Tony van Niekerk, COVER

In today’s complex insurance landscape, risk surveys have become one of the most important tools in ensuring accurate underwriting, sustainable pricing, and meaningful client engagement.

I recently spoke to Gavin Horn, Senior Underwriter at Renasa Insurance Company and Fellow of the Insurance Institute of South Africa, whose 42 years of experience place him at the heart of the industry’s evolving approach to risk.

Gavin’s insights reinforced a truth that many brokers and clients are beginning to understand: risk surveys are not just a procedural checkbox, they are a foundational element of risk intelligence and client service excellence.

Why Risk Surveys matter more than ever – As Gavin pointed out, the role of risk surveys has expanded significantly in recent years. Insurers, brokers, and clients are all recognising that in order to price insurance fairly and ensure comprehensive coverage, you need to deeply understand the risks at play, both current and emerging.

“There is nothing that beats a visitation to the risk,” Gavin said. “A certified, qualified surveyor can observe, question, and report in a way that remote analysis simply cannot achieve.”

Risk surveys are essential for both new business and renewals, especially as technology, operations, and external threats evolve rapidly. Too often, he added, people assume that surveys are only about pricing. In reality, pre-renewal surveys are equally important because they account for changes that could materially alter the risk profile, such as upgraded machinery, new chemicals in use, or deteriorating fire services in the area.

What makes up a strong risk survey – Gavin detailed several critical areas that an effective risk survey must cover:

- Cyber Risk and Data Security: With cyber threats on the rise, understanding a business’s digital vulnerabilities is non-negotiable.

- Business Continuity Plans: Insurers need to know whether operations can continue after a loss.

- Proximity Risks: Businesses near hazardous neighbours or other insured risks contribute to accumulation or concentration challenges.

- Fire Risk and Suppression Systems: Including internal systems, public fire brigade access, and water supply adequacy.

- Site Layout and Employee Data: Useful for evacuation planning and group personal accident cover.

- Hazardous Materials and Operational Procedures: These must comply with local standards like the SANS codes.

- Risk Registers and Improvement Plans: Insight into how seriously the client is managing their risks.

- Weather-related Threats: Including flood zones, hail belts, and susceptibility to wildfires.

These elements not only aid in underwriting but also enable all parties, insurer, broker, and client, to operate from the same set of facts.

Renasa has always been the broker’s best friend.

Our entire business focus is exclusively on helping our intermediaries outcompete their competitors.

Now, as part of TIH, South Africa’s powerful insurance group,

we commit to do even more for our brokers.

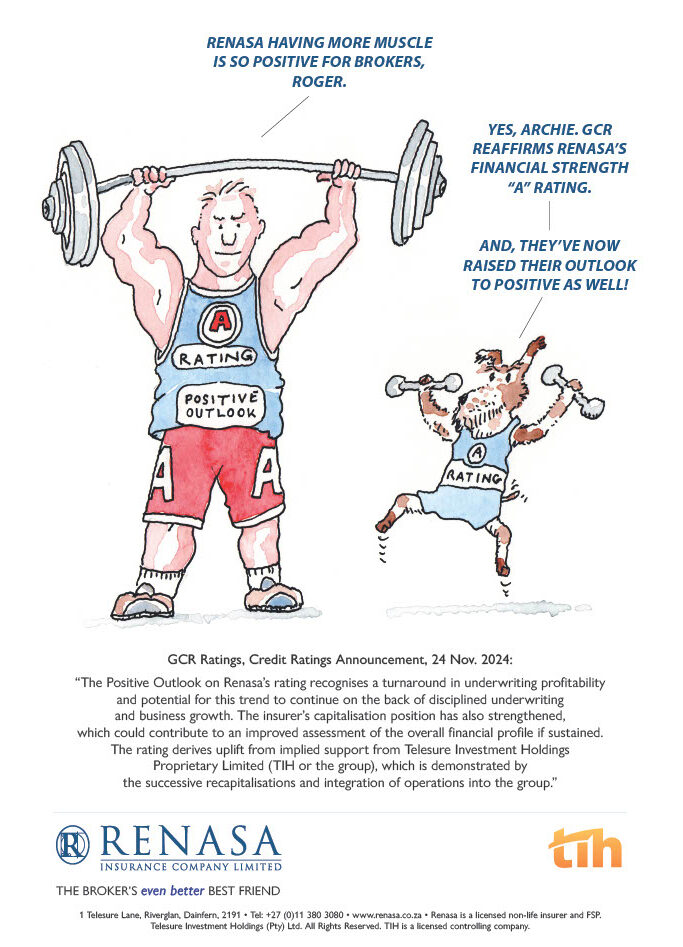

Renasa having more muscle is so positive for brokers, Roger.

“The Positive Outlook on Renasa’s rating recognises a turnaround in underwriting profitability and potential for this trend to continue on the back of disciplined underwriting and business growth.

The insurer’s capitalisation position has also strengthened, which could contribute to an improved assessment of the overall financial profile if sustained. The rating derives uplift from implied support from Telesure Investment Holdings Proprietary Limited (TIH or the group), which is demonstrated by the successive recapitalisations and integration of operations into the group.”

Renasa is a licensed non-life insurer and FSP. Telesure Investment Holdings (Pty) Ltd. All Rights Reserved. TIH is a licensed controlling company.

Three parties, one shared benefit – Gavin was clear about where responsibility lies in the risk survey process: it begins with the insurer advising the broker that a survey is needed. The broker, in turn, must brief the client, arrange the visit, and ideally, attend the survey to clarify needs and intentions.

The client’s role, Gavin emphasised, is to ensure that a senior decision-maker or risk manager accompanies the surveyor. “You need someone who understands the business, the processes, and the plans going forward,” especially where business interruption or supplier dependency is concerned.

Each party benefits in distinct but interlinked ways:

- For the insurer, the survey provides the detailed facts needed for accurate underwriting.

- For the broker, it ensures transparency, positions them as a true risk advisor, and eliminates “economic memory” disputes later.

- For the client, the survey enhances confidence, potentially lowers premiums, and ensures that risk improvement efforts are recognised.

“The better the risk protected, the better the terms the underwriter can provide,” Gavin said.

Challenges and how to overcome them – Not all surveys are smooth sailing. Gavin shared some common pitfalls:

- Brokers may fail to convey the benefits of the survey to clients.

- Clients sometimes assign junior staff to accompany the surveyor, resulting in incomplete or inaccurate assessments.

- There may be resistance to perceived “costly” risk improvement recommendations.

Gavin’s solution is ongoing broker education and open dialogue. At Renasa, brokers are engaged throughout the process, from the moment the survey is commissioned to the final action plan. This collaborative approach ensures that no party is surprised by requirements or excluded from the decision-making.

Importantly, pre-renewal surveys are not reserved for poorly performing risks. “We complete them on low loss ratio risks too,” Gavin noted. “A client who’s invested in risk management deserves the chance to be rewarded with better terms.”

The survey as a living document – Risk surveys shouldn’t be seen as static. Gavin views them as living documents, evolving with the client’s business. A substantial mid-term increase in sum insured? That’s a sign something has changed, and it should trigger a new survey and underwriting review.

He also highlighted the role surveys play in reinsurance, particularly for larger or more complex risks. Survey reports are essential tools for reinsurers to evaluate their own exposure and participation.

The role of relationships – A consistent theme in Gavin’s approach is the value of relationships. “Our underwriters are fully accessible to brokers,” he said. “We don’t make decisions in isolation. We talk through the report, identify requirements together, and decide on reasonable timelines for implementation.”

Yes, some requirements (especially those tied to regulation) are non-negotiable. But where flexibility exists, Renasa prefers consensus over dictation. The result is alignment, and loyalty.

A Journey built on trust – In Gavin’s words, risk surveys are about forming a long-term journey with clients and brokers. They are tools of clarity, collaboration, and protection, not just for insurers, but for the businesses we all aim to support.

Brokers who understand and embrace this process elevate themselves from intermediaries to true advisors, strengthening client trust and securing better outcomes for everyone involved.

As Gavin concluded, “When risks are reduced, terms improve. And that’s how we build sustainable partnerships, by protecting each other.”