Signal & Strategy monthly column

James Steere, Head of Operations, Perspective Investment Management

Executive Summary:

- Both investment returns AND costs compound over time. This means that a seemingly small difference in net investment return per year can make a huge difference in the long run.

- A carefully considered return and cost analysis of your total investment portfolio solutions can create a lot of value over time.

When it comes to investing, compound interest is your greatest ally and is often referred to as the “eighth wonder of the world.” It should do most of the ‘heavy lifting’ for you when saving for the long term.

Einstein famously said that those who understand compound interest “earn it,” while those who don’t “pay it.” This highlights the fact that compound interest can work both for and against you.

It works for you in the form of investment returns, which, when compounded over time, can deliver substantial additional value in the long run. On the other hand, investment management fees and other investment related costs compound against you, and can severely reduce your total net investment return over time. A 1% better net investment return outcome per year does not sound like much, but when compounded over time can have an enormous impact on the final value of your investment.

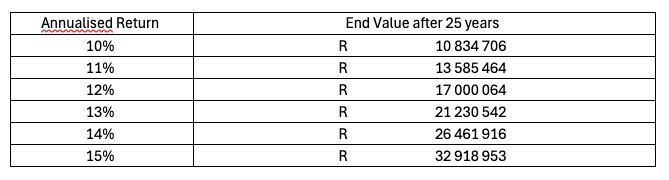

We invite you to consider this practical example. The table below shows the end value of R1,000,000 invested for 25 years, based on different annualised net investment rates of returns.

We have found over the years that a considered cost analysis of an investor’s overall savings portfolio can result in reductions of up to 1% in total annual costs across the investor’s entire portfolio. In some of the worst cases total cost savings have been even higher than this.

Renasa has always been the broker’s best friend.

Our entire business focus is exclusively on helping our intermediaries outcompete their competitors.

Now, as part of TIH, South Africa’s powerful insurance group,

we commit to do even more for our brokers.

RENASA’S ALWAYS BEEN A SAFE PAIR OF HANDS FOR US, BUT NOW THEIR STRENGTH AND STABILITY IS NEXT LEVEL.

- Renasa is now proudly part of TIH, a successful international financial services institution.

- GCR has now further upgraded Renasa’s national strength rating to A, reflecting support from TIH.

- Furthermore, GCR’s outlook is for “Renasa’s earnings to further complement capital injection(s) from TIH, enhancing the insurer’s solvency and liquidity level”.

Renasa is a licensed non-life insurer and FSP. Telesure Investment Holdings (Pty) Ltd. All Rights Reserved. TIH is a licensed controlling company.

Additionally, a sensible, proven, long-term investment approach can lead to superior investment returns over time.

Combining a 1% annual cost saving with a 1% annual investment return increase, an improved net investment return impact of 2% a year, is when the numbers start to get compelling.

When this number increases to 3% per annum the benefits become even more remarkable over time, and you could end up with an end investment value nearly double what you’d otherwise have earned.

We’ve encountered case studies where investors have been badly burned twice over: as the highest-cost investment structures are often also the riskiest. The numbers we present in the table above show what happens with net return improvements of up to 5% per annum, because we know that this level of increase is actually possible!

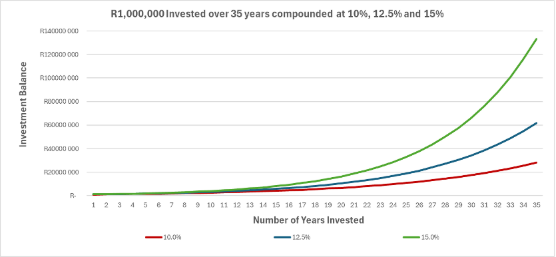

Time is a key component of the wonder of compound interest. The longer the investment time horizon, the greater its effect. This is illustrated in the graph below, using the same R1,000,000 invested for 35 years:

At Perspective, we take great care in the design of our firm and its investment funds to prioritise both return and total cost considerations.

All our funds are carefully constructed based on our long-term investment philosophy. We also place a strong emphasis on cost-efficiency, working to minimise total fund costs to our fund investors wherever possible. Notably, Perspective does not charge any extra performance fees, so that our fund investors are not subject to additional fees in periods of outperformance. As truly long-term owners of assets, we do not transact regularly and that also plays a very important role in keeping our total investment costs as low as possible.

Concluding – Because both investment returns and costs compound over time, we propose that a careful considered analysis of your total investment portfolio holdings across the board can be a very worthwhile exercise.