Lynn Bolin, Head of Communications, M&G Investments

When you sit down (alone or with your financial adviser) to plan your finances, you’ll set certain goals. These could include paying for your child’s tertiary education, saving for an overseas trip to celebrate a special anniversary, or planning for a well-deserved retirement. You’ll determine the amount of capital that you need for each goal, and then calculate what you’ll need to invest every month to achieve your capital requirements.

When calculating this, your adviser will take certain factors into account and make several assumptions that are important for you to understand, as they play key roles in determining how successful you are in meeting your investment goals. Here we unpack the thinking behind the main factors in your calculation.

Time horizon

Your time horizon is a key input in calculating how to reach your financial goals. Each goal will have a different time horizon. The term refers to the amount of time between now and the point at which you’ll need the capital for your goal. If the goal is retirement, this is typically around age 65. If you’re currently 25 years old, your time horizon is 40 years. In other words, you have 40 years to accumulate sufficient capital to retire on. But are you sure you will want to retire then? What about aiming to retire earlier? Or maybe you’re someone who likes to stay very busy and who may want to retire later? Be sure you know what age or time horizon is assumed in your planning.

You also need to think about your time after retirement – you need to make an assumption around how long you’re going to live and include this time horizon in your retirement planning. You can base this assumption on the average longevity figures, which your adviser will know, and factor in any other information you may have such as your state of health. Remember, having an appropriate investment plan in place for after your retirement is also very important, especially if you consider that your capital may need to last another 30+ years, and will still be earning returns even as you draw it down.

Inflation

The next assumption in your plan will be inflation. Simply put, inflation is the general increase in the price of goods and services over time. If your investments aren’t keeping up with inflation, your buying power will be eroded. Nobody knows what the inflation rate will be decades from now, so your adviser will have to make an educated guess. This begins with looking at the long-term history of inflation in this country. Starting at 1994, the year of the first democratic elections in South Africa, until the end of last month, the average inflation rate is 5.3% per year. This is within the Reserve Bank’s target of 3-6%. Using this average as a benchmark, and perhaps upping it a little for safety’s sake, your adviser will then project it over your time horizon to see how much capital you’ll need in the future to achieve your financial goal. Then, he’ll calculate that as a monthly amount. It’s worth remembering that the cost of your financial goal will also increase over time so that the longer you delay investing towards your goal, the more expensive your goal will be in the long run.

Investment performance

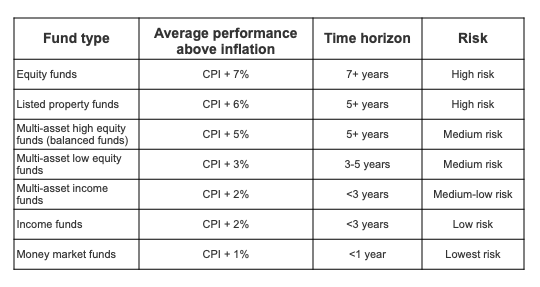

When you choose which unit trusts to invest in, look at the return you need and your investment time horizon. Different types of funds are designed to deliver certain returns and are built around different risk parameters. For example:

Understanding these broad return and risk assumptions for different types of unit trusts can help you choose which funds best fit your particular requirements. Investment managers like M&G Investments provide detailed fund fact sheets and performance commentary that explain a fund’s risk parameters, underlying holdings and suggested investment time horizon to get the best possible returns through economic and financial market cycles.