Sean Cullen, Geospatial Industry lead: Commercial, Esri South Africa

Location intelligence starts with understanding the WHERE component in your data. Leveraging this where component in your data is Location Intelligence.

80% of an organisations data already has a location component. This may be as obvious as a set of coordinates, or a less obvious address or point of interest. Understanding what to look for and how to utilize it, one can start leveraging the where component to achieve location intelligence. Using a process called geocoding, address data can be transformed into coordinates, and these coordinates can be mapped. This is a great start to understanding spatial data and the distribution of records. These records could be clients, assets, branches or anything that has a location in space and time.

Knowing what the distribution of the records looks like, one can start finding patterns that would not necessarily be apparent in the data from a tabular view, seeing where records are in relation to others, the potential for interaction between them. With the appropriate attribute information attached to the location of records you can start seeing more detailed patterns by applying relevant symbology such as the size of the symbol representing the amount of revenue for a branch. You have now taken two-dimensional data and shifted it into a multidimensional story. This helps you gain more insight into your records, but at the same time you can start understanding the underlying business process that you have used to obtain that record, or how you should be managing them.

A practical example of simple analysis that has helped one of our clients was to simply geocoding their policy’s and symbolising each policy based on the branch that policy belongs to. The client started seeing irregularities in their own data such as the quality of the addresses being captured by their consultants and the poaching of policies from other regions. This in turn helped then understand what was required to better capture policy information and manage their own internal business processes.

Where to from here

Once you have your own business data geocoded or mapped you can start looking at other types of data that help answer the question you may have. What is the exposure to hail for this record (location)? Where is the nearest facility in times of an emergency? This is when you start overlaying geology information, average hail day’s per year, flood risk potential, locations of emergency services, crime statistics and more. This type of information helps insurers manage their exposure and aid in the underwriting process.

Spatially displaying your records is just the start to finding some of the basic patters and insights into your business and operations. Geospatial analysis, as found in the esri software, allows you to dig deeper and start finding statistical hotspots and much more. By taking your own data and supplementing it with other data sources you can start looking at the bigger picture of where your records are and how they could be affected by natural and manmade risks. This would also link back into gaps in the market to extend your coverage and market share. This further extends into the utilization of artificial intelligence to start undertaking predictive analysis. Artificial intelligence has been used to spatially analyse claims on policies and find irregularities behind them.

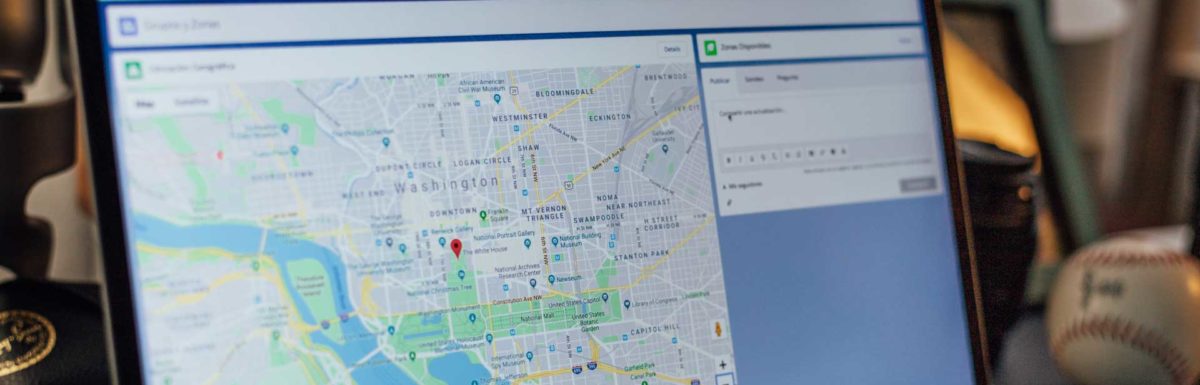

This is all great and wonderful, but you may not be a Spatial Location guru and thus need an easy to use tool to obtain this data and information to make decisions. This is where dashboards and web applications ae used to consolidation this data to interoperate results immediately. Esri South Africa has built a reporting solution that reports on the above mention datasets in an easy to use web application. One simply types in an address or clicks on the map. The address is geocoded in the backend of the application and a PDF report is generated listing the risk associated with that location. This is just one of the many solutions esri South Africa have for the financial industry.

Location Intelligence for insurance is taking your policy information, mapping it in relation to other business and risk data to See What Others Can’t. This is the Science of Where!