By Yvonne Makwela, Consulting Manager, Fairheads Benefit Services

Beneficiary funds manage death benefits on behalf of minor children of deceased retirement fund members. The boards of trustees of the retirement fund need to investigate who was financially dependent on the deceased and then use their discretion whether to pay the funds into a beneficiary fund, coming alongside the guardian or caregiver and paying a monthly income amount for the child member to subsist and also to pay capital amounts for example for school fees or medical costs.

Once the funds have been received by a beneficiary fund, the fiduciary duty falls to the boards of trustees of the beneficiary fund. As a beneficiary fund and administrator, Fairheads Benefit Services will liaise with the guardians/caregiver in order to facilitate this ongoing important relationship to the benefit of the child. The guardian can communicate with us in their home language via our contact centre, SMS, or walk-in centres. We also run an annual guardian roadshow. Armed with the right knowledge and skills, guardians and caregivers then can start to manage monies and help grow financial inclusion in South Africa.

So, where do women fit into the above picture?

Firstly, hardly surprisingly, women make up 70-80% of guardians and caregivers in our industry.

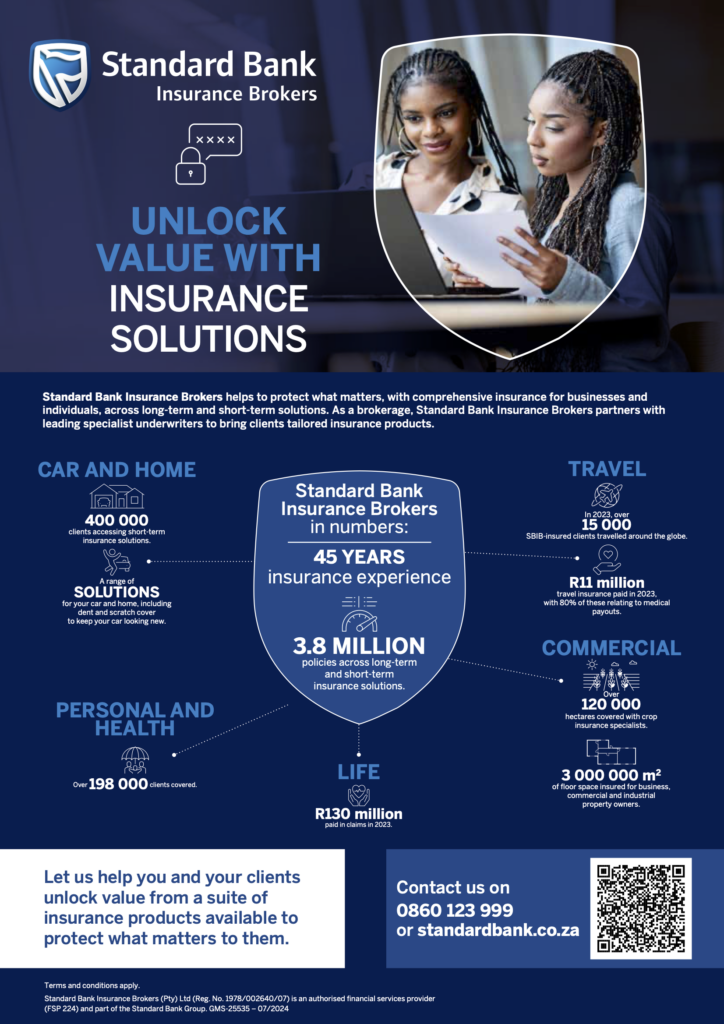

Unlock value with Insurance Solutions

Standard Bank Insurance Brokers helps to protect what matters, with comprehensive insurance for businesses and individuals, across long-term and short-term solutions. As a brokerage, Standard Bank Insurance Brokers partners with leading specialist underwriters to bring clients tailored insurance products.

Terms and conditions apply.

Standard Bank Insurance Brokers (Pty) Ltd (Reg. No. 1978/002640/07) is an authorised financial services provider (FSP 224) and part of the Standard Bank Group.

It is preferable for guardians to speak with a female in the service provider firm, as the latter will likely have experience of bringing up children, often as a single parent, and they will also know intuitively what challenges the guardian may face and bring empathy and understanding to the communication process.

At Fairheads, by far the majority of our employees are women and our culture is such that women’s advancement has been nurtured and encouraged over decades. I can speak personally of the wonderful opportunities I have been given in my career over the past 16 years. We believe the fact that most of our staff are women helps enormously when it comes to dealing with the regular needs of guardians and caregivers.

But what about boards of trustees – both those of the deceased’s employer retirement fund and those of the beneficiary fund? To repeat, the trustees of the retirement fund have the task of identifying minor dependants, assessing the guardian’s financial literacy and then making the decision whether to pay the death benefit into a beneficiary fund or not. The trustees of beneficiary funds need to bring their expertise to bear on the management of assets in the beneficiary fund and ensure that customer-facing staff are doing their job optimally.

Here, as Key Accounts Manager, I have had the opportunity to interact and consult with boards of trustees over many years. In short, while the number of female trustees is growing, the majority are still male. We find that the industry in question affects the gender make-up of boards. For example, in the mining industry it is mainly males that sit on boards of trustees.

We believe that a combination of genders is ideal and so we sincerely hope that boards will realise the need to appoint more females as trustees, so that decisions are made with the additional communication and decision-makings skills that women can bring to bear upon the industry.