By Wimpie van der Merwe (CEO, Global Choices)

One of the most significant moments in my career in the insurance industry occurred many years ago. It was after an enjoyable IIKZN yearend function, during which I decided to take a taxi back to my hotel around 00h15. Surprisingly, I ended up in a completely different venue – the Addington hospital casualty … with no memory of what happened to me!

When reviewing the CCTV footage at the venue, it became clear that I got out of the first taxi to let another person in and subsequently entered a second taxi. According to medical professionals at Addington Hospital, I came by and gave my name and my wife’s cell phone number to them, and she was informed of my circumstances. She contacted my colleague, who was at the function and had left before me, to visit my hotel room, but confirmed I had not slept there. He then rushed to the hospital to locate me.

I had sustained severe head injuries and was immediately transferred to the ICU at a private hospital for further observation and treatment.

As time passed, various details surrounding the incident began to surface. I had been found in a dishevelled and injured state on Old Fort Road, about 300 metres away from my hotel, at five o’clock in the morning. With no identification, wallet, or phone on my person, authorities had no idea of my identity, and it appeared that I had been involved in some sort of altercation or accident.

The police discovered a trending modus operandi in which the attackers stop the taxi, hold up the passenger, and then force them to make withdrawals from various ATMs before releasing them unharmed, but robbed of their possessions. Though I have no memory of the incident, signs of a physical altercation were identified when my medical reports were reviewed. I must have fought back against my assailants and sustained severe injuries as a result.

This brings me to my point of “moments”. In the world of insurance, there are certain moments that hold a greater impact on customers than others. These distinct moments can be the difference between a satisfied customer and a dissatisfied one. For me, my attack in Durban was one of those moments. But more about that later.

In his book “The Power of Moments,” Chip Heath defines a moment as “a short experience that is both memorable and meaningful.” These moments can happen at any point in a customer’s interaction with an insurance company, from the initial quote to the claims process.

The reason moments matter is because they have a disproportionate impact on a customer’s overall perception of an insurance company. Research has shown that people tend to remember the highs and lows of an experience more than the overall average of it. This means that a few standout moments can outweigh a lot of neutral or positive experiences.

What are some of the moments in insurance that have the most impact?

One obvious one is the claims process. When someone files a claim, it’s likely because something negative has happened – they’ve been in a car accident, their home has been damaged, etc. This is a moment that is both memorable and meaningful, and it can have a huge impact on how a customer views their insurance company. A smooth, efficient claims process can go a long way in creating a positive experience, while a frustrating, time-consuming one can lead to dissatisfaction and frustration.

Another important moment is the initial quote. This is the first impression a potential customer has of an insurance company or broker, and it sets the tone for the entire relationship. If the quote is clear, easy to understand, and competitive, the customer is more likely to feel positive about the company. On the other hand, if the quote is confusing, difficult to navigate, or more expensive than expected, the customer may be turned off from the process entirely.

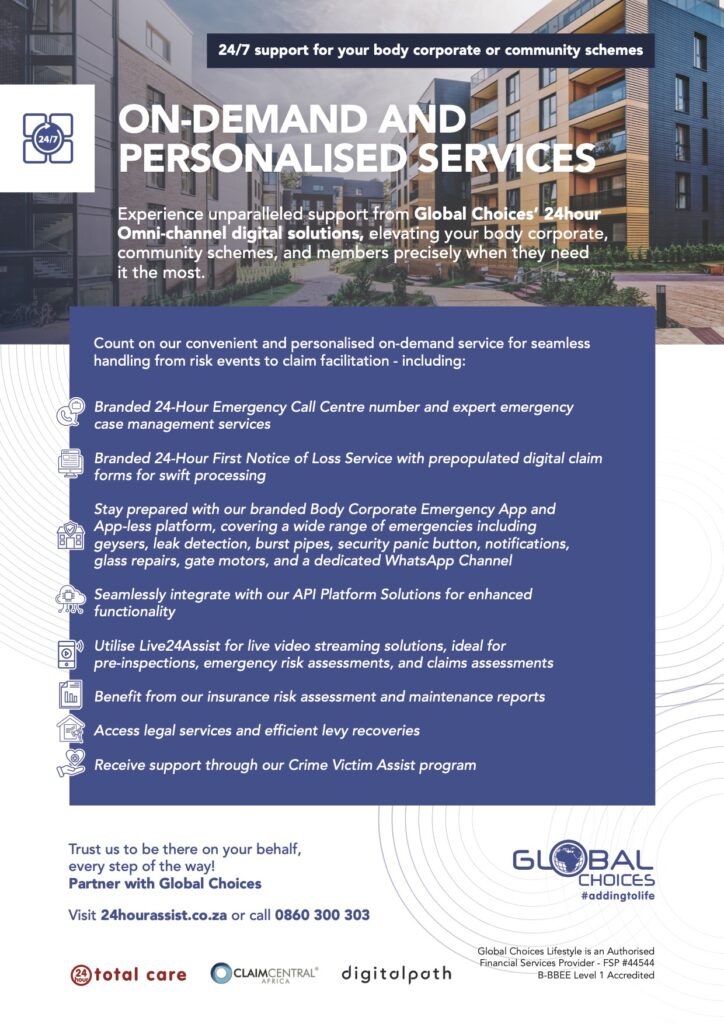

GLOBAL CHOICE’S 24HR

OMNI-CHANNEL DIGITAL

SOLUTIONS FOR BROKERS.

Experience unparalleled support from Global Choices’ 24hour Omni-channel digital solutions, elevating your body corporate, community schemes, and members precisely when they need

it the most.

Trust us to be there on your behalf, every step of the way!

Partner with Global Choices.

Global Choices Lifestyle is an

AuthorisedFinancial Services Provider – FSP #44544

In addition to the aforementioned touchpoints, there are several other crucial moments that can significantly influence a customer’s experience with an insurance company. These moments could involve interactions with the emergency call centre during an emergency risk event, which may eventually lead to the submission of a claim requiring resolution. It could also encompass encounters with customer service representatives, the level of convenience when making policy changes, or the overall quality of educational and informative materials provided by the insurers. Acknowledging these points would help ensure a comprehensive understanding of the factors that affect a customer’s satisfaction.

Empathy for the client’s traumatic moments

During my recovery process after my attack, as I struggled with post-traumatic stress, with physical scars and no memory of the event, seeking help was a difficult and daunting task. I knew that I needed counselling to take control of the trauma and start the healing process. As a design thinker who values adding value to customers’ lives, I began developing a product that could assist victims of crime, specifically those who have experienced hijackings, assaults, home invasion, smash-and-grabs, and other similar events.

The result of my “moment” was the launch of the “We Care Box”, which takes care of a person’s needs as soon as they become victims of crime. When a victim reports their crime incident via our clients’ emergency numbers, we respond immediately with the delivery of a “We Care Box” that contains a RICA’d smartphone with the “We Care” app installed, along with airtime and data. The app allows the client to contact our 24-hour call centre to activate a host of support benefits, including trauma counselling with transportation to and from sessions. The debit card included in the box allows the client to transact and load money until they can replace their bank cards, with all the banks’ contact details on the app.

For clients whose homes become a crime scene, the service offers temporary hotel accommodation. Included are application forms for replacement of identity cards, driver’s licenses, and even temporary car hire in cases where motor vehicles are stolen are also included. We will monitor the victim’s ID number for a year for possible identity theft or fraud.

The benefit also includes an annual panic button subscription service that summons security guards and medical response in times of crisis. In case the need arises, customers can also be provided with pre-populated digital claim forms for personal accident cover or to claim losses from the crime incident from their insurer.

Finally, the “We Care Box” offers legal counselling and assistance during court cases, making sure that victims are not left to navigate the legal system alone. This product is designed to provide comprehensive and holistic support to crime victims and help them regain control of their lives after a traumatic crime event under the insurance brand we represent.

Global Choices is a 24-hour emergency assistance services and digital claim solution company.

Global Choices Lifestyle is an

AuthorisedFinancial Services Provider – FSP #44544

Making moments matter

Ultimately, the power of moments in insurance lies in their ability to shape a customer’s overall perception of an insurer. My moment – my attack – was a negative one, but by focusing on creating positive moments at every touchpoint, insurance companies can build strong relationships with their customers and create lifelong support. Whether it’s through a smooth claims process, a clear and competitive initial quote, excellent customer service or personalised services, these moments can make all the difference in the world for an insurer and for a client.

The power of moments has a transformative impact of defining experiences that have the potential to elevate, influence and change our lives and those of our customers.