Dolana Conco, Regional Executive – Consulting, Alexander Forbes

Receiving the same tax treatment

Changes to retirement benefits for provident fund members, initially meant to come in five years ago and now scheduled for next March, will see tax uniformity for all who contribute towards retirement.

Regional Executive – Consulting, Alexander Forbes

These changes, in terms of the Taxation Laws Amendment Act, will also encourage greater savings, something South Africa desperately needs as it seeks to crawl its way out of an economic hole.

One of the aims of retirement reform is to create a uniform retirement fund system for all types of retirement savings vehicles, such as pension, provident and retirement annuity funds. This will allow all members to receive the same tax treatment of the money contributed and how benefits can be paid at retirement.

Alexander Forbes Member Watch analysis shows that about 50% of members retire with less than one-fifth of their final salary to live on in retirement.

Many reforms have been implemented over the last few years, but it has been a long journey for this next vital step. The changes are beneficial for most retirement fund members and encourage greater savings for retirement and address issues in the retirement system,

Currently, provident fund members can take their retirement benefit as a full cash lump sum and do not have to buy a pension (annuity) from a registered insurer when they retire. However, pension fund members must use at least two-thirds of their retirement benefit to buy a pension, unless the total benefit is less than R247 500.

How retirement reform affects members

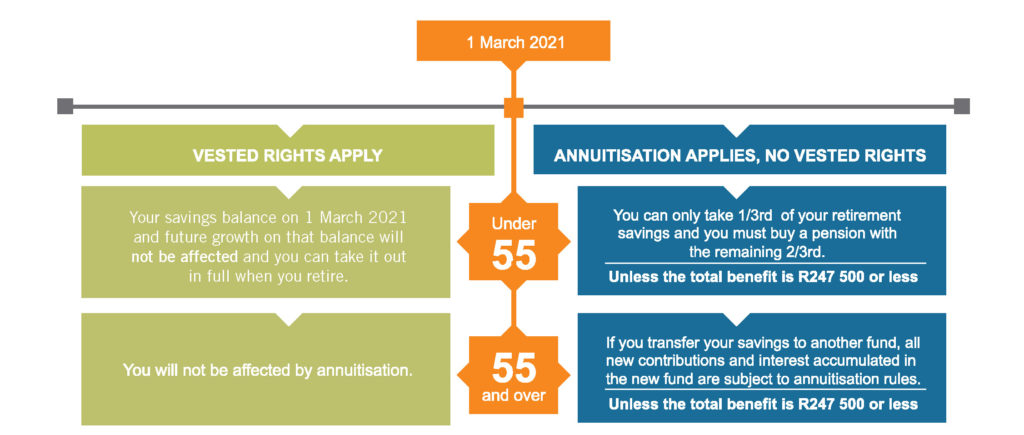

From 1 March 2021, retirement benefits from provident funds will be treated in the same way as pension funds for the part of the benefit based on contributions. The changes for provident fund members are:

- Provident funds will have the same annuitisation rules as pension funds.

This means that members will have to buy a pension (annuity) from a registered insurer with at least two-thirds of their retirement benefit unless the total benefit is R247 500 or less. - Vested rights will apply. Retirement savings will be ring-fenced as follows before the new legislation takes effect:

- Any provident fund balance saved before 1 March 2021 plus the future growth on this until retirement won’t be affected and can be taken in cash on retirement.

- Members who are 55 years or older on 1 March 2021 will not be affected by this change at all if they stay a member of the same provident fund (or provident preservation fund, as proposed in the draft Taxation Laws Amendment Bill until retirement. This means that the retirement benefit will be treated in the same way as it is currently being treated when these members retire. If these members transfer to another fund, they will still have vested rights, but contributions and growth on this to the new fund will require them to buy a pension with two-thirds of their retirement benefit.

The benefit of this change is that funds will be able to transfer members’ savings tax efficiently.

Employers who have multiple retirement funds consider consolidating these funds, as pension funds, provident funds and retirement annuity funds will be harmonised in the tax treatment of contributions and the retirements benefits at the time of retirement. Consolidation requires many other factors to be considered. One such example is understanding the implications on vested rights when transferring provident fund members who are 55 or older on 1 March 2021.

Other factors include:

1.the size of the funds

2.potential cost savings or cost implications

3.Section 14 transfer requirements

4.deregistration

5.liquidation requirements of the transferor fund and so on

The changes to ensure further harmonisation between pension funds, provident funds and retirement annuity funds take effect on 1 March 2021. It is important for trustees to start implementing project plans to get ready for these changes. Amendments to rules, communication to members, and fund consolidation will be some of the matters to consider.