Debbie Holroyd, Chief Executive Officer, CEO at Scottfin Insurance Brokers

The biggest mistake that a leader of any business can make is to minimise the strategic importance of the staff compliment.

I have attended many conferences over the last 10 years focusing on insuretech. The common theme is how to improve customer experience and reduce operational costs.

As Scottfin, we also go caught up in this mad dash to see who can give the customer the fastest, most efficient service.

My light bulb moment was a few years back when we were in our budget season. I was working with one of our branch managers and I realized that there was most definitely a skill shortage when it came to using excel to assist her with her budgeting process.

She was spending more time trying to understand excel and our budget spreadsheet as opposed to strategizing about her budget and how she was going to achieve it.

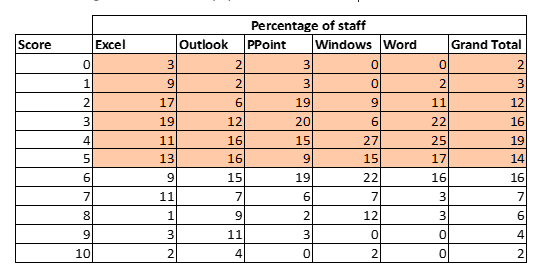

We then engaged with a training company to assess basic computer literacy across our staff. The results were quite astounding. With most of our staff having less than 50% capability on the basic requirements. Remembering that we work in a paperless environment!

Scottfin practices the LEAN principles.

The basic premise is to give your customer what they need, 100% complete and accurate, on time every time at the right price.

The best way to achieve this is through continuous improvement (Kaizen) Identifying gaps, understanding the root cause of the gap and then planning a countermeasure.

It is our users who will identify gaps in our process flows and in our engagements with our clients.

In order for them to be able to identify gaps and more importantly to understand the root cause and possible countermeasure, they need to have a working knowledge of what is available in the market from a tech perspective.

Legislation has forced us to spend time and money on upskilling our staff on regulatory requirements and this has left us wanting in terms of upskilling them in the technical revolution we are experiencing.

All too often, the execs of a company sit around a boardroom table and design wonderful insuretech solutions that make absolutely no sense to the people actually doing the work nor speaks to the needs of our clients.

The designs are sometimes so complicated, that our users find inventive ways to circumvent them.

The complexities of some of these designs can also create the risk of our clients going to our competitors, who may have continued to remain client centric as opposed to tech centric. We believe that balance can be found between the two.

There is a particular company, that brag about its tech and how innovative they are. I wish they would go onto their website and see just how user unfriendly it is.

In a nutshell:

- Know your customers’ needs and make sure that all engagement satisfies that need.

- Upskill your staff on tech

- Spend time coaching staff on the benefits of tech without compromising on your client centric culture – tech is the vehicle, not the driver

- Create an environment where the users can identify gaps in your workflows and engagements with your clients

- Don’t expect insuretech to be your silver bullet. Users are generally weary of silver bullets – they can be one-time-wonders and not sustainable. The designs are sometimes so complicated, that our users find inventive ways to circumvent them and our clients go to our competitions who understand their needs.