lifestyle condition to secure cover and/or lower premiums.

Withholding material information from a life insurer during the underwriting process is a dishonest approach that can leave families financially destitute when the policyholder dies and the death claim is declined by the insurer.

It is critically important for consumers to understand the potentially devastating financial consequences for their families of not honestly disclosing important information such as any lifestyle or health related detail that could materially affect the terms of the policy.

If you are not sure whether the information could be considered as material by the life insurer, rather disclose it. If you cannot remember the exact details of a medical event, disclose what you can remember together with the details of the relevant healthcare provider. The insurer can then obtain more detailed information if it is required.

- Underwriting exclusions

Exclusions applied by life companies are usually for risky part-time activities or territorial exclusions where people spend some time working in other countries under dangerous conditions. If the policyholder is killed because of the excluded activity or in the excluded territory, the life policy will not pay a benefit.

- Suicide

Life insurers generally apply a two-year exclusion period to suicide to prevent someone from taking out life cover with the intention of committing suicide shortly afterwards. Therefore, if a policyholder commits suicide within the first two years of taking out life cover, no death benefit will be payable to the beneficiaries.

- Fraud

Claims fraud usually involves the submission of fraudulent documentation and/or syndicate activity aimed at getting the life company to pay a claim to someone not entitled to the benefit. Where a beneficiary was involved in the death of the policyholder and then submits a claim, the claim is also considered fraudulent.