By: Linah Mabena, Chief Executive at Standard Bank Insurance Brokers

Historically, insurance has relied heavily on technical or mathematically related practices which often coincided with skillsets women were previously not proactively encouraged to foster.

Women’s journey in the insurance industry has been a tale of gradual progress against persistent barriers but in recent years, we have started seeing an encouraging trend towards more equitable representation within the sector and the progress is promising.

While much of the progress can be attributed to an increased focus on female representation, prompting a change in workplace policies that directly address the imbalances that were so prevalent in the past, the new work opportunities offered by the evolving insurance landscape is also contributing to making the industry attractive to more women.

The convergence of a cultural shift with a new generation joining the workforce and advances in technology spanning automation, AI, and robotics has created more opportunities for women to fill diverse roles in the insurance industry.

However, I do feel that there is still little awareness about the need of specialist skills which would traditionally be outside the insurance industry. It is unlikely that people will consider an industry if they don’t know their skills are valuable to its growth and advancement.

I have more than two decades of experience in the insurance sector, encompassing both long-term and short-term aspects. Having witnessed and experienced the industry’s gradual evolution, I have noticed that as the sector progresses, the individuals embodying it are also continuously transforming.

This is apparent when observing the evolving workforce, including the past and present women in C-Suite positions within insurance firms, and other leaders in the insurance sector.

I see this shift as a recognition of the importance of inclusivity and a willingness to embrace diverse viewpoints within the industry and yet, I would further challenge the industry, as a whole, to improve its representation of women in leadership positions.

The lack of prominent women role models in leadership positions and little awareness about the array of appealing career prospects could be what’s hindering young aspiring women professionals from envisioning their success and growth within the insurance industry.

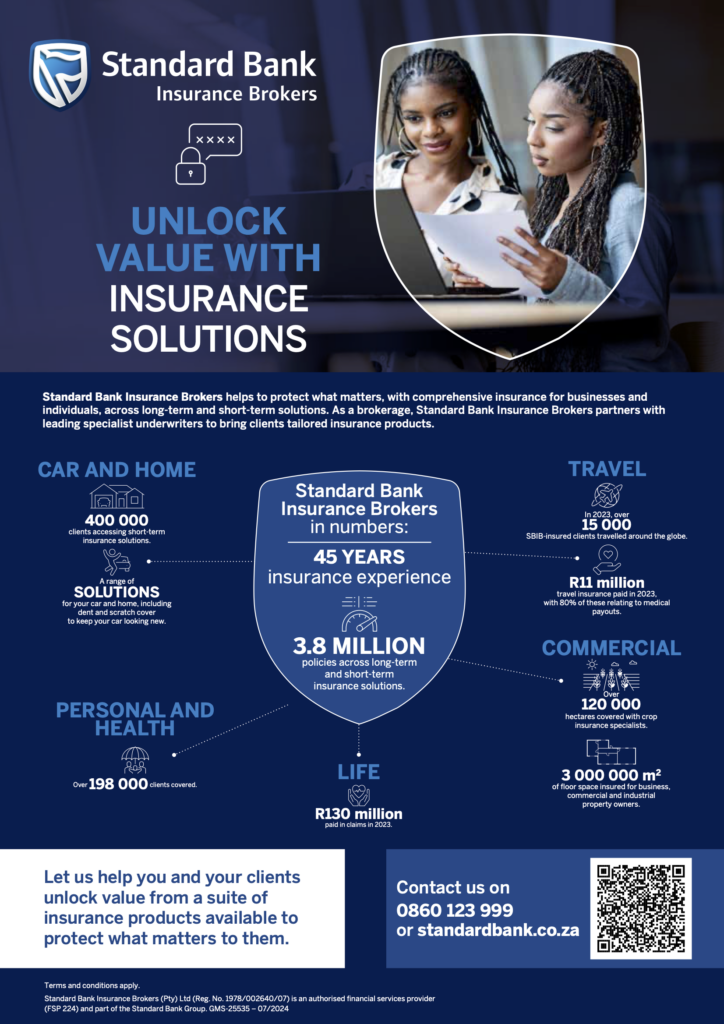

Unlock value with Insurance Solutions

Standard Bank Insurance Brokers helps to protect what matters, with comprehensive insurance for businesses and individuals, across long-term and short-term solutions. As a brokerage, Standard Bank Insurance Brokers partners with leading specialist underwriters to bring clients tailored insurance products.

Terms and conditions apply.

Standard Bank Insurance Brokers (Pty) Ltd (Reg. No. 1978/002640/07) is an authorised financial services provider (FSP 224) and part of the Standard Bank Group.

.

By encouraging women’s participation in technological innovation and decision-making, the insurance industry can benefit from diverse points of view. Considering that women play such a critical role in society, representing the women’s perspective in research and product development can have enormous benefits.

Research has shown that companies with women in leadership positions see higher profits and greater employee satisfaction. Psychological research further reveals that women leaders improve business performance by effectively driving increased productivity, creating the environment for enhanced collaboration and inspiring organisational dedication amongst employees all of which can greatly benefit the insurance industry and clients.

This is a seemingly encouraging view of the changes taking place within insurance and the embracing of gender diversity will be essential for the long-term sustainability of the industry.

However, while much progress has been made, there remain some barriers to attracting more women to insurance (and retaining them).

In order to increase awareness of the skills needed, the answer lies in getting the message out to different communities, especially teachers, so that they can help familiarise more people, particularly youth, to the insurance industry.

We need to get information about insurance into the classrooms and have people from the sector share their passion for their work with students at an early age.

I encourage all industry leaders to become more intentional about fostering an environment of inclusive opportunities, where women can progress their insurance careers.

It is essential to guarantee the fair availability of career prospects for everyone. This involves establishing transparent and fair routes to success and implementing appropriate processes, programmes, and a clearly defined framework to ensure that all team members, regardless of gender, feel supported and unified on their career paths.

While progress may be gradual, a visible shift in the individuals representing the insurance sector is apparent, making the insurance industry an exceptionally captivating environment at present.