Michael Porter, RGA

Choose whichever discouraging adjective you like to describe 2020, and few would argue with you.

Plans, projections, and even our definition of “normal” have gone out the window, with tragic human costs and economic disruption. I feel grief for those who have lost friends and family members to COVID-19, and for those who are bearing the financial brunt of the pandemic. Yet I also feel a certain amount of pride and admiration for my fellow South Africans and for our insurance industry. We are certainly a resilient bunch here on the southern tip of Africa, and once again we’ve shown we can deal with adversity!

We have faced dramatic changes in our way of life, and especially in our way of work. In the midst of sadness, however, many have learned to appreciate our families and reconnect with the things that matter most. We have responded to economic uncertainty with amazing flexibility and ingenuity. Such resiliency serves us well now, and as we prepare for the future.

Further, insurance companies are diligently performing their role in mitigating loss and uncertainty – even as insurers themselves have drawn on their own resiliency and agility. It has been a privilege to be part of an industry that has risen to the occasion to help our customers and stakeholders through this period in the face of these challenges.

Digital initiatives have accelerated to make it possible for people to buy, sell, and support insurance policies. Premium relief options have been implemented. Insurers have shown flexibility in accepting new business and demonstrating fairness in assessing claims. Wellness programs became COVID-friendly when policyholders were unable to go to the gym. Most inspiring to see was that some insurers continued

to pay their agents even if they didn’t sell a policy!

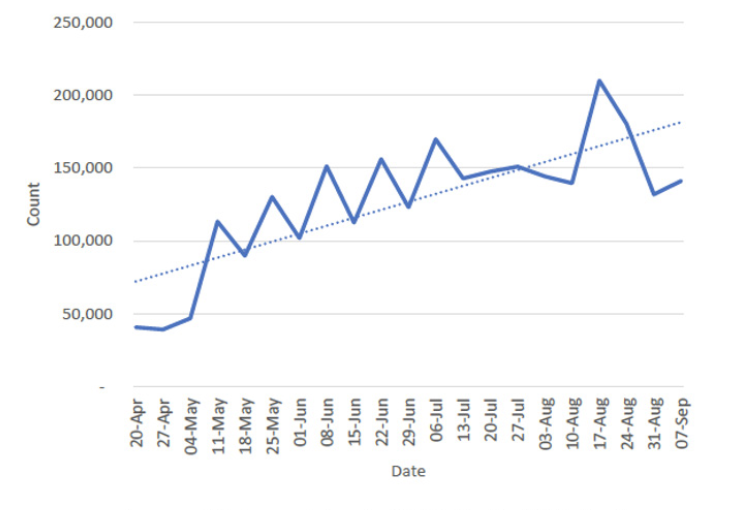

New Policies

It hasn’t been easy, of course. Insurers are feeling the pain due to higher than expected lapses and claims, and lower interest rates. The silver lining, however, is how much this clarifies the value of insurance – it’s been a time for the life insurance industry to step up.

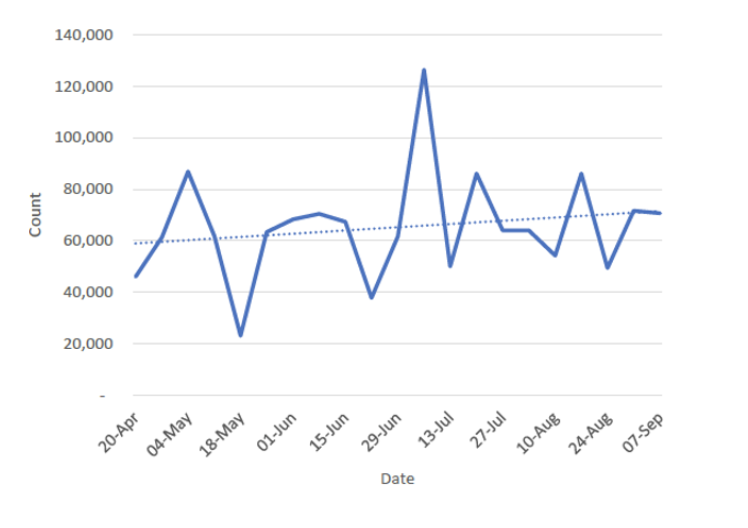

Lapses

Adversity creates opportunity and our focus has been to help insurers keep building and innovating for the future. As a reinsurer, RGA has stood with our clients, expanding our own flexibility and ingenuity to create customized solutions to help them manage their risk, liquidity and capital. We’ve stepped up our service offerings to relieve the pressure on claims and new business teams. Our experts in predictive

analytics, behavioural science, underwriting, and more have shared their knowledge through webinars, podcasts, and other media, and sought the insights of external thought leaders on behalf of our clients.

Yes, there are signs of a struggle, but I still see the signs that also point to success. We have shown we can get comfortable with the uncomfortable. The difference between wishing and hoping is in your expectation. You might wish that things were better, or that something hadn’t happened, but hope is the expectation that things will be better, based on the evidence.

The pluck of our fellow South Africans, the way our businesses have adapted and changed,

the way our industry is agilely meeting the evolving needs of our customers these all raise my expectations of success. And of course, my evidence-based expectation is that RGA will be there for our customers in 2021 – and beyond!