By: Wimpie van Der Merwe (CEO, Global Choices)

Business ecosystems have emerged as an increasingly popular strategy across various geographies, industries, and business categories. Numerous instances in recent years demonstrate large companies adopting ecosystem strategies to drive their growth. Once you become aware of these strategies, you’ll see them everywhere.

In the past decade, we have witnessed the emergence of numerous prominent ecosystems that have captured considerable attention. This can be attributed to the fact that well-designed and effectively implemented ecosystems offer a seamless growth trajectory for businesses, benefiting both the enterprises themselves and their end customers with a total experience.

Understanding business ecosystems strategy

Business ecosystems refer to interconnected networks of companies, individuals, and other stakeholders collaborating and creating value together. These ecosystems leverage complementary strengths and resources to achieve common goals, fostering growth and innovation. By acknowledging the interdependencies within their markets, companies can identify opportunities to build symbiotic relationships and achieve mutually beneficial outcomes.

A typical insurance business ecosystem might be made up of for example a motor vehicle finance company, a 24hour emergency service provider, value added assistance, a loyalty company, an insurance or underwriter, a motor dealership and a motor maintenance network. The partners in this ecosystem will manage all emergencies, motor vehicle risk events, maintenance services and warranties for the finance period or maintenance contract on behalf the customer, with the option to continue with the risk benefits or extend warranties when their contract periods end.

The popularity of business ecosystems

The popularity of ecosystem strategies can be attributed to several factors. Firstly, companies recognise that collaborating within an ecosystem allows them to tap into resources, expertise, and customer bases they may not possess individually. By harnessing collective intelligence, companies can create products and services that meet evolving customer needs more effectively.

Secondly, ecosystems provide a platform for fostering innovation. Collaborating with diverse partners encourages the exchange of ideas, leading to the development of ground-breaking solutions. Companies involved in ecosystems can leverage these innovations to remain competitive and capture new market opportunities.

Lastly, business ecosystems improve resilience to disruptive forces. By diversifying partnerships and distribution channels, companies can mitigate risks and adapt more readily to changing market conditions. This flexibility allows for differentiated approaches to problem-solving and enables agile responses to emerging trends.

Building and succeeding in ecosystem strategies

To embark on a successful ecosystem strategy, insurers should consider the following:

- Define clear goals: Clearly articulate the objectives you aim to achieve through collaboration within the ecosystem. Align these goals with your overall business strategy to ensure compatibility and coherence.

- Identify key partners: Select partners whose strengths and capabilities complement your own, promoting constructive collaboration and the ability to co-create value. Establish mutually beneficial relationships based on trust and shared vision.

- Foster openness and trust: Encourage open communication and transparency within the ecosystem. This enables efficient information-sharing, facilitates collaborative decision-making, and builds trust among ecosystem participants.

- Nurture innovation and experimentation: Create an environment that fosters experimentation and continuous learning. Encourage the generation of innovative ideas and support their rapid prototyping and testing.

- Measure and optimize: Define relevant metrics to track ecosystem performance and success. Continuously evaluate performance, identify areas for improvement, and adjust strategies accordingly.

Building resilient ecosystems

Resilient ecosystems have a higher chance of surviving macroeconomic turbulence. Even if external conditions affect certain aspects of the customer experience, a well-designed ecosystem that enables the entire customer journey provides more opportunities for customers to remain engaged with your company. By expanding the range of offerings available, ecosystems can become self-sustaining and break down industry boundaries.

This encourages customers to keep returning, as it becomes more convenient for them to fulfil their needs in one place. As new products are added, the ecosystem adapts to address needs that cut across multiple industries, enhancing the fluidity customers expect from their service providers. Ecosystem expansion is inherently flexible, driven by a focus on solving customer needs. Loyal customers are more likely to embrace products and services that may seem unrelated to the original business model.

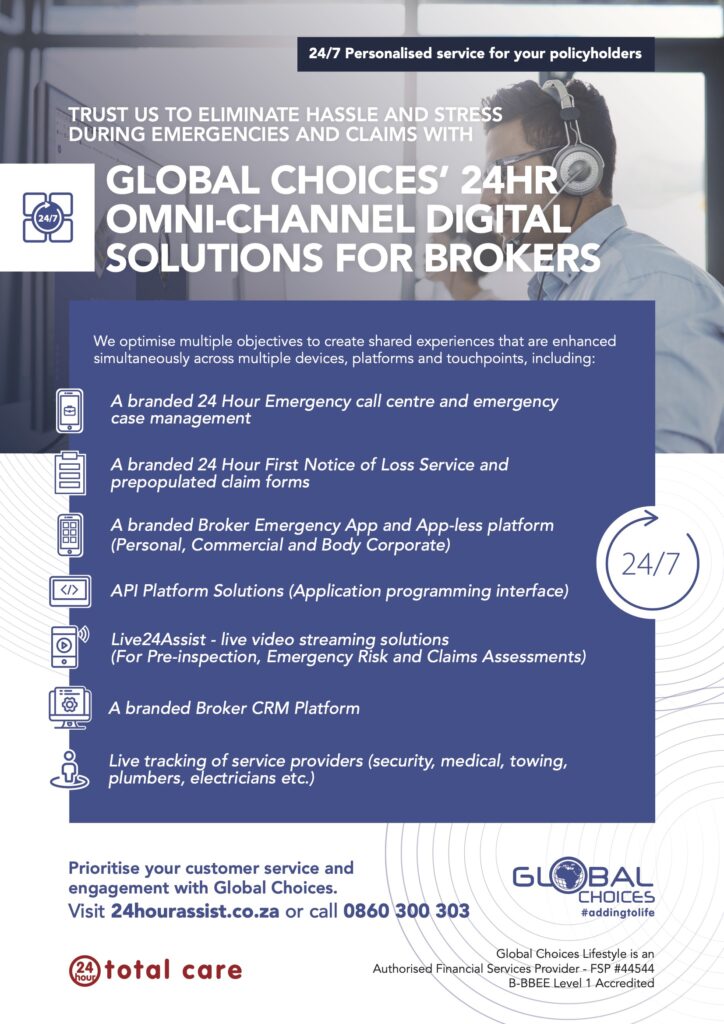

GLOBAL CHOICE’S 24HR

OMNI-CHANNEL DIGITAL

SOLUTIONS FOR BROKERS

We optimise multiple objectives to create shared experiences that are enhanced simultaneously across multiple devices, platforms and touchpoints.

Prioritise your customer service and engagement with Global Choices.

Global Choices Lifestyle is an

AuthorisedFinancial Services Provider – FSP #44544

Building an ecosystem with a customer-centric mindset

When building an ecosystem, it is essential to adopt a customer-centric mindset. Many insurers make the mistake of solely focusing on expanding customer engagement through the addition of insurance products, such as bundling home and auto coverage, rather than considering the total customer experience journey. To develop an effective ecosystem strategy, it is crucial to identify the broader journey that customers go through when interacting with your insurance company and understand the context for potential ecosystem opportunities.

For instance, if you offer home insurance, you are just one aspect of your customers’ overall homeowner experience. By gaining a deep understanding of the end-to-end journey your customers undertake, you can explore avenues for expanding your current product and service offerings beyond insurance. Instead of only engaging customers when they require home insurance, imagine the benefits of engaging them earlier in their home-buying journey. You can do this by helping them to identify the potential hidden risks before they buy their home. You can also assist with their annual home maintenance budget and provide continuous maintenance and proactive risk support or monitoring (in terms of crime prevention, security, cybers threats, lightning protection, fire protection, etc.) throughout their stay in their new home.

At Global Choices we have close working relationships with insurance broker networks, underwriters, insurance companies and agriculture or financial service cooperatives which add incredible depth to our position in the value chain.

By becoming the centre of a scalable ecosystem, you can expand the range of solutions you offer to your customers. If home insurance serves as your core solution, you can proactively branch out into “Adjacent Solutions” that have a close alignment with your core, considering factors such as customer interaction, supply chain, or business model. By diversifying into adjacent solutions, you seize the opportunity to engage customers at every stage of their home and risk journey and create a more comprehensive and valuable ecosystem for them.

As business ecosystems continue to gain prominence, it is essential for insurers to understand their dynamics and leverage their potential. By embracing collaboration, innovation, and adaptability, businesses can navigate the evolving market landscape, unlock new opportunities, and thrive in this era of connected ecosystems.