The insurance sector stands on the brink of transformative change, driven by advancements in artificial intelligence (AI) and data analytics. Rupert Nicolay, Worldwide Financial Services Industry Solutions Lead, Microsoft Services, speaking as part of the inaugural COVER Innovators Network, offers a detailed view into the strategies, opportunities, and challenges faced by the industry. His insights, particularly from working with tier-one insurers and reinsurers, highlight how AI is reshaping traditional processes and preparing the industry for a dynamic future.

The Maturation of AI in Insurance – Nicolay observes that traditional AI capabilities—such as identifying the next best action or recommending products—have matured significantly. Historically, these models relied on limited datasets, often siloed within specific lines of business. Today, the integration of richer data sources, such as real-time customer interactions and loyalty data, is enabling insurers to craft more personalised and timely engagements. For instance, identifying when a customer redeems a loyalty benefit can trigger targeted service enhancements, fostering a stronger relationship.

Another pivotal trend is the use of transactional banking data to inform insurance strategies. Nicolay highlights how companies like Capitec leverage transactional insights to assess potential customers who lack conventional financial documentation, such as pay slips. This approach not only reduces the cost of sales but also enables insurers to tap into underserved markets, often overlooked by competitors.

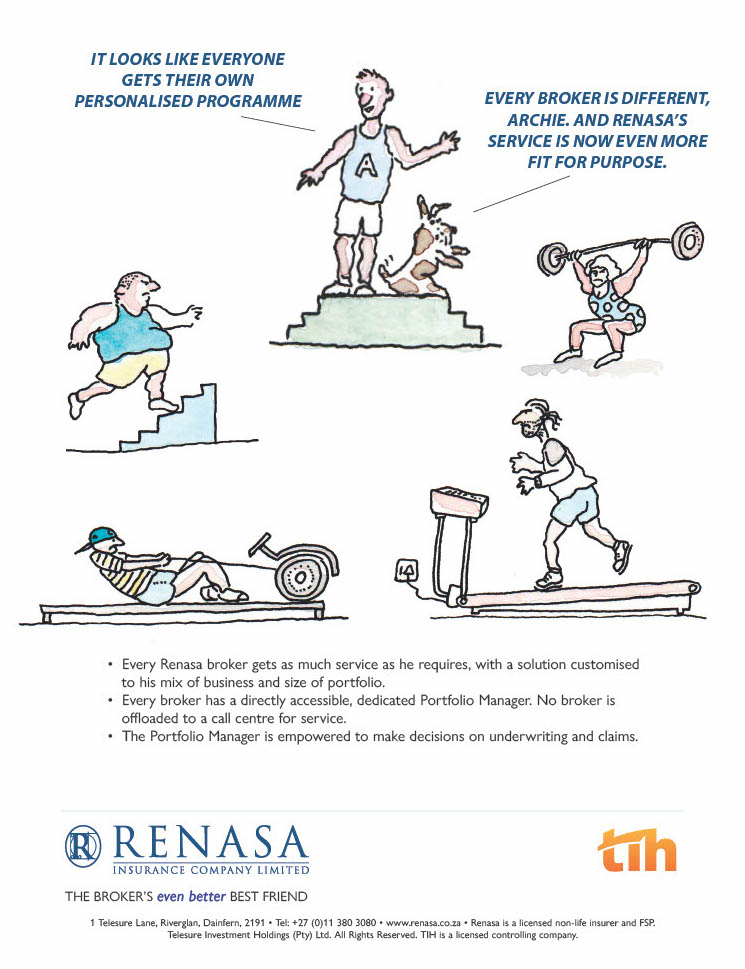

Renasa has always been the broker’s best friend.

Our entire business focus is exclusively on helping our intermediaries outcompete their competitors.

Now, as part of TIH, South Africa’s powerful insurance group,

we commit to do even more for our brokers.

Renasa has always been the broker’s best friend.

- Every Renasa broker gets as much service as he requires, with a solution customised to his mix of business and size of portfolio.

- Every broker has a directly accessible, dedicated Portfolio Manager. No broker is offloaded to a call centre for service.

- The Portfolio Manager is empowered to make decisions on underwriting and claims.

Renasa is a licensed non-life insurer and FSP. Telesure Investment Holdings (Pty) Ltd. All Rights Reserved. TIH is a licensed controlling company.

Harnessing Data Across Lines of Business – For larger insurers operating in diverse sectors—such as medical services and financial advice—there is growing interest in leveraging data across multiple business lines. Nicolay notes that privacy-protected insights can bridge the gap between sectors, enabling shared benefits without compromising customer confidentiality. These insights allow companies to target customers more effectively, optimise operations, and improve decision-making across their ecosystems.

Reinsurers like Swiss Re and Munich Re are taking this further by combining data insights with external models, such as sophisticated weather predictions. These insights are repackaged and sold to banks, providing risk assessments for project financing and other geographically sensitive investments. Such collaborations demonstrate the potential for data-driven innovation to extend beyond traditional insurance applications.

Automation as a Cornerstone of Innovation – The push for automation in insurance is unsurprising, given the industry’s reliance on legacy processes. Robotic Process Automation (RPA) has been instrumental in simplifying tasks like data fetching and system integration. However, Nicolay emphasises that current automation efforts often remain simplistic, heavily dependent on teams well-versed in legacy product rules.

Generative AI introduces a new dimension to automation. By integrating traditional automation tools with generative AI capabilities, insurers can go beyond data retrieval to interpret documents and provide actionable recommendations. For example, in legacy claims processing, AI can analyse product rules, policy details, and claims history to guide agents toward optimal decisions. This approach not only enhances efficiency but also democratises automation, making it accessible to smaller teams without significant IT investment.

AI-Driven Advice and Compliance – Nicolay sees significant potential for AI to revolutionise advice, sales, and compliance in the insurance sector. Sales, a high-cost and high-turnover domain, can benefit from assistive AI tools that support agents by providing tailored recommendations and streamlining workflows. In the affluent sector, AI has the potential to lower the cost of sales, enabling insurers to expand their reach to a broader market segment.

In compliance, AI offers a transformative opportunity to shift from random sampling to comprehensive process analysis. Nicolay envisions AI agents capable of auditing every customer interaction for adherence to regulatory requirements. This shift can significantly reduce compliance costs while improving accuracy and transparency.

Generative AI and the Democratisation of Processes – A particularly compelling use case for generative AI lies in democratizing complex processes. Legacy products, which often require specialised knowledge and significant manual effort, can now be managed with AI assistance. Nicolay explains how AI can learn from historical documentation and dynamically provide guidance, reducing dependency on specialised teams. This not only lowers servicing costs but also improves accuracy and consistency in handling legacy claims and complaints.

Microsoft’s Power Platform, combined with generative AI tools, exemplifies how low-code and no-code solutions can empower insurers. These platforms enable organisations to integrate AI seamlessly into their workflows, facilitating rapid deployment and minimising IT resource requirements. For instance, Microsoft’s Copilot technology allows business users to interact with AI as an assistive agent, enhancing productivity without requiring deep technical expertise.

Future Challenges and Opportunities – While the opportunities for AI in insurance are immense, Nicolay acknowledges the challenges that come with innovation. Regulatory hurdles, customer trust, and the suitability of products for automated channels are critical considerations. He advises insurers to address these challenges proactively by beginning the groundwork for AI integration, even if full implementation remains a longer-term goal.

Nicolay also highlights a growing interest in AI-driven advice for the mass market. In regions where access to professional financial advice is limited, AI has the potential to democratise financial planning, offering affordable and scalable solutions. However, this will require careful navigation of regulatory landscapes to ensure compliance and customer protection.

The Path Forward – For insurers, the key to success lies in balancing short-term wins with long-term vision. Short-term efforts should focus on optimising existing processes through automation and data integration, while medium-term strategies can explore the use of generative AI to enhance customer engagement and operational efficiency. Long-term goals should aim to redefine the role of AI in delivering personalised advice, improving compliance, and expanding market reach.

Nicolay’s insights underscore the transformative power of AI in the insurance industry. By embracing innovation and addressing challenges head-on, insurers can unlock new opportunities for growth and differentiation. The message is clear: the time to invest in AI is now.