By Menso Kwint, Head of Lombard Trade Credit

Lombard Insurance is a multi-line insurance company offering insurance and guarantee solutions across a wide range of products. As such, we are connected to most industries in South Africa and use that connection to help mitigate risk and support opportunities that businesses are faced with.

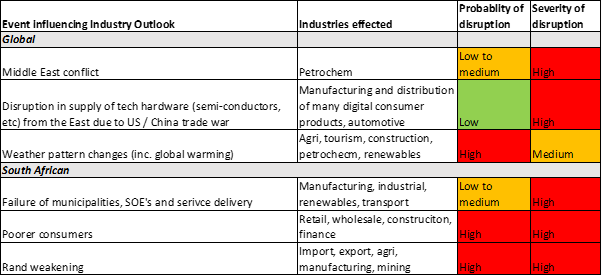

To formulate an outlook on what will happen in our country, economy, and more specifically certain industries, is hard and an imperfect science at best. Yet, just doing the exercise is crucial – regardless of being right or wrong – as it serves to focus thinking on what may happen and what can be done in certain scenarios. Below are examples of current events that could help shape our 2024. They are negative events, however, each of them introduces both risk and opportunity.

- Middle East conflict

Internationally, geopolitical events continue to have dramatic effects on global economies. The Middle East conflict has the potential to push inflation and threaten supply in the petrochemical space once again, driving up fuel and transportation costs. While profits can be made on rising producer price inflation, businesses should beware of being caught with excessive stock once prices begin to come down again.

- Disruption in the supply of tech hardware (semi-conductors, etc.) from the East due to the US / China trade war

The trade war between the US and China could disrupt the supply of tech hardware from the East – for example, semiconductors. This in turn can affect the manufacture and distribution of digital consumer products, like mobile phones, fridges, and cars, etc. which are dependent on these crucial components. The danger here is when manufacturers have high fixed costs that continue to run even when production slows or is halted due to the lack of supply of these parts. The automotive industry was affected in some countries through the Covid cycle of supply chain disruption. An opportunity that presents itself is the shift away from complex import supply chains and a move towards local manufacture of these component parts.

- Weather pattern changes (inc. global warming)

Concerns on global warming and weather pattern changes are now mainstream. As recently as December 2023, a historic vote was passed at a COP28 summit where 200 countries agreed to transition away from fossil fuels by 2050 (https://unfccc.int/news/cop28-agreement-signals-beginning-of-the-end-of-the-fossil-fuel-era). This has large implications for the renewables space and many other areas. In South Africa, the domestic solar boom of late 2022 / early 2023 was nothing short of spectacular, and while that frenetic pace may never return spending here should continue for some time still. This phenomenon is playing out to a greater or lesser degree in most places of the world.

Cutting-edge technology to grow & adapt with you

PROFIDA will meet your needs, both now & on our journey together into the future

Global warming also has large consequences for other industries, including agri and tourism. However, technology is now able to counter these challenges and create opportunities. We construct reclaiming land from rising sea levels, and concepts like smart farming potentially change the nature of the agri industry (smart farming is about managing farms using technologies like the Internet of Things, robotics, drones, and AI to enhance and optimize food production).

- Failure of municipalities, SOEs, and service delivery

Perhaps even more interesting are the current trends and events in South Africa affecting our industry outlooks. The current challenges in the service delivery of power, water and rail/port utilities are dramatically restricting economic growth and the survival of businesses. However, the situation (s) also provides deep opportunities for public/private partnerships or gradual privatisation mechanisms – which we are seeing in power production and potential port takeovers.

- Poorer consumers

I certainly did not fully understand the shift in consumers through the early days of Covid. I did not realise how positively affected disposable income was by the reduction in interest rates and contraction of spend on travel, eating out and alcohol. People were richer in 2020, 2021 and 2022, and this translated to spend in DIY and consumer goods. This has completely reversed though the later half of 2022 and 2023. The return of driving to work has coincided with rising interest rates, high inflation, and a constrained economic environment where employment and wage push is limited by low GDP growth. This has affected lower LSM (Living Standard Measures) groups to a higher degree. Our cash and carry affiliates have stated that they have never seen the low LSM South African consumers as poor as they are right now. This is a devastating reality and has huge social and economic consequences. Certain retailers have catered to this shift well and others not so much – seen on JSE published results.

- Rand weakening

The fiscal deficit in South Africa (the difference between government revenue – tax – and government expenses) continues to grow. To shore up this deficit the government borrows. Our government debt to GDP is currently at about 70%, and is set to go even higher (https://tradingeconomics.com/south-africa/government-debt-to-gdp). This coupled to things like our political instability and financial downgrades means more less demand for ZAR out there, which means price down, i.e., the likelihood of a continual gradual weakening of the Rand. This is a risk if your business is dependent on imported goods, and you cannot pass the price increase on to the end consumer. However, it also means companies that export – like agri and mining – have a positive runway of benefiting from the higher prices of their goods sold.

2024 is around the corner. It will bring challenges, but also opportunities. I think more important than those specific events and their effects is that we are open to understanding what is possible and what we can do about it.