By Rufaida Hamilton (Banoobhai), Head of Payments at Standard Bank, South Africa

It is expected that six years from now, more than 30% of global economic activity could be mediated by digital platforms. That’s around $60 trillion. The logical conclusion is that platform businesses are set to reshape global trade. Not only has the platform economy opened the world up for consumers, but for small and medium-sized businesses too. No longer do they need their own costly supply chains to reach a global network of customers.

And, to realise the future platform economy, payments will play a critical role.

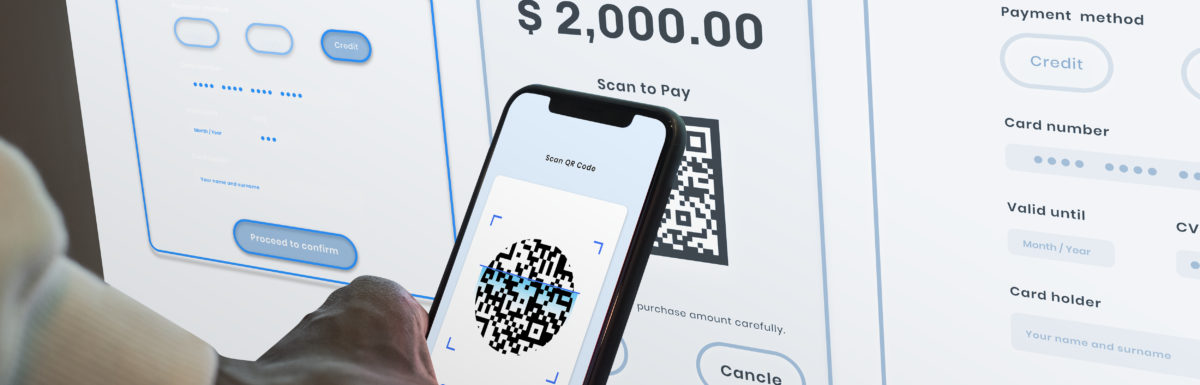

For example, many people who love their iPhones, also love Apple Pay. Within only 6 years of launching, almost half of iPhone users were making payments with their phones. Today, Apple Pay is on track to handle 10% of all global card transactions by 2025. Safe to say that the plastic card is fast being replaced by our mobile phones. This is great and yet, only the beginning for digital payments.

Much more potential exists for what’s been termed as ‘digital matchmaking platforms’, ‘transaction platforms’ or ‘aggregation platforms. Essentially, these types of platforms are very transaction or task-focused. The customer expresses a need, gets a response, makes the deal, and moves on. Think Amazon, TaskRabbit, and eBay. Airbnb, for instance, attracted hosts and guests away from Craigslist by providing superior trust through a rating system, an improved search and navigation experience, and, arguably the most important, an integrated payments platform. Globally, transactions on these kinds of platforms are growing faster than any other type of commerce. And payments are key.

The potential of payment platforms

Payments are not usually a directly profitable platform service. This does not mean they aren’t a critical success factor for any platform. To ensure a seamless sales experience and gain maximum customer retention, payments are the embedded plumbing of these networks. Without them, long-term customer value simply isn’t possible.

Consider the Chinese market as proof of how powerful payment services can be in creating platform stickiness and extra customer value. Successful platforms start from a core product – be it messaging, an auction house, or ride-hailing. From this foundation, many then rapidly add diverse content or functionality to keep customers connected and engaged with the platform for as long as possible. In China, a large market of mobile-native young people created the most diverse and competitive marketplace on the planet by using WeChat, Alipay, Didi and many others.

WeChat and Alipay embed payments into the overall experience using a dedicated wallet, combined with a seamless checkout process and effective dispute management. The goal is to encourage the

user to leave value in the platform for future use. This way, embedded payments become an indispensable component of any platform.

Trying to emulate the success of China in the West, Facebook didn’t just stop at embedding payments – they created their own currency. This may have been an overreach for the social networking platform but despite its failure, the logic of platform payments remains compelling. In the end, it’s clear that with payment platforms, trust will always remain one of the most important currencies.

It’s all about the experience

This kind of trust is formed through seamless reliability. Embedded payments on platforms must be so reliable and easy to engage with that it almost becomes ‘invisible’ to the consumer. This helps create a “virtuous circle” for the platform that means healthy growth. It works like this: Customers who confidently expect ease, convenience and reliability use the platform more and more, and bring their friends in. In turn, this pool of ready customers attracts new service providers. And what does a diverse set of services attract?

You guessed it: More customers

However, don’t be misled by the simplicity of this logic. Many established global companies have underestimated the challenges of integrating payments into their existing platforms. Even digital giants such as Google. The original Google Wallet expected financial institutions to go through a very complex enrollment process to add their brands to Google’s payment app. On top of this, most cellphone carriers would not allow Google the level of security access required to run the app on their phones. Only a year later, the idea was scrapped, and the more streamlined Android Pay was launched.

The learning here is that payments are defined by experience. As mentioned before, payments embedded in platforms must be invisible while providing an immersive, seamless, and frictionless engagement experience. This not only applies to the customers, but everyone who interacts with the platform.

Connecting Africa’s customers

With the goal to make positive changes through payments in the lives and businesses of those who call Africa their home, Standard Bank embarked on a journey to realise open payment solutions through modular payment services that facilitate the secure, seamless, and immediate flow of funds for customers and partners.

The Bank’s ambition to become a platform-based business coupled with our passion to create seamless financial services that drive inclusivity creates connectivity, and fuels financial freedom led to the creation of Unayo. As a mobile money platform, Unayo combines the simplicity of mobile

money with the sophistication of a bank account. The aim is to connect Africa’s informal market to financial services in an easily accessible manner through free or minimal transaction fees.

This multi-faceted, interactive platform reaches into, and across, all sectors and communities. Because it’s not dependent on smart phone technology, this payment platform is set to unlock much-needed economic transactional activity and prosperity on the continent.

By creating an ecosystem of users and merchants that stimulates entrepreneurial activity and drives financial inclusion, we see the development of innovative payment solutions like Unayo as much more than facilitating financial transactions. For Standard Bank, we see these payment platforms as ways to stimulate economic activity between two ends. In this way, these numerous digital trade hubs can combine to ultimately drive the growth of Africa’s economy.