Muvhango Lukhaimane, the Pension Fund Adjudicator

With the lifting of Covid-19 lockdown restrictions, complaints to the Pension Funds Adjudicator came thick and fast – and cases were closed without undue delay.

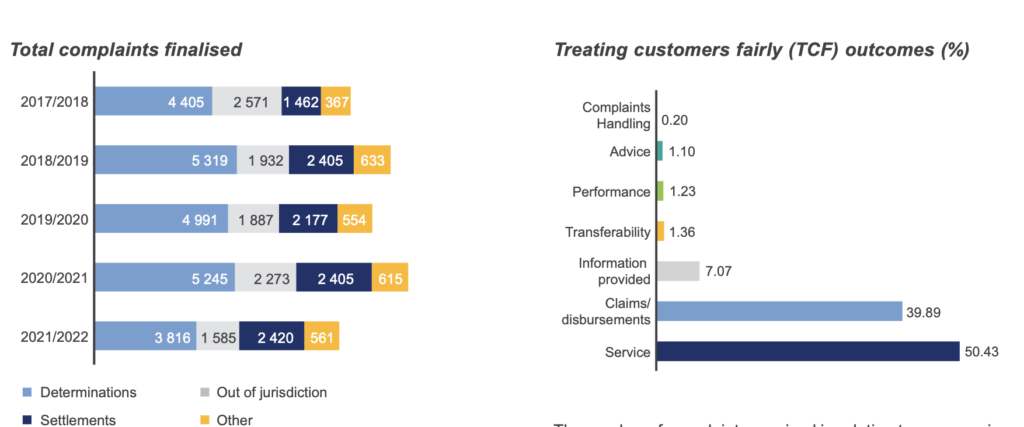

In the 2021-2022 financial year under review, the Office of the Pension Funds Adjudicator (OPFA) received 8 858 new complaints, an increase of 26% compared to the previous year when the Covid level 4 and 5 lockdowns were implemented. 2 109 cases were carried over from the previous financial year.

8 382 cases were closed in this period, 94% of which were wrapped up within six months to ensure timeous relief could be provided to complainants; and 45% of which were resolved by way of formal determinations. As at 31 March 2022, there were 2 259 active cases and only 102 (4%) were older than six months.

The number of complaints received in the financial year under review was still lower than pre-Covid levels.

We had expected a larger number of complaints due to job losses and financial difficulties by employers and funds aggravated by Covid-19, which would have had a direct impact on benefit withdrawals and employer contributions.

The majority of the 8 382 complaints related to withdrawal benefits (45%) and section 13A compliance (40%) where there was non-payment of contributions by employers and funds not adequately discharging their obligation to ensure collection of these contributions.

This is of great concern to the OPFA as fund non-compliance and section 13A matters have been a consistent feature over the years and continue unabated to the detriment of pension fund members.

The OPFA continues to engage funds and administrators that contribute the most to these matters and provide them with guidance on how to resolve some of the issues raised. There is regular engagement with the Financial Sector Conduct Authority management on trends that emanate from the complaints management process and identification of funds that require intervention from the regulator.

Participation in pension fund industry conferences and seminars also provided an opportunity to have the critical issues around non-compliance and delays in filing responses ventilated.

From October 2021, the OPFA implemented a revised complaints’ management process in order to make it easy for complainants to enforce orders by obtaining a writ of execution from the relevant court in the event of non-compliance with the order by an employer or fund. From this date, the OPFA commenced conducting investigations pertaining to arrear contributions in a manner that enables it to make orders sounding in money.

From March 2022, the office also revised its timeframes for filing responses to complaints by requiring parties to file responses within 20 days (instead of 30) if a complaint is not resolved at the refer-to-fund stage (RTF). The parties are granted a further 10 days if a response is not received within the initial 20 days. The revised timeframe is since the parties are afforded enough time – 30 days in all – to resolve complaints at the RTF stage.

Most funds continue to fail to take advantage of the opportunity to resolve administrative issues at the RTF stage as they do not make any attempt to engage the complainant to resolve a complaint and merely file responses to the OPFA.

Some funds that have internal complaints resolution processes continue to fail to use this process adequately – complaints that are referred for internal resolution by funds are not followed through and members are not informed of the process. As a result, these members approach the OPFA with similar complaints that were referred for internal resolution by funds as there is no communication regarding the recovery of arrear contributions or payment of their benefits.

The OPFA should not be investigating complaints that can be easily resolved through the fund’s internal complaints’ resolution process. It is only in instances where a dispute remains unresolved after the fund has attempted to deal with same, that the OPFA should get involved.

The Private Security Sector Provident Fund (PSSPF) remained the biggest contributor to new complaints. However, following various engagements, their turnaround times in filing responses continue to improve. The Chemical Industries National Provident Fund has also contributed to a delay in finalising some of the complaints.

During several meetings with the principal officer of the fund, concerns were raised ranging from data issues, poor service and failure of the previous administrator to issue proper benefit statements to members.