Wimpie van der Merwe, CEO, Global Choices

Experience is everything. As designers of value-add products (VAPs), we strive to provide the best user experience when designing products, services and applications. It is about taking every advantage to optimise the total customer experience.

Total Experience Strategy is based on the fundamental premise that human nature remains constant. As humans, we relentlessly search for meaning and we mark and measure our lives in stories of our experiences and the experiences of others.

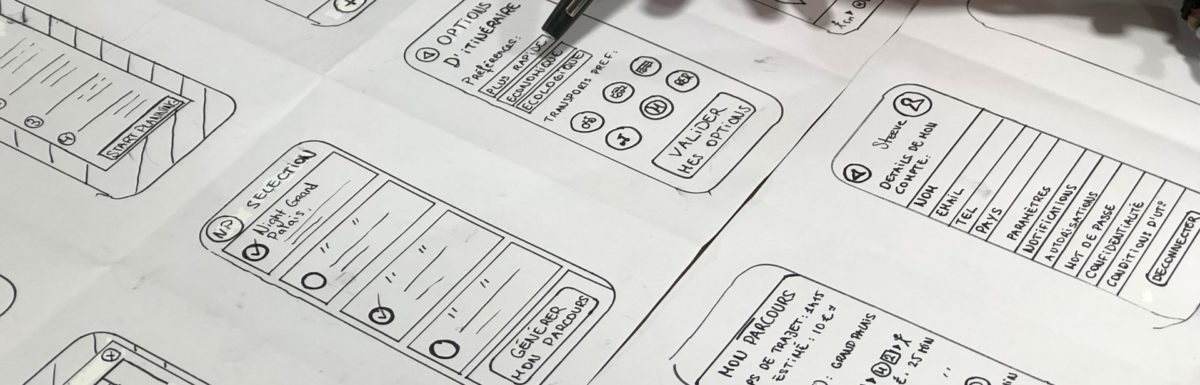

Design thinking anticipates the human experience first. The core differentiator of design thinking is to focus on the client. More importantly, though your focus should relate to an overall goal, realistically analysed in the greater context of the bigger system. The foundation of design thinking is empathy.

Total experience is based on the idea that no experience operates in a vacuum. Employee experience impacts customer experience. User experience impacts employee experience, and so on. They are interconnected and interdependent. And yet, because of how they evolved as business disciplines, they are rarely treated as such. Often, companies have teams and software solutions dedicated to a particular experience (customer experience, user experience, etc.), and those teams and solutions run independently of one another.

Consider the experience, in the shoes of a client, from obtaining an insurance policy, submitting a claim and paying an excess, to understanding their risk profile and liabilities, creating an asset register or renewing their policy with you, as an insurer.

Once insurers recognise that they are in the experience business, they will be able to overcome a cultural shift.

Even in today’s era of rapid change, it appears a lot of insurers are trying to create innovative solutions and customer experiences, yet continuing with their traditional ways. To overcome future challenges requires a completely new methodology and approach.

The experiences an insurer delivers will have the biggest impact on attracting and retaining policyholders in the future. To be future proof, insurers cannot afford to deliver sub-par experiences for their clients. This requires a total experience strategy to optimise multiple objectives. In recent years we have seen the rise of customer experience, user experience and employee experience prioritised.

Total experience is a strategy that creates superior shared experiences by combining the following four disciplines:

- Multi-experience (MX): How an experience is enhanced and delivered simultaneously across multiple devices, platforms and touchpoints

- The customer experience (CX): How a customer interacts with and feels about an insurance brand

- Employee experience (EX): How an employee interacts with and feels about the insurance company they represent

- User experience (UX): How a user interacts with and feels about a product, service or experience, especially in the digital space

Total experience focuses on the relationship a policyholder has with their insurer, made up of all the interactions they have had with a business, from the first contact with their insurer, up to the present day.

Closing the gaps on any policyholder’s interactions is vital to the total experience. The conditions of these experiences shape an insurer’s reputation and affect the quality of their services overall. Through the integration of all the user experience touchpoints, insurers can offer seamless engagements and functions with a smarter edge. Companies should make every effort to design a connected customer experience from the first interaction and throughout the entire customer journey. The handoff points, or intersections, between teams and/or departments, (i.e., from sales process to onboarding the policyholder), are often the most disaster-prone. These points are crucial to focus on when developing a total experience strategy.

Total experience is the future of experience design. It focuses on holistically streamlining the overall experience