By: John Anderson – Executive Enablement and Solutions at Alexforbes

South Africa’s retirement sector is undergoing a significant transformation with the introduction of the two-pot retirement system. This new approach to retirement savings, effective 1 September 2024, is designed to strike a balance between long-term financial security and immediate financial needs. This marks a significant shift from the traditional savings model, and requires retirement funds to engage more proactively and directly with fund members.

Preparing for the change

Service providers are gearing up for the transition with enhanced administration processes, digital platforms and member communication strategies. Key aspects include ensuring that funds can handle significant volumes of claims, as well as ensuring that there is sufficient liquidity in the investment portfolios for the anticipated withdrawals.

As we approach the implementation date, it’s essential that individuals engage with their service providers, understand the new rules and prepare for a more flexible retirement savings journey.

It is critical to ensure that individuals understand their benefits, whether they qualify for the new system and determine if their funds can properly support them in the new environment.

Exclusions

While everyone is anticipating access to their retirement savings, it is important to note that the following exclusions apply:

-Legacy retirement annuity funds

-Beneficiary funds

– Unclaimed benefit funds

-Pensioners

-Members who were 55 years and older on 1 March 2021 who do not choose to opt in to the two-pot retirement system between 1 September 2024 and 1 September 2025

Enabling a goals-driven approach

While retirement savings is primarily for retirement, there are scenarios where individuals would need access to their savings (for emergencies, such as during the Covid-19 pandemic).

The new system aims to provide greater flexibility and individual control over retirement savings. It enables saving with specific goals in mind, which has been shown to increase savings commitments. For low to middle-income earners, this can be a game-changer in managing financial hardships.

30 Year anniversary

Understanding your world, we offer insurance done properly, in a personalised way.

We understand the broker’s world, ensuring long-standing relationships.

© CIB (Pty) Ltd is an Authorised Financial Services Provider FSP No. 8425 Underwritten by Guardrisk Insurance Company Limited FSP No. 75.

The two-pot system challenges the conventional wisdom of not accessing your savings pot before retirement. By allowing withdrawals under certain conditions, it acknowledges the realities of financial needs before retirement. The savings pot can, if other options have been exhausted, be effectively used to assist people to:

• Get out of unsecured debt – short-term (personal or microloans)

• Save for children’s education – long term, 18 years and more

• Access cash at retirement

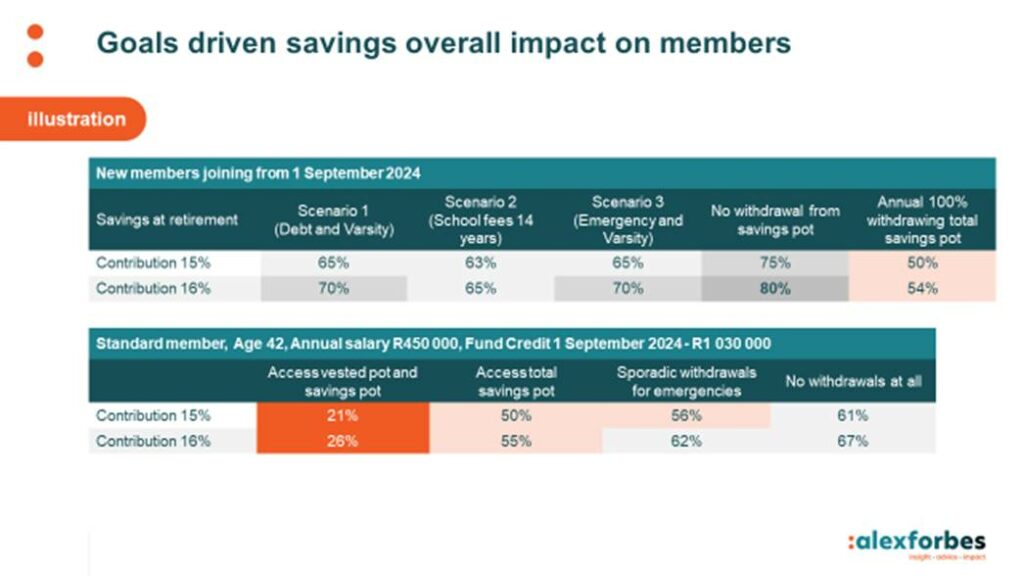

The below table illustrates the various outcomes an individual would experience under certain withdrawal scenarios based on their needs.

Note: The percentages below represent the individuals expected replacement ratio.

Individuals should ensure they get advice prior to taking any action, weighing the pros and cons of their decisions. Members are encouraged to seek holistic financial advice. Strategies should include rebuilding after accessing funds, making additional voluntary contributions and utilising rewards programmes to ease financial burdens.

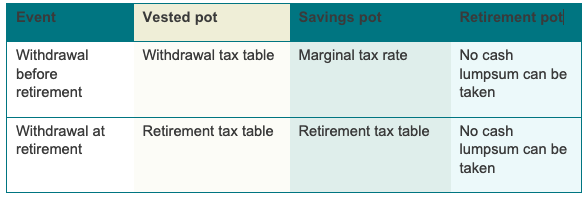

Update on tax

Understanding the tax specifications issued by SARS, which set the basis for applying tax for savings claims at marginal rates, is crucial. Making a withdrawal may push an individual into a higher tax bracket.

As set out above, savings withdrawal benefits are taxed at marginal rates. Importantly, these claims have no impact on the retirement tax table. In other words, these claims do not erode the R550 000 that can be taken tax free on retirement as has been suggested recently in recent articles.

Payment is not instant

Some individuals may encounter special additional requirements before gaining access to their savings pot. Some of these include:

- Consent being required by a non-member spouse where divorce proceedings are underway

- Where the member has a pension-backed housing loan in place, a check needs to be undertaken to ensure that the member will have sufficient money to cover the loan following the withdrawal

It’s important to ensure that administrators have covered all the various scenarios to ensure the fund is ready for the new environment.

Other issues that could result in the withdrawals being delayed include:

1. The fund’s set up, which requires additional calculations (such as defined benefit funds)

2. Tax issues (depending on an individual’s circumstances)

3. Additional requirements to mitigate fraudulent claims

Conclusion

The two-pot system represents a pivotal change in how South Africans save for retirement. By encouraging preservation and providing early access to a portion of savings, the reform balances immediate financial needs with long-term retirement security. Until now, most of the focus has been on what happens on 1 September 2024. However, the system is not just about the build-up to the implementation date but also about sustaining a solid and sustainable savings strategy post 1 September 2024. It is therefore imperative that individuals look at this as an opportunity to assist them in meeting their long-term financial goals and get the right support.