Florbela Yates, head of Momentum Investment Consulting

Prefer to listen to this? Play the podcast above instead

2020 was a year full of challenges, but also one full of opportunities for those agile enough to embrace the unknown and try new things. For us at Momentum Investment Consulting (MIC), it was a year of innovative thinking, embracing technology, learning new skills and growing the business.

head of Momentum Investment Consulting

When we sat down as a team in early January of 2020 to strategize on the best ways to increase efficiencies in the business through better use of technology, none of us could have foreseen that this included the way we engaged with our clients. But merely six weeks later we were forced to use Zoom, Microsoft Teams, and Skype to continue engaging with asset managers and advisers during the lockdown.

Our philosophy has always been to encourage each other to think outside the box, be flexible, put ourselves in our clients’ shoes and adapt to changing conditions. Successful businesses are those who spot the opportunities and run with them, rather than get bogged down by the challenges.

While we had to acclimatise to working from home (or rather living at the office), MIC had a successful year. Our assets under management grew significantly and we had positive net flows every single month, despite investment markets not always delivering positive returns.

If 2020 has taught us anything, it’s not to be too anchored in our plans. We need to be agile and willing to adapt to the environment, which sometimes results in making new plans. But having a goal is essential as it sets the direction and allows us to set the course towards achieving our goals.

Our outcome-based investing philosophy allows us to align our investment outcomes with our clients’ investment goals. Success relies on ensuring that we have the optimal strategic asset allocation and exposure to the best strategies in each asset class. We believe that the journey is as important as the destination. And our clients value the expertise and time that we put into constructing diversified portfolios which focus not only on getting them to their desired outcomes but also make the journey as comfortable as possible.

Source: IRESS, JSE ALSI returns as at 31 August 2020

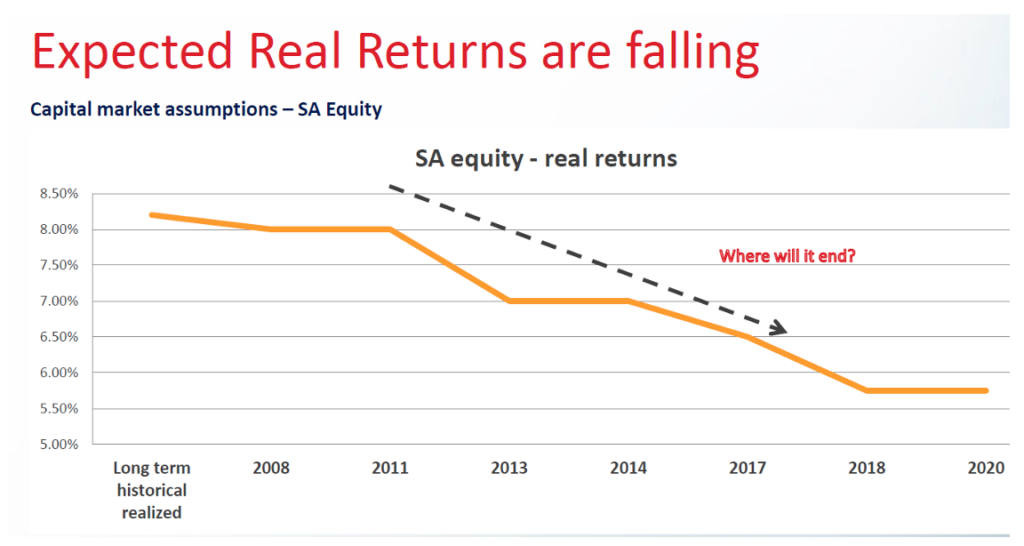

As the graph shows, real returns from South African equity have been falling consistently over the past decade despite certain pockets having done well. For us, as investment managers, we need to continuously evaluate our investment opportunity set and ensure that we have exposure to various asset classes, both locally and globally, to continue to deliver on our CPI+ objectives for clients. By carefully allocating mandates to the best-of-breed managers in each asset class, we are able to build

diversified portfolios with exposure to a range of active, passive and smart-beta strategies as appropriate. This approach has allowed us to produce consistent returns for our investors. The focus for the new year is going to be on finding new investment opportunities in an environment of lower real returns.

One of the biggest advantages of belonging to a big group with a solid balance sheet is our ability to collaborate with investment experts across the wider group, giving us access to investment products, wrappers and mandates that are not available to traditional retail investors. In an ever-changing and lower-return environment, our focus must be on using these to structure better solutions for clients.

Another advantage is our ability to select skilled asset managers with sustainable businesses. Our manager research team currently monitors over 250 investment mandates with 80 asset managers. This allows us to access the best managers to execute on each of our strategies and has been particularly important during the past year, where a shrinking asset base and the sustainability of some asset management businesses has come under pressure.

Towards the end of 2020 some boutiques closed or merged in an effort to survive, and we also saw a movement of portfolio managers between various asset management businesses. This trend may continue for the foreseeable future.

We continue to see the value of sticking to a solid investment philosophy and remaining invested for the longer term, despite short-term volatility in the market. We look through the cycle in building long-term sustainable portfolios, but our portfolios managers are constantly monitoring the opportunity set and evaluating the current environment to ensure that they take advantage of any shorter-term opportunities as they present themselves.

And lastly, the relationships and partnerships between our team, the financial advisers and the underlying asset managers allow us to deliver well-priced, consistent performance for our mutual clients.

Momentum Investment Consulting (Pty) Ltd is an authorised financial services provider (FSP32726) and part of Momentum Metropolitan Holdings Limited and rated B-BBEE level 1.

All the expertise, products and service to help you to keep your clients focused on the destination.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services (FSP6406) and registered credit (NCRCP173) provider.