By: Clyde Parsons, BrightRock

One of the challenges facing financial planners is how to secure their clients’ future insurability affordably and sustainably, in a way that addresses both their present and future needs. When clients first take out life insurance, they’re usually the youngest and healthiest they will ever be – but often that’s also when affordability is most under pressure because that’s when they typically also have the highest insurance need. While you may think an insurance policy that starts off with less cover and grows aggressively over time through future premium and cover increases will bridge the affordability gap while securing their future cover, industry statistics show the opposite is true.

The latest True South Insurance gap study, published by ASISA in 2022, shows an alignment between clients’ behaviour and the decrease in their income protection need over time. While the insurance gap at younger ages up to about the age of 50 is enormous, as people get older, this gap starts to narrow as they reduce their cover in line with this reducing need. Traditional products that offer a lump-sum priced to increase over time don’t adequately address clients’ needs now, or in the future.

One of the factors that contributes to the premium that clients pay for any insurance cover is the how long they want to keep the cover, and if they want it to increase over time. The longer the period of cover, and the more the cover increases, the higher the premium. But if clients are cancelling their cover once they start getting closer to their retirement age, they’re wasting premiums by paying too much from day one for cover that they never needed and that they’re not going to keep. What’s more, when they buy-down later in life, due to these affordability constraints and their reducing income protection needs, they may find themselves without cover and completely uninsurable due to health conditions that may have emerged over the years.

Is your finely crafted financial plan a grand masterpiece?

Or will it be let down by traditional life insurance products that don’t match your clients’ needs?

As a highly skilled financial adviser, you know that every financial plan is carefully designed to meet your client’s needs today, and as their life changes. BrightRock’s needs-matched life insurance lets you create a product solution that precisely matches the financial plan you’ve crafted for your client.

BrightRock Life Ltd is a licensed financial services provider and life insurer. Company registration no: 1996/014618/06, FSP 11643. Terms and conditions apply

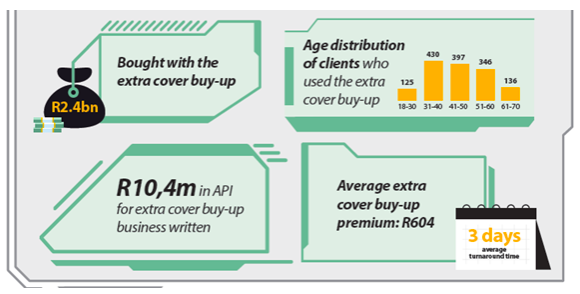

At BrightRock, we identified this problem early on and designed our needs-matched life insurance cover to deliver more cover for our clients when their insurance need is highest, while also safeguarding their future insurability. Our efficient pricing model takes into account that clients’ need for cover changes over time, enabling them to buy up to double the cover when they first sign up with BrightRock compared to what they would be able to purchase with a traditionally-structured product. This also enables them to cover themselves better when they need it most. And then, we’ve built in features into our product design that ensure they can buy more cover in future, if their needs change. The extra cover buy-up is one of the features we developed to make sure our clients could access more cover without facing unnecessary barriers, should their needs change.

BrightRock’s unique extra cover buy-up facility allows our clients with standard rates (including clients with medical loadings of up to 75%) to increase their cover without medical underwriting, provided they do this at least once every three years. Thereafter, the client still has access, but they need to give us a clear declaration of health to be able to add cover. If clients use it regularly, they can increase their cover up to the maximum entry age for the cover they want to add, for example, 70 age next birthday for death cover. You’d be forgiven for thinking that the extra cover buy-up is like future cover, but this isn’t true.

How BrightRock’s extra cover buy-up compares to future cover options in the market

We did a full analysis of the industry’s future cover offerings earlier this year, and some of the findings were quite surprising. For an average 40-year-old client looking for future cover for death, we found:

- All but one provider prohibit the client from accessing the cover when they want. They require specific events to take place, like a marriage. They also need proof of the event and limit the available cover depending on the event;

- One provider has two variations of future cover that are automatically included in the policy for the client (certain terms and conditions apply). The rest of the future cover benefits need underwriting, are sold to the client as an additional benefit, and require the client to pay an additional premium;

- Using the future cover is not always free of medical underwriting, in fact all except one provider will ask for proof of health in some form. The provider that asked for the most evidence will need a cotinine test, occupational underwriting, underwriting for risky part-time activities, travel, and a BMI declaration from the client before the cover can be added;

- Even though clients are paying for the facility (we saw between 5% and 25% cost in our analysis), one provider only allows them to use their future cover for a period of four years once they’re over the age of 31, after which it falls away completely.