Jan van der Merwe, Head of Actuarial and Product, PSG Wealth

Whether you consider yourself wealthy or not, there are steps you can take to secure a financial legacy for your children. Here are some good points financial advisers can discuss with their clients.

Before diving into the detail of the investment products that may help you in creating growing generational wealth for your child, it is important to consider the following:

If you have children that are dependent on you, risk cover is critical. This includes both death and disability cover. Disability cover should extend to a product that provides a regular income if you are not able to work due to disability.

It is also important to have a will in place. This will make your dependants’ lives significantly easier. In particular, it makes the process of winding up of your estate easier, speeding up the ability to get your assets transferred to your dependants and loved ones.

Setting up a trust may be a useful way to create tax and estate efficiencies in leaving a legacy for your dependants.

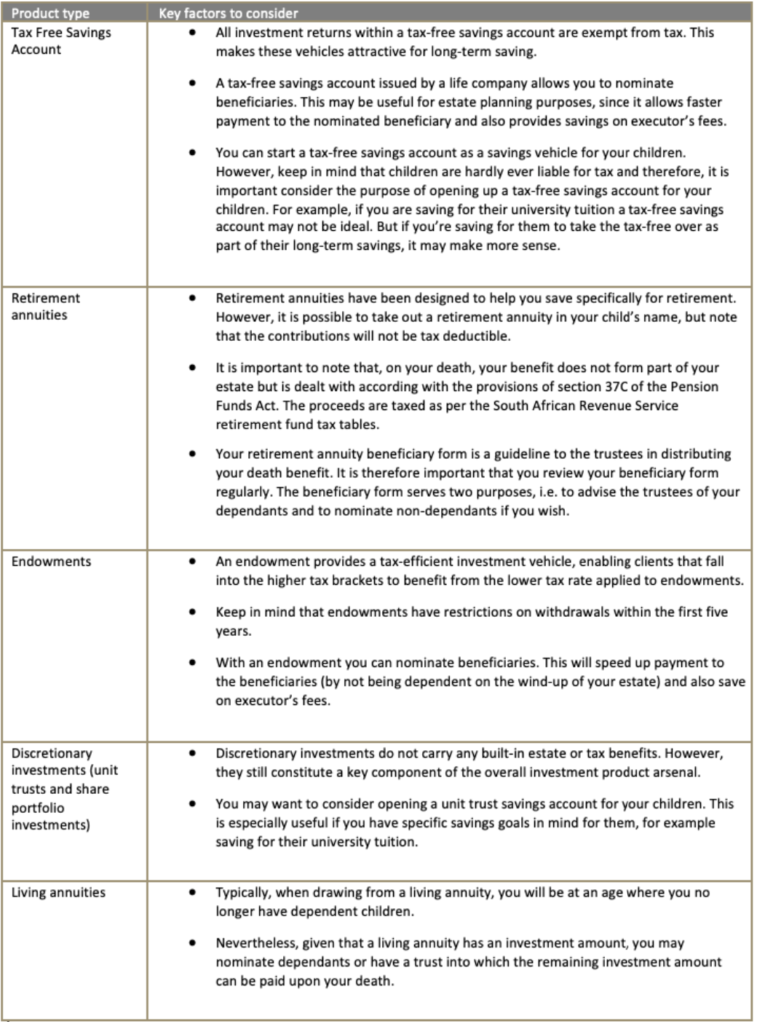

Five investment products to create a financial legacy You can start planning for your children’s financial freedom at any time in their lives. The table below highlights some investment products that may be useful.

Creating a heritage

It is important to think about creating your own wealth. However, you should also consider how this can tie in with the goal of creating a heritage of financial prosperity for your children. When it comes to selecting a product, drawing up a will or getting clarity on tax implications, a financial adviser will be able to make recommendations based on your unique circumstances.