Fanus Coetzee, CEO: Santam Broker Solutions

Sitting on the panel at this year’s African Insurance Exchange in Sun City, I was struck by how far our industry has come – and how far we still have to go.

The session, Beyond Canopy: Reinventing the Broker’s Role in a Digitally Entangled World, was less about predicting the future and more about acknowledging a truth that is already here: our clients are changing, and so must we.

The risk we don’t talk about enough – There is a lot of talk about disintermediation, the fear that digital platforms will make brokers redundant. But that is not what keeps me up at night. The real risk is that we, as brokers and insurers, fail to evolve in line with how our clients are behaving digitally.

People expect convenience and immediacy in every other part of their lives, banking, shopping, even healthcare, and insurance cannot be an exception. If we cling to old ways of working, we risk becoming invisible to clients who are already researching, comparing, and even buying cover online.

Human advice still matters – Technology can do incredible things: process faster, predict better, and deliver insights at scale. But one thing it cannot do is empathise. AI doesn’t do trauma, people do. In moments of crisis, clients don’t want an algorithm; they want someone they trust to guide them.

This is where brokers remain indispensable. Our value lies not just in facilitating transactions but in walking alongside clients when life becomes complicated. The future I see is not digital versus human; it’s a hybrid of the two. Digital tools should empower brokers to deliver better advice, not replace them.

From admin-heavy to advice-led – One of my biggest takeaways from the panel was the need to shift from being admin-heavy to advice-led. Brokers spend too much time buried in paperwork and processes, when our real strength lies in understanding risk and guiding clients through complexity.

This is where insurers, like Santam, have an important role to play. We must equip brokers with technology that streamlines routine tasks, like quoting, claims tracking, document management, so they can focus on the human conversations that matter most. When we remove friction from the process, everyone benefits: brokers, insurers, and, most importantly, clients.

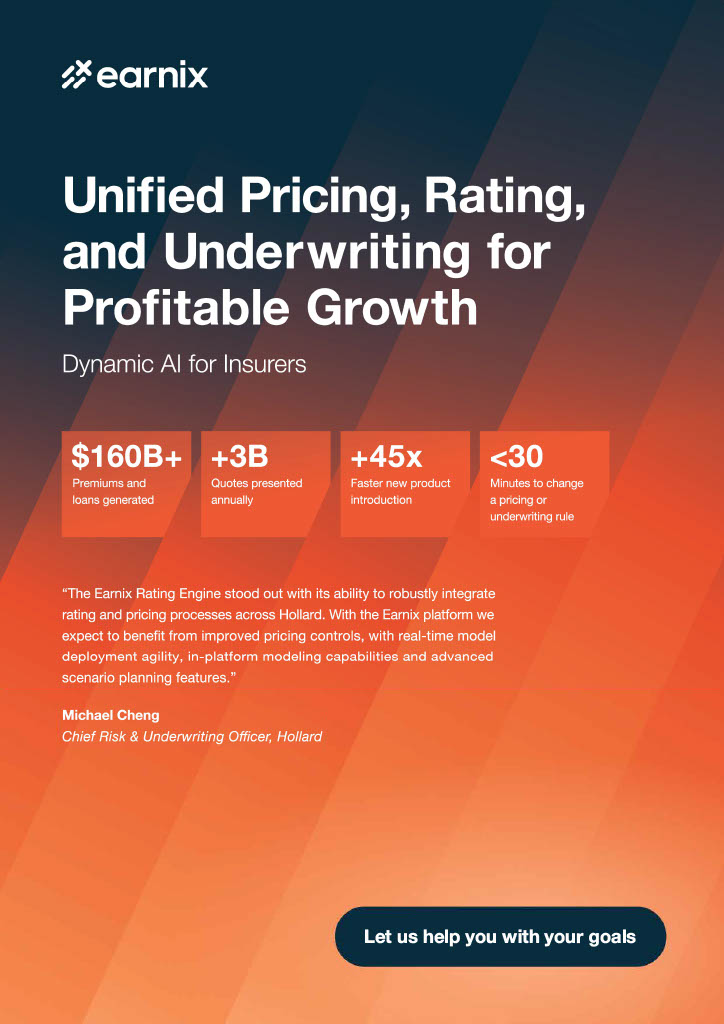

Unified Pricing, Rating & Underwriting for Profitable Growth.

The Earnix Rating Engine stood out with its ability to robustly integrate rating and pricing processes across Hollard. With the Earnix platform we expect to benefit from improved pricing controls, with real-time model deployment agility, in-platform modeling capabilities and advanced scenario planning features.

DYNAMIC AI FOR INSURERS

Building credibility in a connected world – Another point we discussed was the role of digital presence in building trust. Today, clients often meet you online long before they meet you in person. A visible, professional online profile is no longer optional; it signals relevance and credibility.

Simple things make a difference, a clear website, positive reviews, easy ways to get in touch. These touchpoints give clients confidence that you are established and engaged, and they set the tone for the relationship that follows. In an advice-led business like ours, trust starts early, sometimes with a Google search.

Tools that transform the broker experience – We are fortunate to have an abundance of digital tools at our disposal. Online platforms allow brokers to compare quotes from multiple insurers in minutes. Claims can be submitted digitally and tracked in real time, keeping clients informed without endless phone calls.

Customer relationship management systems give brokers a single view of their clients, making follow-ups and renewals more seamless. Features like website chat, inquiry forms, or even virtual consultations mean brokers can be “always-on” without being physically everywhere. These tools don’t just create efficiency; they create space for deeper client relationships.

A partnership approach – Something I emphasised during the discussion, and believe strongly, is that brokers and insurers are part of the same ecosystem. We share the same end goal: delivering the best possible outcomes for our clients. This means working together, not in silos, to bring digital enhancements to the client experience.

Brokers are a rich source of insight into what clients need and expect. When we involve them in designing products and digital solutions, the result is not just more efficient, it’s more relevant and human.

Reflecting on the session, I am encouraged. The broker’s role is not disappearing; it is transforming. Those who embrace digital tools, while doubling down on their human strengths, will find themselves more relevant than ever.

Our clients are telling us what they want: speed, transparency, and empathy. Technology gives us the speed and transparency; brokers give the empathy. The magic happens when we bring the two together. That is the challenge, and the opportunity, before us.