Why quality advice matters more now than ever

By Edward Gibbens, Chief Executive: Distribution, PSG Financial Services

In today’s information-rich environment, we have more access to financial knowledge than ever before. From online trading platforms and social media to corporate podcasts and news sites, there is a constant stream of information right at our fingertips. While this may seem empowering, the flood of available resources can also cause a great deal of confusion. Not all sources are reliable and distinguishing credible advice from misleading or even fraudulent advice has become increasingly challenging.

As South Africa’s financial advisory landscape has matured over time, the pool of advisers has also expanded, making it difficult for the average person to know where to turn for help. Simultaneously, sophisticated scams masquerading as legitimate financial advice have further blurred the line between trustworthy advisers and fly-by-night operators. A 2023 study by the Financial Planning Standards Board (FSPB), which surveyed over 15 000 people across 15 countries, revealed that 70% of respondents who had never received financial advice would consider doing so if they found the “right” adviser. This begs the question: what constitutes the right advice, and how can consumers ensure they are in reliable hands?

What is quality advice?

Quality advice is multi-dimensional, employing financial strategies where it is not a “one-size-fits-all”. Good financial advice requires not only a deep understanding of the client’s financial position, their circumstances, future ambitions and appetite for risk, but they also need to be knowledgeable about the macroeconomic landscape, nationally and globally and be able to determine if and when these factors can impact an investment strategy. For example, our advisers follow a standardised internationally recognised six-step advice process backed by guided architecture. This ensures a methodical, client-focused approach that guarantees every financial recommendation is aligned with the client’s unique circumstances and objectives.

Quality advice and advisers who are credible, qualified, and experienced go hand in hand. A professional adviser should have relevant qualifications and possess a proven track record of helping clients achieve their financial goals. At PSG, for example, all wealth advisers hold tertiary qualifications in Commerce, Marketing or Law, ensuring that they bring a strong academic foundation to their advisory roles.

TAKE THE ‘ADMIN’ OUT OF ADMINISTRATION.

Whatever your present challenges and future goals, C360 provides the best possible platform for building powerful, business-enabling solutions that future-proof your business while providing operational efficiency and regulatory peace of mind.

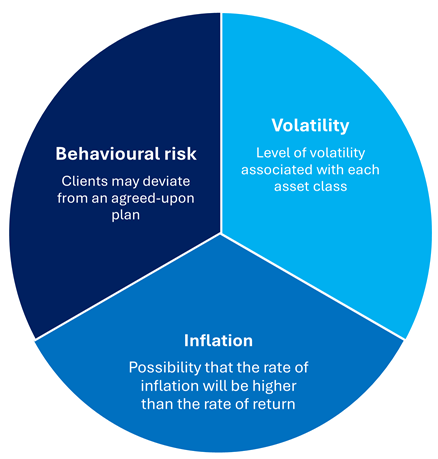

Three key risks that a quality financial adviser will look at when crafting a bespoke investment strategy:

- The first is behavioural risk, where clients might take too little risk, often out of fear or uncertainty, when they could afford to take more without jeopardising their goals. It’s important not to be “recklessly conservative,” especially when this could limit growth opportunities.

- Inflation risk is another concern, as it can erode the value of savings if returns don’t keep pace with inflation.

- Lastly, volatility risk, where unexpected events can lead to temporary declines in portfolio value, must be managed with a clear understanding of both short- and long-term impacts.

The financial landscape is constantly evolving, and so too is the way we provide advice, with technology playing an increasingly bigger role. Integrated technology platforms have the power to streamline processes, making it easier for advisers to focus on what truly matters: understanding and advising their clients. From data analytics that provide insights into client behaviour to data security upgrades that ensure privacy, platforms must be designed to support advisers in delivering quality, consistent advice.

Despite technological advancement, trust remains at the heart of quality financial advice. This combined with professional expertise, as well as clear and regular communication gives clients confidence that they are receiving the quality advice.