Fareeya Adam | CEO of Structured Products and annuities at Momentum Wealth

Financial advisers are often tasked with helping clients navigate the unknown. Retirement, in particular, presents a unique set of challenges. Needs vary, markets fluctuate, and long-term planning requires more than projections; it requires structure.

The most important outcome for retirees is ensuring that they can secure an affordable income for as long as they live. Once this need is met, many people want to consider leaving behind a legacy. Legacies can take the form of leaving an income for a life partner for the rest of their lives, in which case a client could consider a joint-life annuity. There can also be a need to leave a legacy in the form of a lump sum payment either to a life partner or to other dependants.

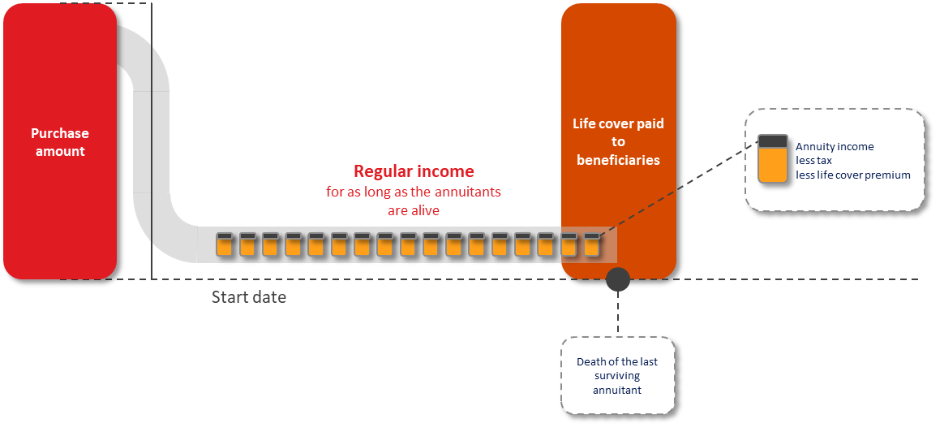

The Capital Protector from Momentum Wealth provides income stability and legacy assurance in a single, integrated offering. It’s a dual product that combines a guaranteed life annuity and a whole life policy. Clients invest a lump sum, which provides a regular guaranteed income before tax for life. At the same time, life cover equal to the purchase amount is maintained and paid to beneficiaries when the client passes away.

Tax and life cover premiums are deducted from the annuity income, simplifying administration and ensuring transparency. There is no need for medical underwriting, which makes the product easily accessible to a broader range of clients, including those with health concerns.

The Momentum Wealth Capital Protector offers a lifetime guarantee on life cover premiums for clients aged 60 and older. This means that Momentum will not review the premium at any time, completely avoiding affordability issues for clients later in life.

Income certainty is not a luxury, it’s a necessity.

Add certainty to your client’s retirement income planning with a guaranteed annuity.

Personalised certainty.

The Guaranteed Annuity and the life insurance policy for the Capital Protector are life insurance products, underwritten by Momentum Metropolitan Life Limited, a

licensed life insurer under the Insurance Act. Momentum Wealth is part of Momentum Investments and Momentum Group Limited. Momentum Wealth (Pty) Ltd is an

authorised financial services provider (registration number 1995/008800/07, FSP number 657). Momentum Metropolitan Life Limited is an authorised financial services

and credit provider (registration number 1904/002186/06, FSP number 6406).

Income and premium increases are aligned with the client’s selected increase rate, supporting long-term planning.

The whole life policy can pay out directly to beneficiaries. This approach can sometimes reduce estate duty, avoid executor fees, and ensure faster access to money.

A client can purchase a Capital Protector with money from a retirement fund or with discretionary savings. When retirement money is used, the full income received from the life annuity will be taxed as income. When using discretionary savings, only the interest portion of each income payment will be taxed. This makes it a very efficient way to convert a lump sum into a sustainable income for life, plus legacy benefits without medical underwriting.

The structure is clear, the benefits are tangible, and the outcome is a retirement solution that aligns with clients’ financial goals.

How it works

Including the Capital Protector in a client’s financial plan supports a practical approach to retirement planning. It provides a stable income, supports legacy goals, and simplifies estate planning. It presents a compelling option for advisers seeking to offer clients a dependable and well-structured solution. It’s personalised certainty in practice.

For more information on investment and retirement solutions, visit our website: https://www.momentum.co.za