In a world marked by constant change and evolving circumstances, adaptability has become a cornerstone of success.

This sentiment is especially true in the realm of insurance, where clients require solutions that can grow and evolve alongside their lives. In an enlightening conversation, Tony van Niekerk sat down with Heleshia Wales, Senior Financial Adviser, and Subash Chatrooghoon, Executive Financial Advisor at Liberty, to delve into the dynamic landscape of insurance and the unique advantages offered by Liberty’s versatile product, the Liberty Lifestyle Protector.

The Wisdom of Experience: A Solid Foundation

With a combined experience of over four decades in the financial planning sector, Heleshia and Subash bring a wealth of knowledge and insights to the table. They’ve weathered market fluctuations, witnessed global crises like COVID-19, and have an intimate understanding of the diverse needs and challenges faced by their clients.

The Liberty Lifestyle Protector stands as a testament to Liberty’s commitment to delivering tailored solutions that stand the test of time. Celebrating its 20th anniversary this year, LP20 has gained a reputation for its adaptability and ability to be customised to meet the unique needs of individual clients.

A Paradigm of Flexibility: The Lifestyle Protector Advantage

The defining feature of the product is its remarkable flexibility. Unlike some traditional insurance products, this product is not bound by rigid parameters or predefined bundles of benefits. Heleshia highlights this versatility, emphasising that Lifestyle Protector can be seamlessly adapted to match a client’s existing benefits or coverage gaps. This adaptability is liberating, empowering financial advisors to craft insurance plans that precisely address clients’ specific requirements.

Subash echoes this sentiment, noting that the product’s flexibility is a result of its design based on the client’s needs analysis. The Lifestyle Protector operates as a fluid structure, allowing for the addition or subtraction of benefits as circumstances evolve. This unique approach ensures that the product remains aligned with the client’s changing life stages and financial priorities.

A life covered is a life lived

20 years ago we created Lifestyle Protector which Financial Advisers could offer their clients. Ever since, we’ve insured more than a million people and 400 000 families to the value of R1.5 trillion in cover. We’ve kept our promise of care to our clients in moments that matter and paid out R8.8 million every working day, amounting to R46 billion over 20 years.

Here’s to you, every one of our clients, for trusting us to be in it with you. Get in touch with a Liberty Accredited Financial Adviser today to help you secure your family’s future.

Liberty Group Limited is a licensed Life Insurer and Authorised Financial Services Provider (no.2409) Terms, conditions, risks and limitations apply.

Simplicity Amidst Complexity: Navigating Multi-Benefit Products

A common concern with multi-benefit insurance products is their perceived complexity. The intricacies of comprehensive policies can make both their initial construction and ongoing maintenance challenging. However, Subash challenges this perception, asserting that Lifestyle Protector is designed to simplify the process.

The heart of the product is a comprehensive needs analysis. This analysis provides a clear roadmap, guiding financial advisors and clients alike to identify the most critical aspects of coverage. Heleshia emphasises that simplicity lies in the visual representation of this analysis. With the aid of tools like “Advice Plus,” advisors can present clients with a straightforward breakdown of the coverage blocks, fostering a deeper understanding of the product’s relevance.

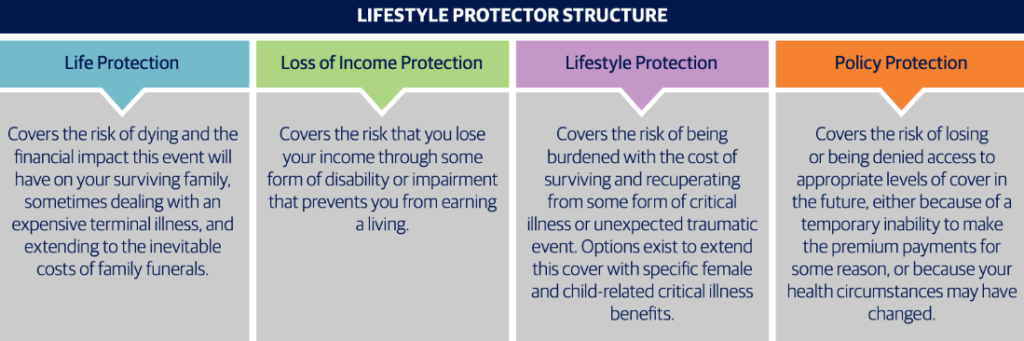

Lifestyle Protector benefits are covered under four main pillars:

Empowering Holistic Financial Planning: Real-Life Success Stories

The true testament to a product’s value lies in its real-world impact. Heleshia and Subash share compelling success stories that underscore the value of Lifestyle Protector’s flexibility and holistic approach.

Heleshia shares a real-life example. In 2020, a client of hers was diagnosed with multiple sclerosis, a severe level five case, leaving him with about five years to live. They submitted a dread disease claim, which has the benefit that you do not have to stop working to be able to claim the benefit.

They received a payout for him and, thanks to COVID and circumstances changing, he could still work from home. So, there was no need to go to the office. But unfortunately, a year later his health had deteriorated, and he could not work anymore, he could not go to the office, he could not even work from home. So, they then did an income protector claim as well as a lump sum disability which was also paid out. The client unfortunately passed on in 2022.

But those payouts had helped because he needed a daycare person for during the day, and then the last three months he needed someone at night, because he could not move anymore, and he needed to be moved around. All those payouts helped him have the best standard of living that he could under the circumstances and assisted his wife.

Then, when he passed away, life cover paid out as well. His wife was left with no debt and could carry on living the best she could under the circumstances because she has not been left financially challenged after all the medical costs.

Subash reminisces on the very early days of the lifestyle protector product. He was referred to a client who had a single need in that she wanted her bond covered in the event of death. She was pretty much sorted in the other avenues of financial planning, and this was a simple need where he put life cover and capital disability in place as that was what she needed. As the years went by, she resigned from her employer and Subash had to add on additional life cover, income protection and dread disease cover to the same product. This is what demonstrates the versatility of lifestyle protector.

As the years went by, she was diagnosed with cancer and Liberty paid out her critical illness/ dread disease benefit. A few months had gone by, and she was no longer able to work, so another claim was submitted, resulting in Liberty paying her income disability until she passed away several years later. Upon her death, there was money for her husband to maintain his standard of living as well.

A Formula for Client Retention: The Power of Adaptability

In a business landscape where client retention is a prised asset, Lifestyle Protector’s adaptability emerges as a key driver. Heleshia highlights how the flexibility of the product fosters enduring relationships. Clients find comfort in the knowledge that their coverage can be adjusted to accommodate both prosperity and adversity. Subash emphasises that this feature strengthens the advisor-client bond, creating a sense of reassurance and long-term commitment.

In the rapidly changing world of insurance, the conversation with Heleshia and Subash underscores the value of insurance products that mirror life’s fluidity. The Liberty Lifestyle Protector serves as a beacon of innovation, reminding us that insurance should be a dynamic, evolving partnership.

As Heleshia, Subash, and the Lifestyle Protector product demonstrate, insurance’s true strength lies in its capacity to adapt and protect, ensuring a secure future amidst the uncertainties of tomorrow.