By: Christelle Colman, Founder and CEO of Ami Underwriting Managers

South Africa’s High-Net-Worth Insurance Landscape

South Africa’s insurance market is seeing notable transformations, especially within the High-Net-Worth-Individuals (HNWIs) sector. The changes are driven by multifaceted influences encompassing economic, demographic, and societal dynamics, necessitating careful scrutiny and strategic responses.

An ongoing industry debate revolves around whether the high-net-worth sector is contracting or if we’re expanding our understanding of wealth. Despite economic hurdles, the HNWI sector remains resilient and vibrant. We’re observing an evolution, kindled by a new generation of wealth creators who are reshaping the notion of ‘high-net-worth’.

The industry is formulating strategic responses to cater to this unique market. Numerous insurance companies have dedicated teams for this sector, acknowledging its distinct requirements and growth potential. Brokerages also demonstrate interest in this market, signifying robust demand for bespoke, high-value insurance solutions.

A noteworthy trend in the HNWI insurance landscape is the growing demand for custom solutions that align with the unique lifestyles and asset portfolios of these individuals. This development underlines the need not just to insure high-value items but also to comprehend the complex risks associated with HNWI lifestyles.

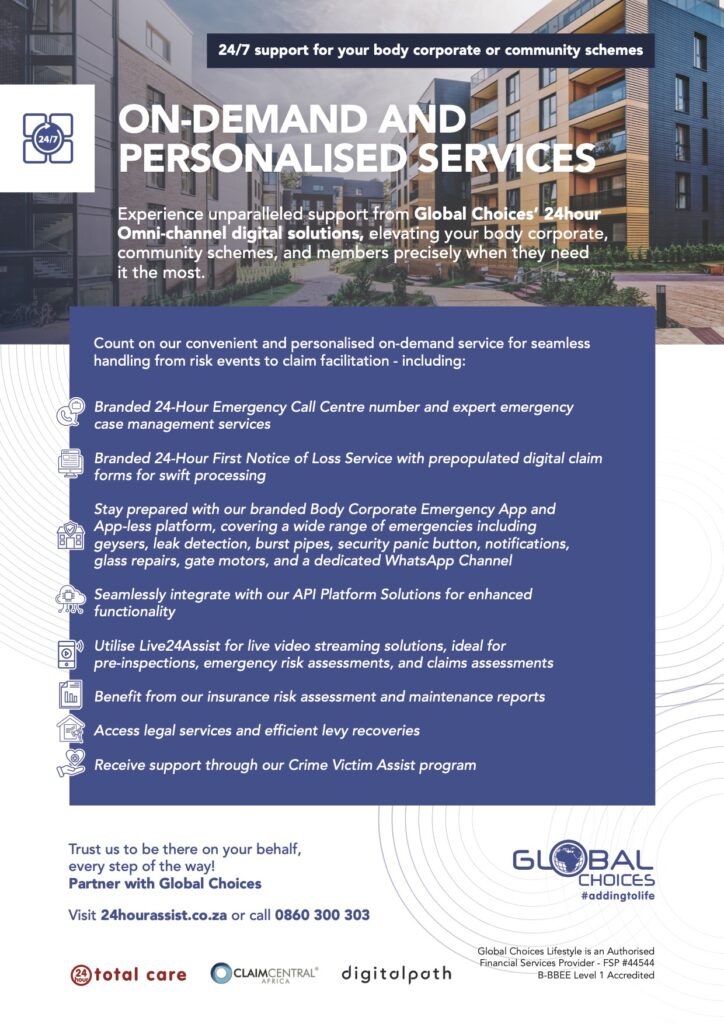

GLOBAL CHOICE’S 24HR

OMNI-CHANNEL DIGITAL

SOLUTIONS FOR BROKERS.

Experience unparalleled support from Global Choices’ 24hour Omni-channel digital solutions, elevating your body corporate, community schemes, and members precisely when they need

it the most.

Trust us to be there on your behalf, every step of the way!

Partner with Global Choices.

Global Choices Lifestyle is an

AuthorisedFinancial Services Provider – FSP #44544

There’s a marked rise in the mobility of wealth, with HNWIs increasingly establishing roots in different parts of the world. For example, since the end of the COVID pandemic, we have noticed an uptick in foreign home buyers, especially in the highly coveted area of the Western and Southern Cape. Such global relocation of wealth adds intricacy to the insurance needs of this demographic, necessitating refined solutions that cater to global asset protection and the management of cross-border risks.

The distinctive challenges in the South African insurance market, especially load shedding, with the phenomenon of intermittent power cuts becomes an unwelcome routine, it raises risks for security systems, digital assets, and luxury appliances – features characteristic of HNWI homes. Insurers are adjusting their products and services to manage these risks, often reconfiguring their cover. This situation calls for astute brokers to meticulously design the appropriate coverage for damages triggered by power surges or losses ensuing from security system failures.

In conclusion, South Africa’s HNWI insurance sector is not contracting but evolving. This evolution is influenced by changing demographics, global wealth mobility, and new challenges like load shedding. As we navigate this dynamic landscape, the role of specialist HNWI underwriters like Ami, who understand these unique needs and offer bespoke solutions, is of paramount importance.