Tony Singleton, CEO of Turnberry

A report by the Council for Medical Schemes states that in 2018, the rate of Caesarean section births among medical aid scheme members was a staggering 76.9%. While C-sections are a necessary operation that can save lives, they are often unnecessary in the majority of normal, uncomplicated births and deliveries and are on average at least 75% more expensive than natural vaginal deliveries, which means for members, the likelihood of significant medical expense shortfalls is increased. However, there are other options for birth, which will also be covered by medical aid, including midwife-led care.

Changing opinions

C-sections have become the norm among medical scheme members in South Africa, as indicated by the statistics from the Council for Medical Schemes. In the public sector, the rate is far lower at 44%. However, these stats are all from before Covid-19, and it will be interesting to see how things have changed.

The pandemic has led women to explore their options, including the option of home birth led by a midwife, because giving birth in a hospital during the height of the pandemic meant medical providers in full PPE, partners not permitted for the birth, a lack of emotional and physical support…

How does midwife-led care work?

Midwifery is the health science and profession that deals with pregnancy, childbirth and after birth support.

A midwife acts as the primary healthcare provider throughout a woman’s pregnancy, performing regular check-ups including monitoring the wellbeing of both mother and baby, supporting the mother’s emotional health, and answering any questions she may have. Midwives are professionally trained experts and will always refer patients to an obstetrician if any concerns are found, and for ultrasound scans of the baby.

However, for most women, pregnancy and childbirth is uncomplicated, and the option for a home birth can be a safe choice that might suit lifestyle and preferences better than a hospital. Home births are covered by medical aid and attract a lower cost than hospital births, which means that any medical expense shortfalls will be a lot less.

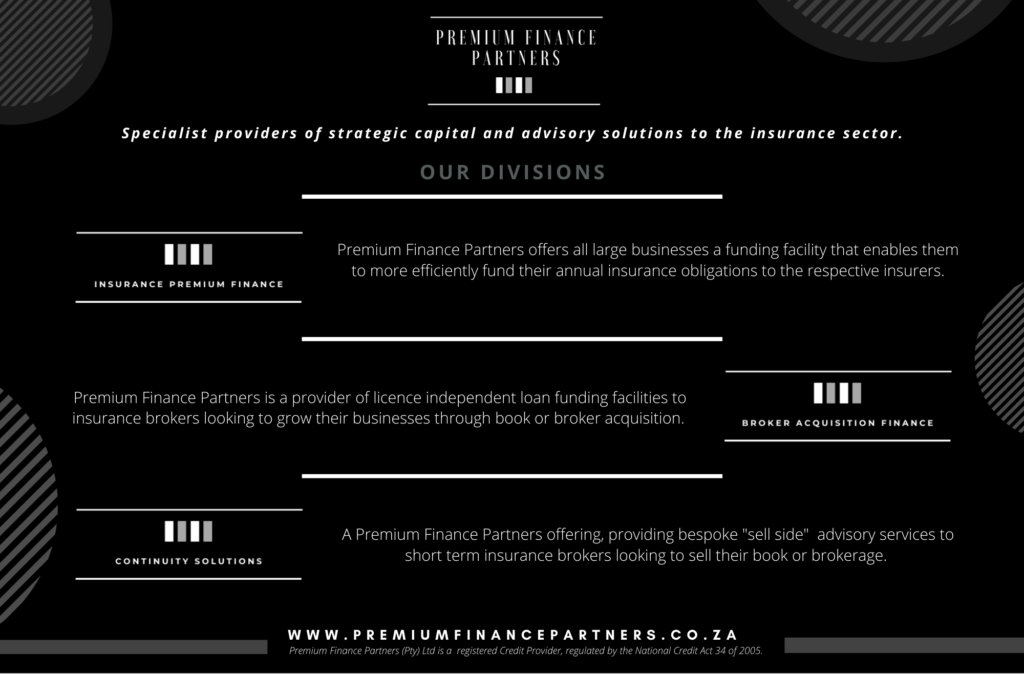

Specialist providers of strategic capital and advisory solutions to the insurance sector.

Premium Finance Partners offers all large businesses a funding facility that enables them to more efficiently fund their annual insurance obligations to the respective insurers.

Premium Finance Partners (Pty) Ltd is a registered Credit Provider, regulated by the National Credit Act 34 of 2005.

Where do doulas fit in?

Doulas are not the same as midwives – they do not offer pregnancy and childbirth care. They perform the role of emotional and physical support that can be helpful during the birthing and after birth phases. If the doula is also a nurse and has a practice number, their fees may also be covered by medical aid for the birth.

Why do I need gap cover?

There often are medical expense shortfalls, regardless of the birth option that has been chosen. With C-sections, this shortfall can be in excess of R35 000, and although a midwife-led birth will have reduced medical expense shortfalls, there is often still a medical expense shortfall involved.

Having to worry about paying off significant sums of money when you are just starting out on your family journey is a stressful experience that nobody should have to deal with. Gap cover will cover the shortfalls for childbirth in a hospital setting, including the services of a midwife in a hospital, as well as for home births that have been authorised by medical aid, if there is a payment from the risk benefit of the medical aid. Gap cover may also cover the shortfalls for two follow up consultations with your midwife to ensure proper support after birth.

Expert advice for physical and financial wellbeing

Having gap cover in place will ensure that any medical expense shortfalls, from whichever birth option you choose with the guidance from your healthcare provider, will be covered, so that you can start (or continue) your family journey on the best note. When it comes to your financial needs, always speak to your broker or financial advisor, who will be able to give the best advice on cover to protect your financial wellbeing.